Shaw 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

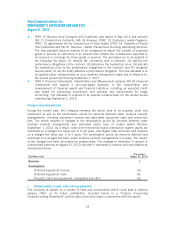

vii) Employee benefit plans

As at August 31, 2014, Shaw had non-registered defined benefit pension plans for key senior

executives and designated executives and various registered defined benefit plans for certain

unionized and non-unionized employees. The amounts reported in the financial statements

relating to the defined benefit pension plans are determined using actuarial valuations that are

based on several assumptions including the discount rate and rate of compensation increase.

While the Company believes these assumptions are reasonable, differences in actual results or

changes in assumptions could affect employee benefit obligations and the related income

statement impact. The differences between actual and assumed results are immediately

recognized in other comprehensive income/loss. The most significant assumption used to

calculate the net employee benefit plan expense is the discount rate. The discount rate is the

interest rate used to determine the present value of the future cash flows that is expected will

be needed to settle employee benefit obligations and is also used to calculate the interest

income on plan assets. It is based on the yield of long-term, high-quality corporate fixed income

investments closely matching the term of the estimated future cash flows and is reviewed and

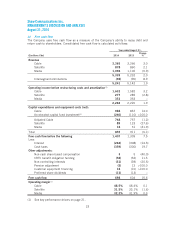

adjusted as changes required. The following table illustrates the increase on the accrued

benefit obligation and pension expense of a 1% decrease in the discount rate:

Accrued Benefit

Obligation at

End of Fiscal 2014

Pension Expense

Fiscal 2014

Weighted Average Discount Rate – Non-registered Plans 4.00% 4.75%

Weighted Average Discount Rate – Registered Plans 4.09% 4.84%

Impact of: 1% decrease ($millions) – Non-registered Plans $ 85 $ 4

Impact of: 1% decrease ($millions) – Registered Plans $ 31 $ 2

viii) Deferred income taxes

The Company has recognized deferred income tax assets and liabilities for the future income

tax consequences attributable to differences between the financial statement carrying amounts

of assets and liabilities and their respective tax bases. Deferred tax assets are also recognized in

respect of losses of certain of the Company’s subsidiaries. The deferred income tax assets and

liabilities are measured using enacted or substantially enacted tax rates expected to apply to

taxable income in the years in which the temporary differences are expected to reverse or the

tax losses are expected to be utilized. Realization of deferred income tax assets is dependent

upon generating sufficient taxable income during the period in which the temporary differences

are deductible. The Company has evaluated the likelihood of realization of deferred income tax

assets based on forecasts of taxable income of future years, existing tax laws and tax planning

strategies. Significant changes in assumptions with respect to internal forecasts or the inability

to implement tax planning strategies could result in future impairment of these assets.

ix) Commitments and contingencies

The Company is subject to various claims and contingencies related to lawsuits, taxes and

commitments under contractual and other commercial obligations. Contingent losses are

recognized by a charge to income when it is likely that a future event will confirm that an asset

has been impaired or a liability incurred at the date of the financial statements and the amount

can be reasonably estimated. Contractual and other commercial obligations primarily relate to

network fees, program rights and operating lease agreements for use of transmission facilities,

30