Shaw 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

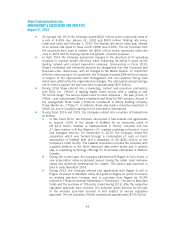

Global delivered solid programming results throughout the year with new programs such as The

Blacklist and returning favourites including the NCIS franchise, Bones and Survivor. The

conventional fall programming premiered through the month of September and into October

with a solid returning line-up combined with new drama programming.

Throughout the year, Media’s specialty portfolio held solid positions in the channel rankers in

the Adult 25-54 category and closed out the year with 3 of the Top 10 analog channels and 5

of the Top 10 digital channels. In late fiscal 2014, Shaw Media announced the rebranding of

two existing channels to FYI and Crime + Investigation which took place early in fiscal 2015.

During 2014, Global News retained the number one position in the Vancouver, Calgary and

Edmonton markets, while continued focus on on-line and mobile audiences has maintained

Globalnews.ca as Canada’s fastest growing major news site. Global News continues to receive

recognition for the quality of its journalism and public service and was honoured during the

current year with numerous awards from various organizations, including Global Calgary

receiving the prestigious “Best Local Newscast in Canada” award. In addition, Globalnews.ca

won the 2013 Eppy Award for the best overall news website design, surpassing major Canadian

and US news sites. In August 2014 Shaw filed an application with the CRTC for a new Category

C hybrid national and local all news channel.

Higher capital investment was incurred in fiscal 2013 to support various initiatives including

the launch of BC1 Regional News Channel, completion of the DTV transition in mandated

markets, and various facility investments.

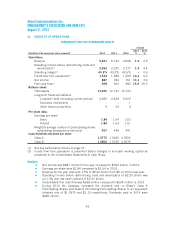

IV. FINANCIAL POSITION

Total assets were $13.2 billion at August 31, 2014 compared to $12.7 billion at August 31,

2013. Following is a discussion of significant changes in the consolidated statement of

financial position since August 31, 2013.

Current assets increased $138 million primarily due to increases in cash, accounts receivable

and inventories of $215 million, $7 million and $23 million, respectively partially offset by a

decrease in assets held for sale of $105 million upon closing the sale of Historia and Series+ in

the second quarter. Cash increased as funds provided by operations exceeded cash outlays for

investing and financing activities. Accounts receivable increased due to timing of collection of

advertising and other receivables while inventories were higher due to timing of equipment

purchases.

Investments and other assets increased $50 million due to various financial investments

including the investments in Pulser and SHOP.CA.

Property, plant and equipment increased $282 million primarily as a result of current year

capital investment exceeding amortization.

Other long-term assets decreased $23 million primarily due to lower deferred equipment costs

and related customer equipment financing receivables.

Intangibles increased $45 million mainly due to additional investments in software intangibles

and acquired program rights and advances exceeding the amortization for the current year.

Current liabilities decreased $809 million due to the repayment of the promissory note of $48

million, a decline in the current portion of long-term debt of $950 million, a decrease in

liabilities associated with assets held for sale of $14 million and lower accounts payable and

51