Shaw 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

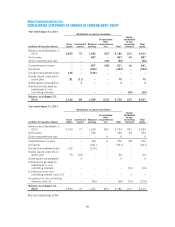

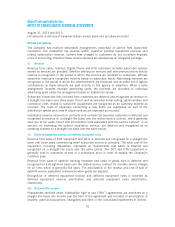

Shaw Communications Inc.

CONSOLIDATED STATEMENTS OF INCOME

Years ended August 31 [millions of Canadian dollars

except per share amounts]

2014

$

2013

$

Revenue [note 24] 5,241 5,142

Operating, general and administrative expenses [note 21] (2,979) (2,922)

Restructuring costs [notes 12 and 21] (58) –

Amortization –

Deferred equipment revenue [note 15] 69 121

Deferred equipment costs [note 9] (142) (257)

Property, plant and equipment, intangibles and other [notes 8, 9, 10

and 15] (692) (718)

Operating income 1,439 1,366

Amortization of financing costs – long-term debt [note 13] (3) (4)

Interest expense [notes 13 and 24] (266) (309)

Gain on sale of media assets [note 3] 49 –

Gain on sale of cablesystem [note 3] –50

Acquisition and divestment costs [notes 3 and 31] (4) (8)

Gain on sale of associate [note 3] –7

Accretion of long-term liabilities and provisions (6) (9)

Debt retirement costs [note 13] (8) –

Other losses [note 22] (6) (26)

Income before income taxes 1,195 1,067

Current income tax expense [note 23] 354 162

Deferred income tax expense (recovery) [note 23] (46) 121

Net income 887 784

Net income attributable to:

Equity shareholders 857 746

Non-controlling interests in subsidiaries 30 38

887 784

Earnings per share [note 18]

Basic 1.84 1.64

Diluted 1.84 1.63

See accompanying notes

64