Shaw 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014 and 2013

[all amounts in millions of Canadian dollars except share and per share amounts]

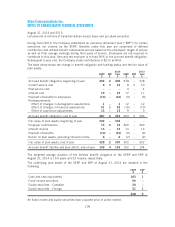

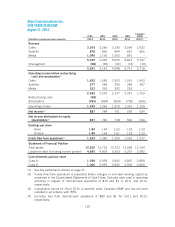

The Company’s undiscounted contractual maturities as at August 31, 2014 are as follows:

Accounts

payable and

accrued

liabilities(1)

Other

long-term

liabilities

Long-term

debt

repayable at

maturity

Interest

payments

$$$$

Within one year 828 – – 267

1 to 3 years – 5 1,000 506

3 to 5 years – – – 439

Over 5 years – – 3,740 2,190

828 5 4,740 3,402

(1) Includes accrued interest and dividends of $215.

29. CONSOLIDATED STATEMENTS OF CASH FLOWS

Additional disclosures with respect to the Consolidated Statements of Cash Flows are as

follows:

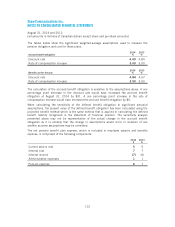

(i) Funds flow from operations

2014 2013

$$

Net income 887 784

Adjustments to reconcile net income to funds flow from operations:

Amortization 768 858

Program rights (10) (31)

Deferred income tax expense (recovery) (46) 121

CRTC benefit obligation funding (58) (52)

Gain on sale of media assets [note 3] (49) –

Gain on sale of cablesystem [note 3] –(50)

Divestment costs [note 3] –5

Gain on sale of associate [note 3] –(7)

Share-based compensation 34

Defined benefit pension plans (5) (288)

Accretion of long-term liabilities and provisions 69

Debt retirement costs [note 13] 8–

Write-down of properties [note 22] 614

Other 14 13

Funds flow from operations 1,524 1,380

119