Samsung 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 87

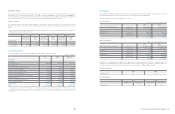

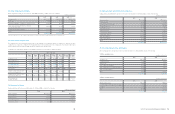

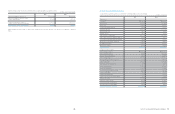

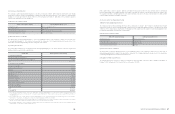

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

33. Business Combination

The Company acquired Samsung Digital Imaging Co., Ltd. with a closing date of April 1, 2010 to improve shareholders’ value through

enhancement of business efficiency and maximization of synergy effect with other existent businesses. The acquisition of Samsung Digital

Imaging Co., Ltd. was approved by the Board of Directors of the Company on December 15, 2009. None of the goodwill recognized is

expected to be deductible for income tax purposes.

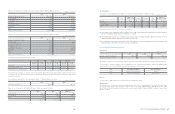

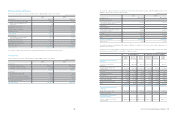

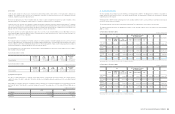

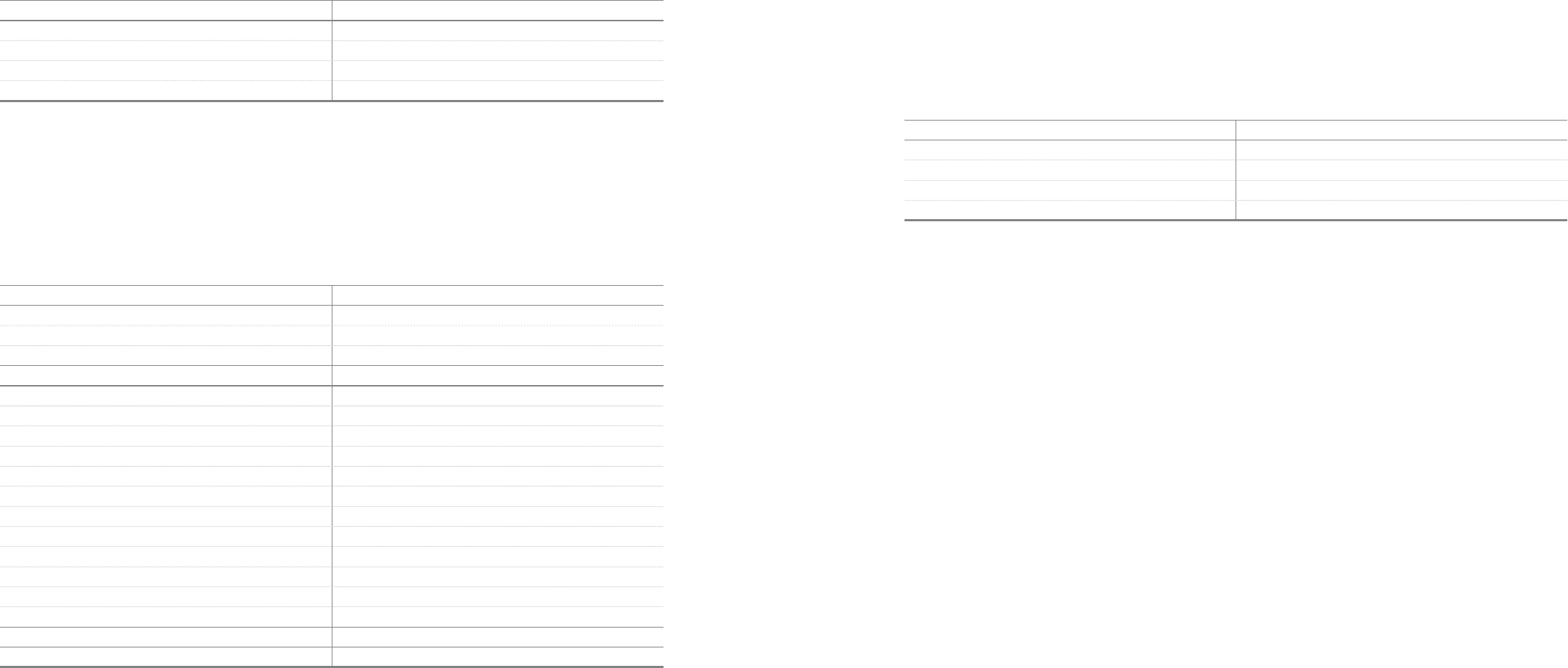

(1) Overview of the acquired company

(2) Terms of the business combination

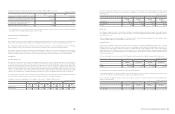

The shareholders of Samsung Digital Imaging Co., Ltd. received 0.0577663 shares of the Company’s common stock for each share

of Samsung Digital Imaging Co., Ltd. common stock owned on the closing date. The Company transferred its treasury stocks to the

shareholders of Samsung Digital Imaging, instead of issuing new stocks to them.

(3) Purchase price allocation

The following table summarizes the consideration paid for Samsung Digital Imaging Co., Ltd. and the amounts of the assets acquired and

liabilities assumed recognized at the acquisition date.

Name of the acquired company Samsung Digital Imaging Co., Ltd.

Headquarters location Suwon-si, Gyeonggi-do Korea

Representative director Sang-Jin Park

Classification of the acquired company Listed company in the Korea stock exchange

Former relationship with the Company An associated company

Classification Amount (In millions of Korean Won)

I. Considerations transferred

Fair value of consideration transferred (*1)

₩

812,154

Fair value of previously held equity interest in the acquiree (*2) 278,949

Total

₩

1,091,103

II. Identifiable assets and liabilities

Cash and cash equivalents 63,470

Trade and other receivables (*3) 290,407

Inventories 88,133

Property, plant, and equipment 40,678

Intangible assets 307,454

Other financial assets 75,202

Trade and other payables (213,454)

Short-term borrowings (83,660)

Long-term trade and other payables (62,125)

Retirement benefit obligation (24,574)

Deferred income tax liabilities (14,711)

Total

₩

466,820

III. Goodwill (*4)

₩

624,283

(*1) The Company transferred its treasury stocks to the shareholders of Samsung Digital Imaging Co., Ltd and re-measured the transferred treasury stock

at its acquisition-date (April 1, 2010) fair value. The Company recognized KRW 398,090 million of gain on disposal and has paid KRW 15,921 million for

the odd-lot prices.

(*2) The Company held 25.5% of equity interest in Samsung Digital Imaging Co.,Ltd. and remeasured its previously held equity interest at its acquisition-

date (April 1, 2010) fair value. Accordingly, the Company recorded resulting gain of KRW 216,747 million.

(*3) Fair value of acquired trade and other receivables (KRW 290,407 million) include trade receivables amounting to KRW 274,369 million. Total nominal

amount of the receivables is KRW 290,407 million, and none of them are expected to be uncollected.

(*4) The goodwill is attributable to increased efficiency of digital camera business management and the synergy effect expected from combining Samsung

Digital Imaging Co., Ltd. and the related existing businesses.

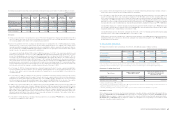

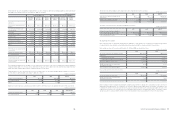

If the acquisition had occurred on January 1, 2010, the consolidated revenue and net profit for the year ended December 31, 2010 would

have increased by KRW 421,513 million and KRW 14,753 million, respectively. The amounts of revenue and net profit of the acquiree since

the acquisition date (April 1, 2010) included in the consolidated statement of income for the year ended December 31, 2010 are KRW

2,264,243 million and KRW 63,228 million, respectively.

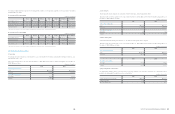

34. Events after the Reporting Period

1) Merger of Samsung Gwangju Electronics

The Company acquired Samsung Gwangju Electronics with a closing date of January 1, 2011 to improve shareholder value through

enhancement of business efficiency and manufacturing competitiveness in the digital media (appliance) business. The approval of the Board

of Directors of the Company replaces shareholders’ meeting approval of the acquisition, as the acquisition of Samsung Gwangju Electronics

is a small and simple merger as defined in the commercial law.

(1) Overview of the acquired company

(2) Terms of the business combination

The shareholders of Samsung Gwangju Electronics. received 0.0252536 shares of the Company’s common stock for each share of

Samsung Gwangju Electronics common stock owned on the closing date. The Company transferred its treasury stocks to the shareholders

of Samsung Gwangju Electronics, instead of issuing new stocks.

2) Acquisition of Medison and Prosonic

The Company entered into contracts to acquire 43.5% of Medison’s shares and 100% of Prosonic’s shares, of KRW 331,384 million, on

February 16, 2011 with approval of the Board of Directors on December 14, 2010.

Name of the acquired company Samsung Gwangju Electronics

Headquarters location Gwangju, Gwangsan-gu

Representative director Chang-wan Hong

Classification of the acquired company Unlisted company

Former relationship with the Company Subsidiary