Shaw 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

Senior notes

The senior notes are unsecured obligations and rank equally and ratably with all existing and

future senior indebtedness. The fixed rate notes are redeemable at the Company’s option at any

time, in whole or in part, prior to maturity at 100% of the principal amount plus a make-whole

premium.

On January 31, 2014, the Company issued $500 senior notes at a rate of 4.35% due

January 31, 2024 and $300 floating rate senior rates due February 1, 2016. The $300 senior

notes bear interest at an annual rate equal to three month CDOR plus 0.69%.

Other

Burrard Landing Lot 2 Holdings Partnership (the “Partnership”)

The Company has a 33.33% interest in the Partnership which built the Shaw Tower project

with office/retail space and living/working space in Vancouver, BC. In the fall of 2004, the

commercial construction of the building was completed and at that time, the Partnership issued

ten year 6.31% secured mortgage bonds in respect of the commercial component of the Shaw

Tower. In February 2014, the Partnership refinanced its debt. The Partnership received a

mortgage loan and used the proceeds to prepay the outstanding balance of the previous

mortgage and loan excess funds to each of its partners. The mortgage loan matures on

November 1, 2024 and bears interest at 4.683% compounded semi-annually with interest only

payable for the first five years. The mortgage loan is collateralized by the property and the

commercial rental income from the building with no recourse to the Company.

Debt retirement costs

On February 18, 2014, the Company redeemed the 6.50% senior notes. In connection with the

early redemption, the Company incurred costs of $7 and wrote-off the remaining finance costs

of $1.

Debt covenants

The Company and its subsidiaries have undertaken to maintain certain covenants in respect of

the credit agreements and trust indentures described above. The Company and its subsidiaries

were in compliance with these covenants at August 31, 2014.

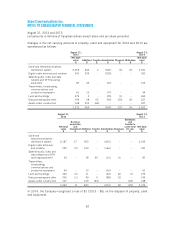

Long-term debt repayments

Mandatory principal repayments on all long-term debt in each of the next five years and

thereafter are as follows:

$

2015 –

2016 600

2017 400

2018 –

2019 –

Thereafter 3,740

4,740

93