Shaw 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

Preferred share dividends

Holders of the Series A Preferred Shares are entitled to receive, as and when declared by the

Company’s Board of Directors, a cumulative quarterly fixed dividend yielding 4.50% annually

for the initial period ending June 30, 2016. Thereafter, the dividend rate will be reset every five

years at a rate equal to the then current 5-year Government of Canada bond yield plus 2.00%.

Holders of Series A Preferred Shares will have the right, at their option, to convert their shares

into Cumulative Redeemable Floating Rate Preferred Shares, Series B (the “Series B Preferred

Shares”), subject to certain conditions, on June 30, 2016 and on June 30 every five years

thereafter. The Series B Preferred Shares also represent a series of Class 2 preferred shares and

holders will be entitled to receive cumulative quarterly dividends, as and when declared by the

Company’s Board of Directors, at a rate set quarterly equal to the then current three-month

Government of Canada Treasury Bill yield plus 2.00%.

Dividend reinvestment plan

The Company has a Dividend Reinvestment Plan (“DRIP”) that allows holders of Class A Shares

and Class B Non-Voting Shares who are residents of Canada to automatically reinvest monthly

cash dividends to acquire additional Class B Non-Voting Shares. Class B Non-Voting Shares

distributed under the Company’s DRIP are new shares issued from treasury at a 2% discount

from the 5 day weighted average market price immediately preceding the applicable dividend

payment date.

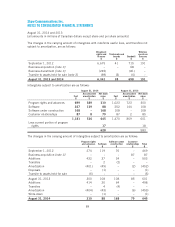

Dividends declared

The dividends per share recognized as distributions to common shareholders for dividends

declared during the year ended August 31, 2014 and 2013 are as follows:

2014 2013

Class A Voting Share Class B Non-Voting Share Class A Voting Share Class B Non-Voting Share

1.0775 1.0800 $1.0050 $1.0075

The dividends per share recognized as distributions to holders of Series A Preferred Shares was

$1.125 during each of the years ended August 31, 2014 and 2013.

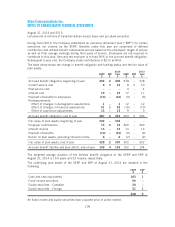

On June 26, 2014, the Company declared dividends of $0.28125 per Series A Preferred Share

which were paid on September 30, 2014. The total amount paid was $3 of which $1 was not

recognized as at August 31, 2014.

On October 23, 2014, the Company declared dividends of $0.091458 per Class A Voting Share

and $0.091667 per Class B Non-Voting Share payable on each of December 30,

2014, January 29, 2015 and February 26, 2015 to shareholders of record at the close of

business on December 15, 2014, January 15, 2015 and February 13, 2015, respectively.

On October 23, 2014, the Company declared dividends of $0.28125 per Series A Preferred

Share payable on December 31, 2014 to holders of record at the close of business on

December 15, 2014.

99