Shaw 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

Company would pay approximately $510 million in common share dividends during 2015

(before taking into account the Company’s dividend reinvestment plan (“DRIP”), see further

details on page 54). While the Company expects to generate sufficient free cash flow in 2015

to fund these dividend payments, if actual results are different from expectations there can be

no assurance that the Company will continue common share dividend payments at the current

level.

xiii) Acquisitions and other strategic transactions

The Company may from time to time make acquisitions and enter into other strategic

transactions. In connection with these acquisitions and strategic transactions, Shaw may fail to

realize the anticipated benefits, incur unanticipated expenses and/or have difficulty

incorporating or integrating the acquired business, the occurrence of which could have a

material adverse effect on the Company.

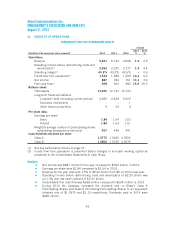

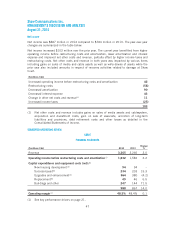

II. SUMMARY OF QUARTERLY RESULTS

Quarter Revenue

Operating

income

before

restructuring

costs and

amortization(1)

Net income

attributable

to equity

shareholders

Net

income(2)

Basic

earnings

per share

Diluted

earnings

per share

($millions Cdn except per share amounts)

2014

Fourth 1,263 525 187 192 0.40 0.40

Third 1,342 601 219 228 0.47 0.47

Second 1,274 528 215 222 0.46 0.46

First 1,362 608 236 245 0.51 0.51

Total 5,241 2,262 857 887 1.84 1.84

2013

Fourth 1,246 496 111 117 0.24 0.24

Third 1,326 585 239 250 0.52 0.52

Second 1,251 538 172 182 0.38 0.38

First 1,319 601 224 235 0.50 0.49

Total 5,142 2,220 746 784 1.64 1.63

(1) See key performance drivers on page 21.

(2) Net income attributable to both equity shareholders and non-controlling interests.

Quarterly revenue and operating income before restructuring costs and amortization are

primarily impacted by the seasonality of the Media division and fluctuate throughout the year

due to a number of factors including seasonal advertising and viewing patterns. Typically, the

Media business has higher revenue in the first quarter driven by the fall launch of season

premieres and high demand and the third quarter which is impacted by season finales and mid

season launches. Advertising revenue typically declines in the summer months of the fourth

quarter when viewership is generally lower.

Net income has fluctuated quarter-over-quarter primarily as a result of the changes in operating

income before restructuring costs and amortization described above and the impact of the net

change in non-operating items. In the fourth quarter of 2014, net income decreased by $36

million primarily due to lower operating income before restructuring costs and amortization of

40