Shaw 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

(ii) Investments and other assets and Other long-term assets

The fair value of publicly traded investments is determined by quoted market prices.

Investments in private entities which do not have quoted market prices in an active

market and whose fair value cannot be readily measured are carried at cost. No

published market exists for such investments. These equity investments have been made

as they are considered to have the potential to provide future benefit to the Company and

accordingly, the Company has no current intention to dispose of these investments in the

near term. The fair value of long-term receivables approximates their carrying value as

they are recorded at the net present values of their future cash flows, using an

appropriate discount rate.

(iii) Long-term debt

The carrying value of long-term debt is at amortized cost based on the initial fair value as

determined at the time of issuance. The fair value of publicly traded notes is based upon

current trading values. Other notes and debentures are valued based upon current

trading values for similar instruments.

(vi) Other long-term liabilities

The fair value of program rights payable, estimated by discounting future cash flows,

approximates their carrying value.

(v) Derivative financial instruments

The fair value of US currency forward purchase contracts is determined using an

estimated credit-adjusted mark-to-market valuation.

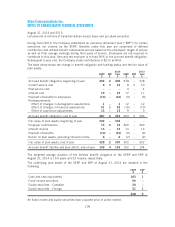

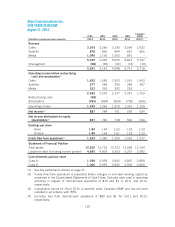

The carrying values and estimated fair values of derivative financial instruments, an investment

in a publicly traded company and long-term debt are as follows:

August 31, 2014 August 31, 2013

Carrying

value

Estimated

fair value

Carrying

value

Estimated

fair value

$$$$

Assets

Derivative financial instruments(2) ––33

Investment in publicly traded company(1) 77 ––

Liabilities

Long-term debt(1) 4,690 5,390 4,818 5,275

(1) Level 1 fair value – determined by quoted market prices.

(2) Level 2 fair value – determined by valuation techniques using inputs based on observable

market data, either directly or indirectly, other than quoted prices.

As at August 31, 2013, US currency forward purchase contracts qualified as hedging

instruments and were designated as cash flow hedges.

116