Shaw 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

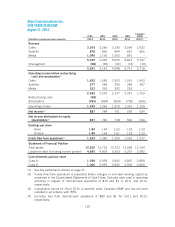

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

Risk management

The Company is exposed to various market risks including currency risk and interest rate risk,

as well as credit risk and liquidity risk associated with financial assets and liabilities. The

Company has designed and implemented various risk management strategies, discussed further

below, to ensure the exposure to these risks is consistent with its risk tolerance and business

objectives.

Market risk

Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate as

a result of changes in market prices, including foreign exchange and interest rates, the

Company’s share price and market price of publicly traded investments.

Currency risk

Certain of the Company’s capital expenditures and equipment costs are incurred in US dollars,

while its revenue is primarily denominated in Canadian dollars. Decreases in the value of the

Canadian dollar relative to the US dollar could have an adverse effect on the Company’s cash

flows. To mitigate some of the uncertainty in respect to capital expenditures and equipment

costs, the Company regularly enters into forward contracts in respect of US dollar

commitments. With respect to 2014, the Company entered into forward contracts to purchase

US $135 over a period of 12 months commencing in September 2013 at an average exchange

rate of 1.0403 Cdn. At August 31, 2014 the Company had no forward contracts in respect of

US dollar commitments.

Interest rate risk

Due to the capital-intensive nature of its operations, the Company utilizes long-term financing

extensively in its capital structure. The primary components of this structure are a banking

facility and various Canadian senior notes with varying maturities issued in the public markets

as more fully described in note 13.

Interest on the Company’s banking facility is based on floating rates, while the senior notes are

primarily fixed-rate obligations. The Company utilizes its credit facility to finance day-to-day

operations and, depending on market conditions, periodically converts the bank loans to fixed-

rate instruments through public market debt issues. As at August 31, 2014, 94% of the

Company’s consolidated long-term debt was fixed with respect to interest rates.

Sensitivity analysis

The Company held no foreign exchange forward contracts at August 31, 2014. A portion of the

Company’s accounts receivables and accounts payable and accrued liabilities is denominated in

US dollars; however, due to their short-term nature, there is no significant market risk arising

from fluctuations in foreign exchange rates.

Interest on the Company’s banking facility is based on floating rates and the variable rate senior

notes are based on CDOR. There is no significant market risk arising from interest rates

fluctuating by reasonably possible amounts from their actual values at August 31, 2014.

117