Shaw 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

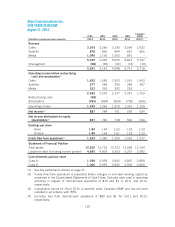

Shaw Communications Inc.

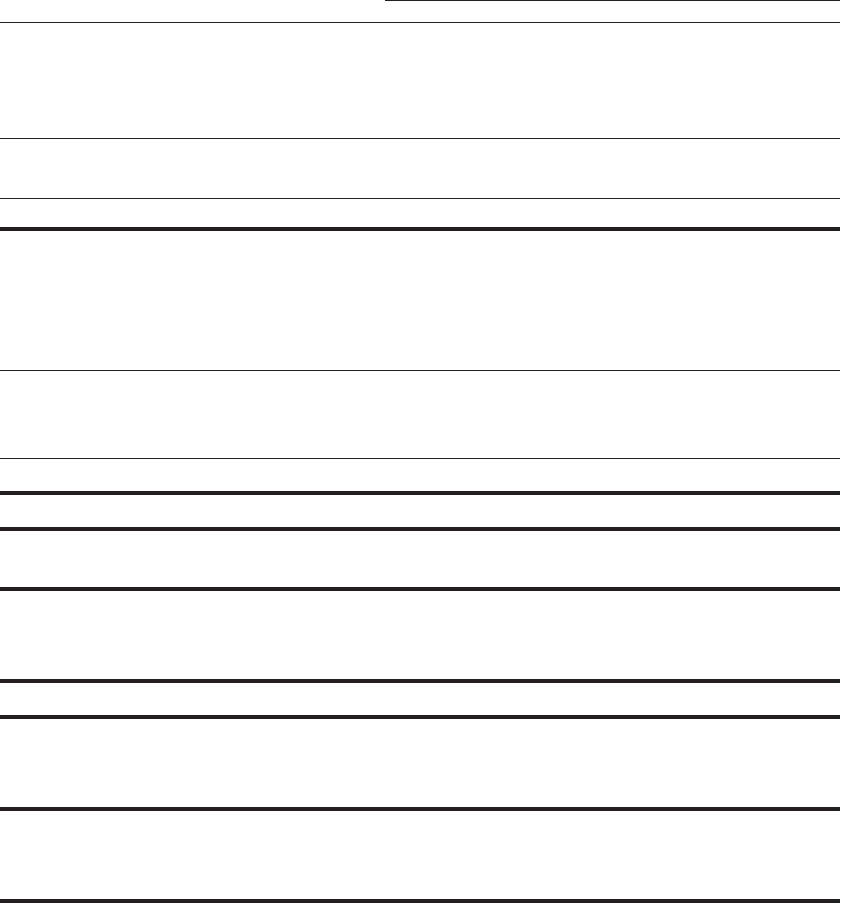

FIVE YEARS IN REVIEW

August 31, 2014

IFRS IFRS IFRS IFRS

Canadian

GAAP

($millions except per share amounts) 2014 2013 2012 2011 2010(3)

Revenue

Cable 3,365 3,266 3,193 3,096 2,932

Satellite 878 860 844 827 805

Media 1,096 1,106 1,053 891 –

5,339 5,232 5,090 4,814 3,737

Intersegment (98) (90) (92) (73) (19)

5,241 5,142 4,998 4,741 3,718

Operating income before restructuring

costs and amortization(1)

Cable 1,632 1,582 1,502 1,510 1,453

Satellite 277 285 293 289 307

Media 353 353 332 252 –

2,262 2,220 2,127 2,051 1,760

Restructuring costs (58) ––––

Amortization (765) (854) (808) (735) (656)

Operating income 1,439 1,366 1,319 1,316 1,104

Net income(4) 887 784 761 559 534

Net income attributable to equity

shareholders(4) 857 746 728 540 534

Earnings per share

Basic 1.84 1.64 1.62 1.23 1.23

Diluted 1.84 1.63 1.61 1.23 1.23

Funds flow from operations(2) 1,524 1,380 1,299 1,433 1,377

Statement of Financial Position

Total assets 13,250 12,732 12,722 12,588 10,154

Long-term debt (including current portion) 4,690 4,818 5,263 5,257 3,982

Cash dividends paid per share

Class A 1.058 0.993 0.942 0.897 0.858

Class B 1.060 0.995 0.945 0.900 0.860

(1) See key performance drivers on page 21.

(2) Funds flow from operations is presented before changes in non-cash working capital as

presented in the Consolidated Statements of Cash Flows. Excludes cash used in operating

activities in respect of discontinued operations of $10 and $1 in 2011 and 2010,

respectively.

(3) Comparative period for fiscal 2010 is reported under Canadian GAAP and has not been

restated in accordance with IFRS.

(4) Excludes loss from discontinued operations of $89 and $1 for 2011 and 2010,

respectively.

122