Shaw 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2014

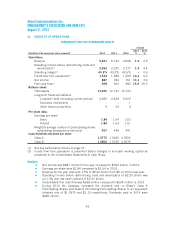

Amortization

($millions Cdn) 2014 2013

Change

%

Amortization revenue (expense) –

Deferred equipment revenue 69 121 (43.0)

Deferred equipment costs (142) (257) (44.7)

Property, plant and equipment, intangibles and other (692) (718) (3.6)

Amortization of deferred equipment revenue and deferred equipment costs decreased over the

comparable year primarily due to the impact of the change in the amortization period for

amounts in respect of customer premise equipment from two to three years.

Amortization of property, plant and equipment, intangibles and other decreased over the

comparable year as the amortization of new expenditures was more than offset by the impact of

assets that became fully depreciated and the effect of changes in useful lives of certain assets.

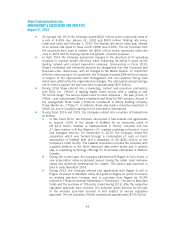

Amortization of financing costs and Interest expense

($millions Cdn) 2014 2013

Change

%

Amortization of financing costs – long-term debt 34 (25.0)

Interest expense 266 309 (13.9)

Interest expense decreased over the comparable year primarily due to the combined impact of a

lower average debt level and reduced average cost of borrowing.

Other income and expenses

($millions Cdn) 2014 2013

Increase

(decrease)

in

income

Gain on sale of media assets 49 –49

Gain on sale of cablesystem –50 (50)

Acquisition and divestment costs (4) (8) 4

Gain on sale of associate –7 (7)

Accretion of long-term liabilities and provisions (6) (9) 3

Debt retirement costs (8) – (8)

Other losses (6) (26) 20

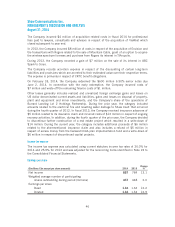

During 2013, the Company agreed to sell its 50% interest in its two French-language channels,

Historia and Series+, to Corus, a related party subject to common voting control. The sale of

Historia and Series+ closed on January 1, 2014 and the company recorded proceeds of

$141 million and a gain of $49 million.

During 2013, the Company closed the sale of Mountain Cable in Hamilton, Ontario to Rogers.

The Company received proceeds, after working capital adjustments, of $398 million and

recorded a gain of $50 million.

45