Shaw 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

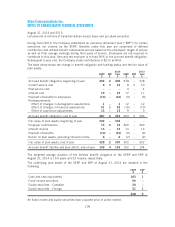

2013

Cable

$

Media

$

Satellite

$

Intersegment

eliminations

$

Total

$

Revenue 3,266 1,106 860 (90) 5,142

Operating income before amortization 1,582 353 285 – 2,220

Amortization(1) (854)

Operating income 1,366

Operating income before amortization as % of revenue 48.4% 31.9% 33.1% – 43.2%

Interest(1) 308

Burrard Landing Lot 2 Holdings Partnership 1

309

Cash taxes(1) 300

Corporate/other (138)

162

Capital expenditures and equipment costs (net) by segment

Capital expenditures 825 31 42 – 898

Equipment costs (net) 42 – 81 – 123

867 31 123 – 1,021

Reconciliation to Consolidated Statements of Cash Flows

Additions to property, plant and equipment 802

Additions to equipment costs (net) 132

Additions to other intangibles 69

Total of capital expenditures and equipment costs (net) per Consolidated

Statements of Cash Flows 1,003

Increase in working capital related to capital expenditures 33

Increase in customer equipment financing receivables (9)

Less: Proceeds on disposal of property, plant and equipment (3)

Less: Satellite services equipment profit(2) (3)

Total capital expenditures of equipment costs (net) reported by segments 1,021

(1) The Company does not report restructuring costs, amortization, interest or cash taxes on a

segmented basis.

(2) The profit from the sale of satellite equipment is subtracted from the calculation of

segmented capital expenditures and equipment costs (net) as the Company views the

profit on sale as a recovery of expenditures on customer premise equipment.

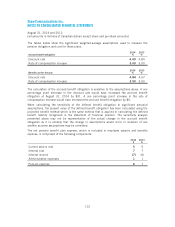

25. COMMITMENTS AND CONTINGENCIES

Commitments

(i) The Company owns and leases Ku-band and C-band transponders on the Anik F1R, Anik

F2 and Anik G1 satellites. As part of the Ku-band transponder agreements with Telesat

Canada, the Company is committed to paying annual transponder maintenance and

license fees for each transponder from the time the satellite becomes operational for a

period of 15 years.

105