Samsung 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 75

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

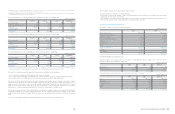

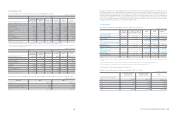

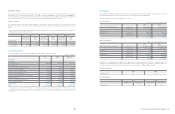

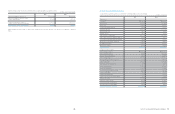

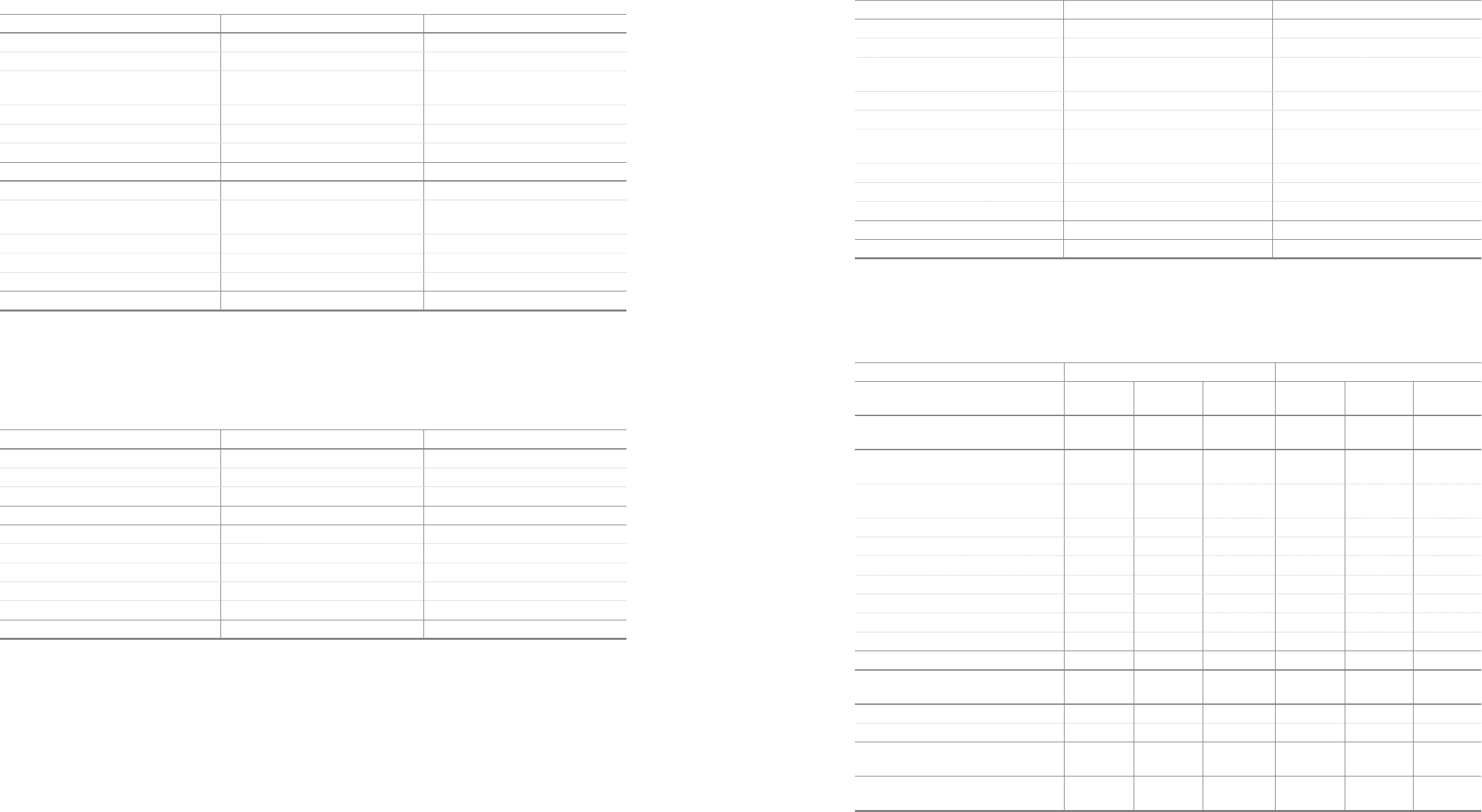

26. Finance Income and Expenses

Finance income and expenses for the years ended December 31, 2010 and 2009, consists of the following:

The company recognizes the profits and losses regarding translation differences as financial income and expenses.

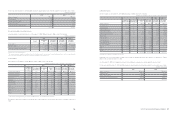

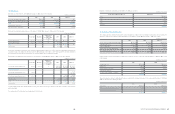

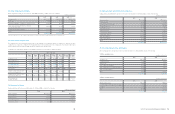

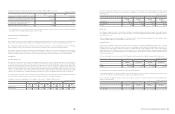

27. Income Tax

Income tax expense for the years ended December 31, 2010 and 2009, consists of the following:

2010 2009

Interest income

₩

558,113

₩

361,006

Interest income from loans and receivables 556,624 360,962

Interest income from available-for-sale

financial assets 1,489 44

Realized foreign exchange gains 6,012,626 7,699,429

Unrealized foreign exchange gains 496,543 1,322,525

Other finance income 397,846 344,297

Finance income 7,465,128 9,727,257

Interest expense: 581,091 535,287

Interest expense from financial liabilities

measured at amortized cost 581,091 535,287

Realized foreign exchange losses 6,274,744 8,154,318

Unrealized foreign exchange losses 414,077 1,054,144

Other finance expenses 430,187 430,470

Finance expenses

₩

7,700,099

₩

10,174,219

2010 2009

Current taxes:

Current tax on profits for the year

₩

3,330,420

₩

1,947,943

Adjustments in respect of prior years (163,739) 124,259

3,166,681 2,072,202

Deferred taxes:

Deferred income taxes-tax credit (363,802) 30,603

Deferred income taxes-temporary difference 341,137 250,637

Deferred income taxes-accumulated operating loss 41,036 74,610

Items charged directly to equity (2,921) 2,994

Income tax expense

₩

3,182,131

₩

2,431,046

(In millions of Korean Won)

(In millions of Korean Won)

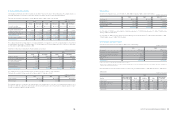

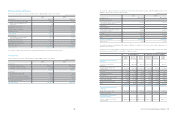

The tax on the company’s profit before tax differs from the theoretical amount that would arise using the weighted average tax rate

applicable to profits of the consolidated entities as follows:

The weighted average tax rate declined in 2010 compared to 2009 due to changes of the tax rates in certain countries, primarily due to a

reduction in tax rates in Korea.

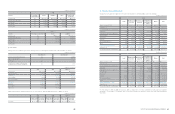

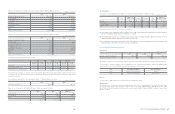

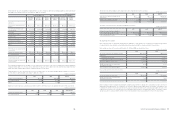

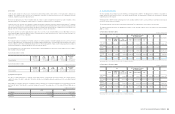

Deferred income tax assets and liabilities resulting from the tax effect of temporary differences including available tax credit carryforwards

and undisposed accumulated deficit as of December 31, 2010, are as follows:

2010 2009

Income before tax

₩

19,328,656

₩

12,191,596

Weighted average tax rate

Tax calculated at domestic tax rates applicable

to profits in the respective countries 4,712,450 2,900,059

Tax effects of:

Permanent difference (126,283) (74,873)

Temporary differences for which no deferred

income tax was recognized (88,469) (142,395)

Tax credit (1,887,582) (801,854)

Overseas subsidiaries and associates operations 527,553 518,936

Other 44,462 31,173

Actual income tax expense

₩

3,182,131

₩

2,431,046

Effective tax rate 16.5% 19.9%

(In millions of Korean Won)

(In millions of Korean Won)

Temporary differences Deferred income tax asset (Liabilities)

Beginning

balance

Increase

(Decrease)

Ending

balance

Beginning

balance

Increase

(Decrease)

Ending

balance

Deferred tax arising from temporary

differences

Special reserves appropriated for

tax purposes

₩

(644,811)

₩

626,665

₩

(18,146)

₩

(156,044)

₩

152,052

₩

(3,992)

Associates and joint ventures and

other investments (9,032,482) (5,127,725) (14,160,207) (1,581,746) (527,553) (2,109,299)

Depreciation (36,830) 167,226 130,396 (54,935) 45,610 (9,325)

Capitalized interest expense (41,662) 1,795 (39,867) (9,345) 535 (8,810)

Accrued income (39,568) (105,053) (144,621) (9,576) (25,354) (34,930)

Allowance (Technical expense, others) 3,819,074 (76,731) 3,742,343 950,284 (23,571) 926,713

Foreign currency translation 77,823 (100,845) (23,022) 17,512 (24,080) (6,568)

Impairment losses on investments 34,395 11,025 45,420 7,568 2,426 9,994

Others (2,415,409) 478,961 (1,936,448) (336,616) 43,498 (293,118)

₩

(8,279,470)

₩

(4,124,682)

₩

(12,404,152)

₩

(1,172,898)

₩

(356,437)

₩

(1,529,335)

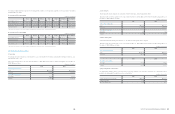

Deferred tax assets arising from the

carryforwards

Undisposed accumulated deficit

₩

285,568

₩

(244,746)

₩

40,822

₩

45,612

₩

(41,250)

₩

4,362

Tax credit carryforwards 1,348,621 233,204 1,581,825 1,056,534 363,902 1,420,436

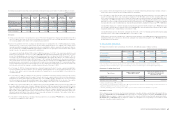

Deferred items recognized in other

comprehensive income

Valuation of available-for-sale financial

assets and others

₩

(856,800)

₩

(1,417,671)

₩ (

2,274,471)

₩

(127,611)

₩

(296,510)

₩

(424,121)