Shaw 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

TVtropolis

The acquisition of Rogers’ 33.3% interest in TVtropolis increased the Company’s ownership to

100%. The difference between the consideration of $59, which was initially paid as a deposit

pending regulatory approval of the transaction, and the carrying value of the interest acquired of

$23 has been charged to retained earnings.

Business acquisition

On April 30, 2013, the Company acquired Enmax Envision Inc. (“Envision”), a wholly-owned

subsidiary of ENMAX Corporation, for $222 in cash. Envision provides telecommunication

services to business customers in Calgary. The purpose of the transaction is to expand on the

Company’s business initiatives and enhance the profile of its telecommunications services in

the competitive Calgary business marketplace.

Envision contributed approximately $12 of revenue and $1 of net income for the four month

period in fiscal 2013. If the acquisition had occurred on September 1, 2012, revenue and net

income would have been approximately $33 and $4, respectively. Acquisition related costs of

$3 to effect the transaction have been incurred and are included in acquisition and divestment

costs in the statement of income.

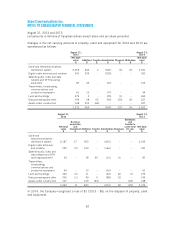

A summary of net assets and allocation of consideration is as follows:

$

Accounts receivable 3

Other current assets 1

Property, plant and equipment 73

Intangibles(1) 87

Goodwill(2) 68

232

Accounts payable and accrued liabilities 1

Unearned revenue 2

Deferred credits 5

Deferred income tax liability 2

222

(1) Intangibles is comprised of customer relationships and are being amortized over 15 years.

(2) Goodwill represents the combined value of growth expectations, an assembled workforce

and expected synergies and efficiencies from integrating the operations with the

Company’s existing business. Goodwill of $66 is deductible for income tax purposes.

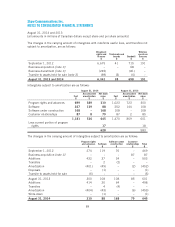

Assets held for sale

A real estate property of $11, being the estimated fair value less costs to sell, has been

classified as held for sale in the statement of financial position at August 31, 2014 and 2013.

The estimated fair value has been determined by a commercial real estate service by means of

84