Shaw 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

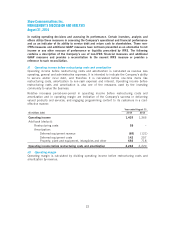

in making operating decisions and assessing its performance. Certain investors, analysts and

others utilize these measures in assessing the Company’s operational and financial performance

and as an indicator of its ability to service debt and return cash to shareholders. These non-

IFRS measures and additional GAAP measures have not been presented as an alternative to net

income or any other measure of performance or liquidity prescribed by IFRS. The following

contains a description of the Company’s use of non-IFRS financial measures and additional

GAAP measures and provides a reconciliation to the nearest IFRS measure or provides a

reference to such reconciliation.

ii) Operating income before restructuring costs and amortization

Operating income before restructuring costs and amortization is calculated as revenue less

operating, general and administrative expenses. It is intended to indicate the Company’s ability

to service and/or incur debt, and therefore it is calculated before one-time items like

restructuring costs, amortization (a non-cash expense) and interest. Operating income before

restructuring costs and amortization is also one of the measures used by the investing

community to value the business.

Relative increases period-over-period in operating income before restructuring costs and

amortization and in operating margin are indicative of the Company’s success in delivering

valued products and services, and engaging programming content to its customers in a cost-

effective manner.

Year ended August 31,

($ millions Cdn) 2014 2013

Operating income 1,439 1,366

Add back (deduct):

Restructuring costs 58 –

Amortization:

Deferred equipment revenue (69) (121)

Deferred equipment costs 142 257

Property, plant and equipment, intangibles and other 692 718

Operating income before restructuring costs and amortization 2,262 2,220

iii) Operating margin

Operating margin is calculated by dividing operating income before restructuring costs and

amortization by revenue.

22