Shaw 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

accrued liabilities of $31 million which were partially offset by increases in provisions of $18

million, income taxes payable of $205 million and unearned revenue of $11 million. The

current portion of long-term debt decreased due to the repayment of the 7.5% $350 million

senior notes which were due in November 2013 and early redemption of the 6.5% $600

million senior notes which were due June 2014. Liabilities associated with assets held for sale

decreased as the sale of Historia and Series+ closed during the second quarter at which time

the Company settled the promissory note that had been owing to Corus. Accounts payable and

accruals declined due to a decrease in CRTC benefit obligations as well as timing of payment

and fluctuations in various payables. During the current year, the Company funded the

remaining expenditure commitments in respect of the fiscal 2007 CRTC benefit obligation

which the Company had assumed as part of the media acquisition in 2010. Provisions

increased primarily due to the restructuring while income taxes payable increased due to the

current year expense partially offset by net tax installment payments. Unearned revenue was

higher primarily due to an increase in advance bill payments.

Long-term debt increased $822 million due to the issuance of 4.35% $500 million senior

notes and $300 million floating rate senior notes and the refinancing of the Partnership’s

mortgage debt.

Other long-term liabilities increased $28 million due to an increase in employee benefit plans,

primarily as a result of actuarial losses, partially offset by a decrease in CRTC benefit

obligations.

Deferred credits decreased $10 million due to amortization of deferred IRU revenue.

Deferred income tax liabilities, net of deferred income tax assets, decreased $63 million due to

the current year income tax recovery.

Shareholders’ equity increased $524 million primarily due to increases in share capital of $227

million and retained earnings of $347 million partially offset by an increase in accumulated

other comprehensive loss of $46 million. Share capital increased due to the issuance of

9,199,784 Class B Non-Voting Shares under the Company’s option plan and DRIP. As of

November 15, 2014, share capital is as reported at August 31, 2014 with the exception of the

issuance of a total of 1,951,937 Class B Non-Voting Shares under the DRIP and upon exercise

of options under the Company’s option plan. Retained earnings increased due to current year

earnings of $857 million partially offset by dividends of $510 million. Accumulated other

comprehensive loss increased due to the remeasurements recorded on employee benefit plans.

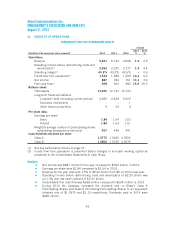

V. CONSOLIDATED CASH FLOW ANALYSIS

Operating activities

($millions Cdn) 2014 2013

Change

%

Funds flow from operations 1,524 1,380 10.4

Net change in non-cash working capital balances 216 (11) >100.0

1,740 1,369 27.1

Funds flow from operations increased over the comparative year due to improved operating

income before restructuring costs and amortization, lower interest expense and a decrease in

program rights purchases in the current year as well as the initial $300 million supplemental

52