Shaw 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

3. PURCHASE AND SALE OF ASSETS, BUSINESS ACQUISITION, AND

ASSETS HELD FOR SALE

Purchase and sale of assets

Transactions with Corus Entertainment Inc. (“Corus”)

During 2013 the Company entered into a series of agreements with Corus (see note 27) to

optimize its portfolio of specialty channels. Effective April 30, 2013, the Company sold to

Corus its 49% interest in ABC Spark and acquired from Corus its 20% interest in Food Network

Canada. In addition, the Company agreed to sell to Corus its 50% interest in its two

French-language channels, Historia and Series+. The sale of Historia and Series+ closed on

January 1, 2014.

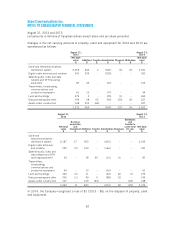

Historia and Series+

Historia and Series+ represented a disposal group within the media segment and accordingly,

were not presented as discontinued operations in the statement of income. Sale proceeds of

$141 included $2 in respect of working capital adjustments. The Historia and Series+ assets

and liabilities disposed of in fiscal 2014 and classified as held for sale in the statement of

financial position at August 31, 2013 are as follows:

2014

$

2013

$

Accounts receivable 54

Other current assets 45

Intangibles 93 92

Goodwill 44

106 105

Accounts payable and accrued liabilities 22

Deferred income tax liability 12 12

14 14

Food Network Canada and ABC Spark

In 2013 the acquisition of an additional 20% interest in Food Network Canada increased the

Company’s ownership to 71%. The difference between the consideration of $67 and carrying

value of the interest acquired of $47 has been charged to retained earnings.

The Company recorded proceeds, including working capital adjustments, of $19 and gain on

sale of associate of $7 on the disposition of its 49% interest in ABC Spark.

The Company issued a non-interest bearing promissory note of $48 to satisfy the net

consideration in respect of these transactions. The promissory note was settled in fiscal 2014

in connection with the closing of the sale of Historia and Series+ to Corus.

Transactions with Rogers Communications Inc. (“Rogers”)

During 2013, the Company entered into agreements with Rogers to sell to Rogers its shares in

Mountain Cablevision Limited (“Mountain Cable”) and grant to Rogers an option to acquire its

82