Shaw 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

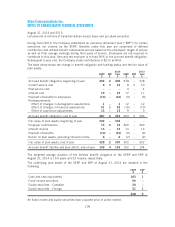

20. OTHER COMPREHENSIVE INCOME (LOSS) AND ACCUMULATED OTHER

COMPREHENSIVE LOSS

Components of other comprehensive loss and the related income tax effects for 2014 are as

follows:

Amount

$

Income taxes

$

Net

$

Items that may subsequently be reclassified to income

Change in unrealized fair value of derivatives designated as

cash flow hedges 3– 3

Adjustment for hedged items recognized in the period (6) 1 (5)

Unrealized loss on available-for-sale investment (2) – (2)

(5) 1 (4)

Items that will not be subsequently reclassified to income

Remeasurements on employee benefit plans (58) 16 (42)

(63) 17 (46)

Components of other comprehensive income and the related income tax effects for 2013 are as

follows:

Amount

$

Income taxes

$

Net

$

Items that may subsequently be reclassified to income

Change in unrealized fair value of derivatives designated as

cash flow hedges 5 (1) 4

Adjustment for hedged items recognized in the period (1) – (1)

4 (1) 3

Items that will not be subsequently reclassified to income

Remeasurements on employee benefit plans 4 (1) 3

8 (2) 6

Accumulated other comprehensive loss is comprised of the following:

2014

$

2013

$

Items that may subsequently be reclassified to income

Fair value of derivatives –2

Unrealized loss on available-for-sale investment (2) –

Items that will not be subsequently reclassified to income

Remeasurements on employee benefit plans (131) (89)

(133) (87)

100