Samsung 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48 49

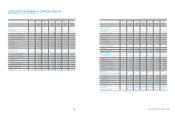

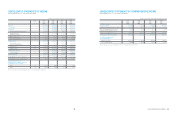

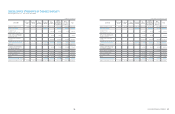

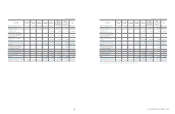

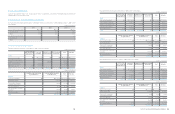

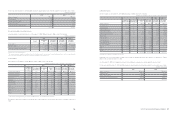

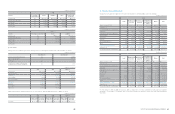

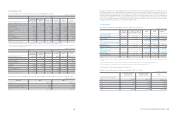

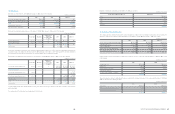

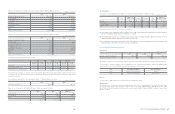

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1) Sales of goods

Sales of products and merchandise are recognized upon delivery

when the significant risks and rewards of ownership of goods have

transferred to the buyer, continuing managerial involvement usually

associated with ownership and effective control have ceased, the

amount of revenue can be measured reliably, it is probable that the

economic benefits associated with the transaction will flow to the

Company and the costs incurred or to be incurred in respect of

the transaction can be measured reliably. The Company records

reductions to revenue for special pricing arrangements, price

protection and other volume based discounts. If product sales are

subject to customer acceptance, revenue is not recognized until

customer acceptance occurs.

2) Sales of services

Revenues from rendering services are generally recognized using

the percentage-of-completion method, based on the percentage

of costs to date compared to the total estimated costs, contractual

milestones or performance.

The Company enters into transactions involving multiple components

consisting of any combination of goods, services, etc. The

commercial effect of each separately identifiable component of

the transaction is evaluated in order to reflect the substance of the

transaction. The consideration received from these transactions is

allocated to each separately identifiable component based on the

relative fair value of each component. The Company determines the

fair value of each component by taking into consideration factors

such as the price when component or a similar component is sold

separately by the Company or a third party.

3) Other sources of revenue

Interest income is recognized using the effective interest method.

When a loan and receivable is impaired, the Company reduces the

carrying amount to its recoverable amount, being the estimated

future cash flow discounted at the original effective interest rate of

the instrument, and continues unwinding the discount as interest

income. Royalty income is recognized on an accruals basis in

accordance with the substance of the relevant agreements.

Dividend income is recognized when the right to receive payment is

established.

2.20 Government Grants

Grants from the government are recognized at their fair value where

there is a reasonable assurance that the grant will be received and

the Company will comply with the conditions attached. Government

grants relating to income are deferred and recognized in the

statement of income over the period necessary to match them with

the income that they are intended to compensate. Government

grants relating to property, plant and equipment are included in non-

current liabilities as deferred government grants and are credited to

the statement of income on a straight-line basis over the expected

lives of the related assets.

2.21 Income Tax Expense and Deferred Taxes

Deferred income tax is recognized, using the liability method, on

temporary differences arising between the tax bases of assets and

liabilities and their carrying amounts in the consolidated financial

statements. However, the deferred income tax is not accounted

for if it arises from initial recognition of an asset or liability in a

transaction other than a business combination that at the time of

the transaction affects neither accounting nor taxable profit or loss.

Deferred income tax is determined using tax rates (and laws) that

have been enacted or substantively enacted by the balance sheet

date and are expected to apply when the related deferred income

tax asset is realized or the deferred income tax liability is settled.

Deferred income tax assets are recognized only to the extent that it

is probable that future taxable profit will be available against which

the temporary differences can be utilized.

Deferred income tax is provided on temporary differences arising

on investments in subsidiaries, associates and joint ventures

except where the timing of the reversal of the temporary difference

is controlled by the group and it is probable that the temporary

difference will not reverse in the foreseeable future.

Deferred income tax assets and liabilities are offset when there is a

legally enforceable right to offset current tax assets against current

tax liabilities and when the deferred income taxes assets and

liabilities relate to income taxes levied by the same taxation authority

on either the taxable entity or different taxable entities where there

is an intention to settle the balances on a net basis.

2.22 Earnings Per Share

Basic earnings per share is calculated by dividing net profit for the

period available to common shareholders by the weighted-average

number of common shares outstanding during the year.

Diluted earnings per share is calculated using the weighted-average

number of common shares outstanding adjusted to include the

potentially dilutive effect of common equivalent shares outstanding.

2.23 Segment Reporting

Operating segments are reported in a manner consistent with

the internal reporting provided to the chief operating decision-

maker. The chief operating decision-maker, who is responsible for

making strategic decisions on resource allocation and performance

assessment of the operating segments, has been identified as the

company’s Management Committee.

2.24 Critical Estimates and Judgments

The preparation of consolidated financial statements requires

management to exercise significant judgment and assumptions

based on historical experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances.

The Company makes estimates and assumptions concerning the

future. The resulting accounting estimates will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next financial

year are addressed below.

1) Revenue recognition

The Company uses the percentage-of-completion method in

accounting for its fixed-price contracts to deliver installation

services. Use of the percentage-of-completion method requires

the company to estimate the services performed to date as a

proportion of the total services to be performed. Revenues and

earnings are subject to significant change, effected by early steps

in a long-term projects, change in scope of a project, cost, period,

and plans of the customers.

2) Provision for warranty (Note 16)

The Company recognizes provision for warranty at the point of

recording related revenue. The company accrues provision for

warranty based on the best estimate of amounts necessary to

settle future and existing claims on products sold as of each

balance sheet date. Continuous release of products, that are more

technologically complex and changes in local regulations and

customs could result in additional allowances being required in

future periods.

3) Estimated impairment of goodwill (Note 12, 33)

The Company tests at the end of each reporting period whether

goodwill has suffered any impairment in accordance with the

accounting policy described in Note 2.11. The recoverable amounts

of cash generating units have been determined based on value-in-

use calculations. These calculations require the use of estimates.

4) Legal contingencies (Note 17)

Legal proceedings covering a wide range of matters are pending or

threatened in various jurisdictions against the Company. Provisions

are recorded for pending litigation when it is determined that an

unfavorable outcome is probable and the amount of loss can be

reasonably estimated. Due to the inherent uncertain nature of

litigation, the ultimate outcome or actual cost of settlement may

materially vary from estimates.

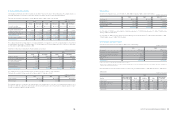

2.25 Convenience Translation into United States Dollar

Amounts

The Company operates primarily in Korean Won and its official

accounting records are maintained in Korean Won. The U.S.

dollar amounts provided in the financial statements represent

supplementary information solely for the convenience of the

reader. All Won amounts are expressed in U.S. dollars at the rate

of

₩

1,138.90 to US $1, the exchange rate in effect on December

31, 2010. Such presentation is not in accordance with generally

accepted accounting principles, and should not be construed as

a representation that the Won amounts shown could be readily

converted, realized or settled in U.S. dollars at this or at any other

rate.

2.26 These consolidated financial statements were

approved by the Board of Directors on January 28,

2011.

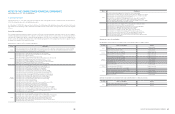

3. Transition to International Financial Reporting

Standards as adopted by the Republic of

Korea from Generally Accepted Accounting

Principle in the Republic of Korea.

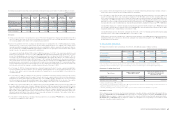

The Company adopted Korean IFRS from the fiscal year 2010

(the date of first-time adoption to Korean IFRS: January 1, 2010).

The comparison year, 2009,is restated in accordance with Korean

IFRS 1101, First-time adoption of international financial reporting

standards (the date of transition to Korean IFRS: January 1, 2009).

Significant differences in accounting policies

Significant differences between the accounting policies chosen by

the Company under Korean IFRS and under previous Korean GAAP

are as follows:

1) First time adoption of Korean IFRS

The Company elected the following exemptions upon the adoption

of Korean IFRS in accordance with Korean IFRS 1101, First-time

adoption of international financial reporting standards:

a) Business combination: Past business combinations that

occurred before the date of transition to Korean IFRS will not

be retrospectively restated under Korean IFRS 1103, Business

combinations.

b) Fair value as deemed cost: The Company elects to measure

certain land assets at fair value at the date of transition to Korean

IFRS and use the fair value as its deemed cost. Valuations were

made on the basis of recent market transactions on the arm's

length terms by independent valuers.

c) Cumulative translation differences: All cumulative translation gains

and losses arising from foreign subsidiaries and associates as of

the date of transition to Korean IFRS are reset to zero.

d) Employee benefits: The Company elected to use the ‘corridor’

approach for actuarial gains and losses and all cumulative

actuarial gains and losses have been recognized at the date of

transition to Korean IFRS.

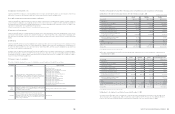

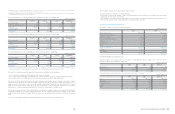

2) Employee benefits

Employees and directors with at least one year of service are

entitled to receive a lump-sum payment upon termination of their

employment with SEC, its Korean subsidiaries and certain foreign

subsidiaries, based on their length of service and rate of pay at the

time of termination. Under the previous severance policy pursuant

to Korean GAAP, Accrued severance benefits represented the

amount which would be payable assuming all eligible employees

and directors were to terminate their employment as of the end

of the reporting period. However, under Korean IFRS, the liability

is determined based on the present value of expected future

payments calculated and reported using actuarial assumptions.