Shaw 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

Total capital investment of $89 million for the current year declined from $123 million last

year. Success based capital was down primarily due to lower customer growth. The decrease in

Transponders reflects the final payment related to Anik G1 in the prior year while the decline in

Buildings and other relates to higher investment last year in various uplink equipment.

During the year, Shaw Direct launched a number of new HD and SD channels and currently

offers over 650 channels of which more than 220 are HD.

SUBSCRIBER STATISTICS

2014 2013 Growth

Shaw Direct customers(1) 880,623 903,565 (22,942)

(1) Including seasonal customers who temporarily suspend their service.

MEDIA

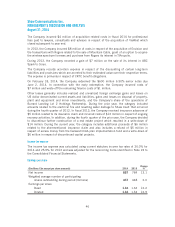

FINANCIAL HIGHLIGHTS

($millions Cdn) 2014 2013

Change

%

Revenue 1,096 1,106 (0.9)

Operating income before restructuring costs amortization(1) 353 353 –

Capital expenditures:

Broadcast and transmission 10 13 (23.1)

Buildings/other 818 (55.6)

18 31 (41.9)

Other adjustments:

CRTC benefit obligation funding (58) (52) 11.5

Non-controlling interests (31) (39) (20.5)

Operating margin(1) 32.2% 31.9% 0.3

(1) See key performance drivers on page 21.

OPERATING HIGHLIGHTS

2014 revenue of $1.10 billion and operating income before restructuring costs and

amortization of $353 million compared to $1.11 billion and $353 million, respectively, for the

prior year. Revenues declined due to reduced advertising revenues and the impact of the

disposition of Historia and Series+. This was partially offset by increased subscriber and other

revenues that included a retroactive adjustment of $6 million related to Global’s share of

royalties for distant signal transmission for the years 2009 through 2013. Operating income

before restructuring costs and amortization was unchanged year-over-year as the current year

revenue decline was offset through various lower expenses including employee related and

marketing. The prior year also benefitted from a favorable adjustment of approximately $3

million to align certain broadcast license fees with the CRTC billing period.

50