Samsung 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42 43

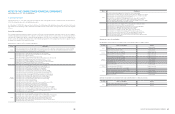

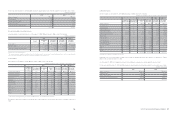

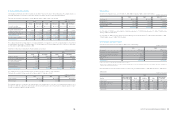

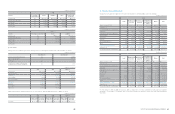

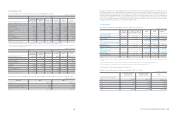

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

2. Summary of Significant Accounting Policies

The Company first adopted the International Financial Reporting

Standards as adopted by Republic of Korea (“Korean IFRS”) from

January 1, 2010 (the date of transition: January 1, 2009). These

standards have been consistently applied to 2009 comparative

financial information presented.

The principles used in the preparation of these financial statements

are based on Korean IFRS and interpretations effective as of

December 31, 2010 or standards that will be enforceable after

December 31, 2010 but which the Company has decided to early

adopt.

Principal adjustments made by the Company in restating its

previously published financial statements in accordance with

generally accepted accounting principle in the Republic of Korea

(“Korean GAAP”) are described in Note 3.

The principal accounting policies applied in the preparation of these

consolidated financial statements are set out below:

2.1 Basis of Presentation

The Company prepares its financial statements in accordance

with International Financial Reporting Standards as adopted by

Korea (“Korean IFRS”). These are those standards, subsequent

amendments and related interpretations issued by the IASB that

have been adopted by Korea.

First-time adoption of Korean IFRS is set out under Korean IFRS

1101, First-time Adoption of International Financial Reporting.

Korean IFRS 1101 requires application of the same accounting

policies to the opening statement of financial position and for

the periods when the first comparative financial statements

are disclosed. In addition, mandatory exceptions and optional

exemptions which have been applied by the Company are

described in Note 3.

There are a number of standards, amendments and interpretations,

which have been issued but not yet come into effect. The Company

does not expect that the adoption of these new standards,

interpretations and amendments will have a material impact on the

financial condition and results of operations.

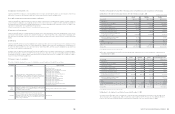

New standards, amendments and interpretations issued but not

effective for the financial year beginning 1 January 2010 and not

early adopted.

The Company’s and parent entity’s assessment of the impact of

these new standards and interpretations is set out below.

‘Revised IAS 24 (revised), ‘Related party disclosures’. It supersedes

IAS 24, ‘Related party disclosures’ . IAS 24 (revised) is mandatory

for periods beginning on or after January 1, 2011. Earlier

application, in whole or in part, is permitted. The Company will

apply the revised standard from January 1, 2011. When the revised

standard is applied, the Company and the parent will need to

disclose any transactions between its subsidiaries and its associates.

It is, therefore, not possible at this stage to disclose the impact, if

any, of the revised standard on the related party disclosures.

‘Classification of rights issues’ (amendment to IAS 32). The

amendment applies to annual periods beginning on or after February

1, 2010. Earlier application is permitted. The amendment addresses

the accounting for rights issues that are denominated in a currency

other than the functional currency of the issuer. Provided certain

conditions are met, such rights issues are now classified as

equity regardless of the currency in which the exercise price is

denominated. Previously, these issues had to be accounted for

as derivative liabilities. The amendment applies retrospectively in

accordance with IAS 8 ‘Accounting policies, changes in accounting

estimates and errors’. The Company will apply the amended

standard from January 1, 2011. It is not expected to have any

impact on the Company or the parent entity’s financial statements.

‘IFRIC 19, ‘Extinguishing financial liabilities with equity instruments’.

The interpretation clarifies the accounting by an entity when the

terms of a financial liability are renegotiated and result in the entity

issuing equity instruments to a creditor of the entity to extinguish

all or part of the financial liability (debt for equity swap). It requires a

gain or loss to be recognized in profit or loss, which is measured as

the difference between the carrying amount of the financial liability

and the fair value of the equity instruments issued. If the fair value

of the equity instruments issued cannot be reliably measured, the

equity instruments should be measured to reflect the fair value

of the financial liability extinguished. The Company will apply the

interpretation from January 1, 2011. It is not expected to have any

impact on the Company or the parent entity’s financial statements.

‘Prepayments of a minimum funding requirement’ (amendments to

IFRIC 14). The amendments correct an unintended consequence

of IFRIC 14, ‘IAS 19-The limit on a defined benefit asset,

minimum funding requirements and their interaction’. Without the

amendments, entities are not permitted to recognize as an asset

some voluntary prepayments for minimum funding contributions.

This was not intended when IFRIC 14 was issued, and the

amendments correct this. The amendments are effective for annual

periods beginning January 1, 2011. The Company will apply these

amendments for the financial reporting period commencing on

January 1, 2011. It is not expected to have any impact on the

Company or the parent entity’s financial statements.

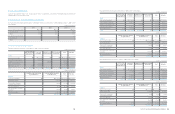

2.2 Consolidation

1) Subsidiaries

The consolidated financial statements include the accounts of

SEC and its controlled subsidiaries. Control over a subsidiary is

presumed to exist when the Company has the power to govern the

financial and operating policies of an entity to obtain benefits from

its activities generally accompanying a shareholding of more than

one half of the voting rights. The existence and effects of potential

voting rights that are currently exercisable or convertible are

considered in determining whether the Company controls another

entity. Subsidiaries are fully consolidated from the date when control

is transferred to the Company and de-consolidated from the date

which control ceases to exist.

The purchase method of accounting is used to account for

the acquisition of subsidiaries by the Company. The cost of an

acquisition is measured at the fair value of the assets given, equity

instruments issued and liabilities incurred or assumed at the date of

exchange. Identifiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured initially

at their fair values at the acquisition date, irrespective of the extent

of any non-controlling interest. The excess of the cost of acquisition

over the fair value of the Company’s share of the identifiable net

assets acquired is recorded as goodwill. If the cost of acquisition is

less than the fair value of the net assets of the subsidiary acquired,

the difference is recognized directly in the statement of income. All

inter-company transactions and balances are eliminated as part

of the consolidation process. For each business combination, the

Company shall measure any non-controlling interest in the acquiree

at the non-controlling interest’s proportionate share of the acquiree’s

identifiable net assets.

2) Transactions and non-controlling interests

Profit or loss and each component of other comprehensive income

are attributed to the owners of the parent and to the non-controlling

interests. Total comprehensive income is attributed to the owners of

the parent and to the non-controlling interests even if this results in

the non-controlling interests having a deficit balance. And changes

in a parent's ownership interest in a subsidiary that do not result

in a loss of control are accounted for as equity transactions (i.e.

transactions among owners in their capacity as owners).

3) Associated companies and joint ventures

Investments in companies in which the Company does not have

the ability to directly or indirectly control the financial and operating

decisions, but does possess the ability to exercise significant

influence, are accounted for using the equity method. Generally, it

is presumed that if at least 20% of the voting stock and potential

voting rights is owned, significant influence exists. The Company’s

investment in associates includes goodwill identified on acquisition,

net of any accumulated impairment loss. Investments in companies

in which the Company has joint control are also accounted for using

the equity method.

The Company’s share of its associates’ and joint ventures’ post-

acquisition profits or losses is recognized in the consolidated

statement of income, and its share of post-acquisition movements

in other reserves is recognized in other reserves. The cumulative

post-acquisition movements are adjusted against the carrying

amount of the investment. When the Company’s share of losses

in an associate equals or exceeds its interest in the associate,

including any other unsecured receivables, the Company does not

recognize further losses, unless it has incurred obligations or made

payments on behalf of the associate or joint venture.

Unrealized gains and loss on transactions between the Company

and its associates are eliminated to the extent of the parent

company’s interest in the associates and joint ventures. Unrealized

losses are also eliminated unless the transaction provides evidence

of an impairment of the asset transferred. Accounting policies

of associates have been changed where necessary to ensure

consistency with the policies adopted by the group.

Any dilution gains and losses arising in investments in associates

and joint ventures are recognized in the statement of income.

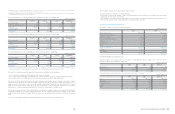

2.3 Foreign Currency Translation

1) Functional and presentation currency

Items included in the financial statements of each of the Company’s

entities are measured using the currency of the primary economic

environment in which an entity operates (‘the functional currency’).

The consolidated financial statements are presented in Korean

Won, which is the SEC’s functional currency.

2) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where items are remeasured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at the exchange rate at the

end of the reporting period of monetary assets denominated in

foreign currencies are recognized in the statement of income,

except when deferred in equity as qualifying cash flow hedges and

qualifying net investment hedges.

Changes in the fair value of monetary securities denominated in

foreign currency classified as available-for-sale financial assets are

analyzed between translation differences resulting from changes in

the amortized cost of the security and other changes in the carrying

amount of the security. Translation differences related to changes in

amortized cost are recognized in profit or loss, and other changes in

carrying amount are recognized in other comprehensive income.

Translation differences on non-monetary financial assets such

as equities held at fair value through profit or loss are recognized

in profit or loss as part of the fair value gain or loss. Translation

differences on non-monetary financial assets such as equities

classified as available-for-sale are included in other comprehensive

income.

3) Foreign subsidiaries

The results and financial position of all the foreign entities that have

a functional currency different from the presentation currency of the

Company are translated into the presentation currency as follows:

Assets and liabilities for each statement of financial position

presented are translated at the closing rate at the end of the

reporting date.

Income and expenses for each statement of income are translated

at average exchange rates, unless this average is not a reasonable

approximation of the cumulative effect of the rates prevailing

on the transaction dates, in which case income and expenses

are translated at the rate on the dates of the transactions;

and all resulting exchange differences are recognized in other

comprehensive income and presented as a separate component of

equity.