Shaw 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

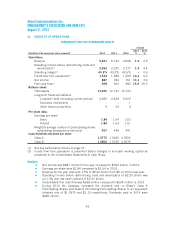

Net income

Net income was $887 million in 2014 compared to $784 million in 2013. The year-over-year

changes are summarized in the table below.

Net income increased $103 million over the prior year. The current year benefitted from higher

operating income before restructuring costs and amortization, lower amortization and interest

expense and improved net other costs and revenue, partially offset by higher income taxes and

restructuring costs. Net other costs and revenue in both years was impacted by various items

including gains on sales of media and cable assets as well as write-downs of assets while the

prior year also included amounts in respect of recovery activities related to damage at Shaw

Court.

($millions Cdn)

Increased operating income before restructuring costs and amortization 42

Restructuring costs (58)

Decreased amortization 90

Decreased interest expense 43

Change in other net costs and revenue(1) 11

Increased income taxes (25)

103

(1) Net other costs and revenue includes gains on sales of media assets and cablesystem,

acquisition and divestment costs, gain on sale of associate, accretion of long-term

liabilities and provisions, debt retirement costs and other losses as detailed in the

Consolidated Statements of Income.

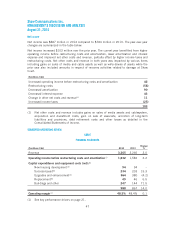

SEGMENTED OPERATIONS REVIEW

CABLE

FINANCIAL HIGHLIGHTS

($millions Cdn) 2014 2013

Change

%

Revenue 3,365 3,266 3.0

Operating income before restructuring costs and amortization(1) 1,632 1,582 3.2

Capital expenditures and equipment costs (net):(6)

New housing development(2) 94 94 –

Success-based(3) 234 203 15.3

Upgrades and enhancement(4) 364 380 (4.2)

Replacement(5) 49 46 6.5

Buildings and other 247 144 71.5

988 867 14.0

Operating margin(1) 48.5% 48.4% 0.1

(1) See key performance drivers on page 21.

47