Shaw 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

wireless spectrum licenses as well as to purchase from Rogers its 33.3% interest in TVtropolis

General Partnership (“TVtropolis”). The sale of Mountain Cable closed on April 30, 2013 and

the acquisition of the additional interest in TVtropolis closed on June 30, 2013. The exercise of

the option and the sale of the wireless spectrum licenses is still subject to various regulatory

approvals. The transactions are strategic in nature allowing the Company to use a portion of the

net proceeds to accelerate various capital investments to improve and strengthen its network

advantage.

The Company incurred costs of $5 in respect of the transactions with Rogers. These costs have

been expensed and are included in acquisition and divestment costs in the statement of

income.

Mountain Cable

Mountain Cable had approximately 40,000 video customers in its operations based in

Hamilton, Ontario. It represented a disposal group within the cable operating segment and

accordingly, was not presented as discontinued operations in the statement of income.

The Company received proceeds of $398 in cash on the sale of the Mountain Cable and

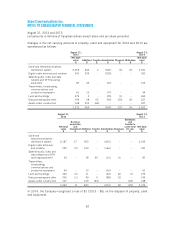

recorded a gain of $50. The assets and liabilities disposed of were as follows:

$

Accounts receivable 2

Property, plant and equipment 65

Other long-term assets 3

Intangibles 245

Goodwill 81

396

Accounts payable and accrued liabilities 1

Income tax payable 1

Unearned revenue 2

Deferred credits 2

Deferred income taxes 42

48

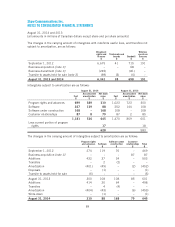

Wireless spectrum licenses

The wireless spectrum licenses are not classified as assets held for sale as the exercise of the

option and the sale of the wireless spectrum licenses is subject to various regulatory approvals.

The Company received $50 in respect of the purchase price of the option to acquire the

wireless spectrum licenses. The amount is recorded in deferred credits and will be included as

part of the proceeds received on exercise of the option and sale of the wireless spectrum

licenses, or alternatively as a gain if the option is not exercised and expires. In addition, the

Company received a $200 refundable deposit in respect of the option exercise price. The

deposit has been recorded in deferred credits and will be included as part of the proceeds

received on exercise of the option and sale of the wireless spectrum licenses or refunded to

Rogers if the option is not exercised and expires.

83