Shaw 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

$76 million partially offset by the impact of the restructuring announced during the previous

quarter. In the third quarter of 2014, net income increased $6 million due to higher operating

income before restructuring costs and amortization of $73 million and lower interest and

amortization expense totaling $25 million partially offset by restructuring expenses of $53

million and reduction in net other revenue items of $41 million. The reduction in net other

revenue items was primarily due to the gain on sale of media assets of $49 million net of the

$8 million of debt retirement costs recorded in the second quarter. In the second quarter of

2014, net income decreased $23 million due to lower operating income before restructuring

costs and amortization of $80 million and increased amortization of $8 million partially offset

by an improvement in net other non-operating items of $36 million and lower income tax

expense of $24 million. In the first quarter of 2014, net income increased $128 million due to

increased operating income before restructuring costs and amortization of $112 million, a

reduction in net non-operating items of $21 million and lower amortization of $29 million

partially offset by higher income taxes of $36 million. The reduction in amortization is due to

changes in estimated useful lives of certain property, plant and equipment as well as a change

in the amortization period for deferred equipment revenue and the associated deferred

equipment costs. Net other non-operating items decreased due to a refund of $5 million in

respect of excess money from the Canwest CCAA plan implementation fund received in the first

quarter and the write-down of a real estate property of $14 million in the fourth quarter. In the

fourth quarter of 2013, net income decreased $133 million due to lower operating income

before restructuring costs and amortization of $89 million and reduction in net other revenue

items of $67 million partially offset by lower income taxes of $34 million. The reduction in net

other revenue items was mainly due to the gain on sale of Mountain Cable of $50 million

recorded in the third quarter and write-down of a real estate property of $14 million in the

fourth quarter. In the third quarter of 2013, net income increased $68 million due to increased

operating income before restructuring costs and amortization of $47 million, the

aforementioned gain on sale of Mountain Cable and the gain on sale of the specialty channel

ABC Spark partially offset by higher income taxes of $30 million and acquisition and

divestment costs in respect of the transactions with Rogers and the acquisition of Envision. In

the second quarter of 2013, net income decreased $53 million primarily due to lower operating

income before restructuring costs and amortization of $63 million partially offset by lower

income taxes of $5 million. As a result of the aforementioned changes in net income, basic and

diluted earnings per share have trended accordingly.

The following further assists in explaining the trend of quarterly revenue and operating income

before restructuring costs and amortization:

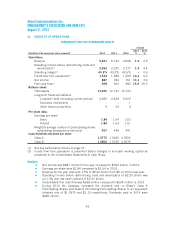

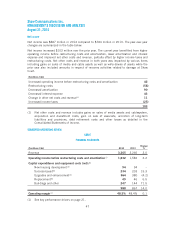

Growth in subscriber statistics as follows:

2014 2013

Subscriber Statistics First Second Third Fourth First Second Third Fourth

Video customers (29,619) (20,758) (12,075) (20,166) (23,877) (29,525) (26,578) (29,522)

Internet customers 2,746 12,767 12,399 11,983 5,637 7,675 4,157 10,564

Digital Phone lines 1,351 8,075 4,834 1,114 16,750 13,225 17,719 4,722

DTH customers (9,323) (1,405) (5,608) (6,606) (4,021) 1,328 (2,930) (835)

41