Samsung 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 59

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

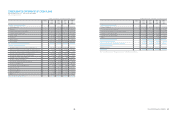

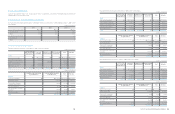

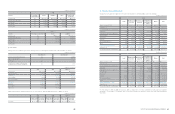

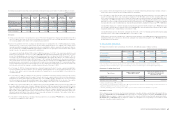

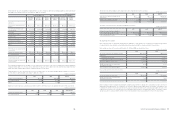

8. Trade and Other Receivables

Substantially all current trade and other receivables are due within 1 year from the end of the reporting period. The carrying amount is a

reasonable approximation of fair value for current trade and other receivables, with effect of discount being insignificant.

Trade and other receivables of December 31, 2010, 2009 and January 1, 2009, consist of the following:

The Company transferred receivable balances to financial institutions in exchange for cash. The outstanding balance of transferred

receivable balances amounting to

5,090,433 million,

5,355,185 million and

5,533,419 million has been accounted for as borrowings

as of December 31, 2010, 2009 and January 1, 2009.

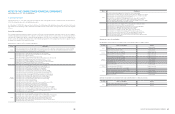

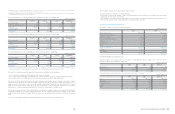

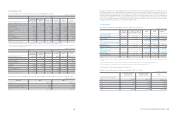

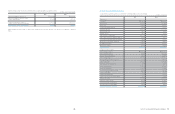

Movements on the provision for impairment of trade receivables are as follows:

The company does not consider receivables that are overdue for less than or equal to 31 days as impaired.

Trade and other receivables that are overdue for less than or equal to 31 days are as follows:

The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivable mentioned above. As of

December 31, 2010, the Company has credit insurance with Korea Trade Insurance and overseas insurance companies against its export

accounts receivables from approved foreign customers.

2010 2009 2009. 1. 1

Trade Non-trade Trade Non-trade Trade Non-trade

Receivables excluding

associates and joint ventures

₩

19,277,300

₩

2,171,115

₩

17,926,719

₩

2,049,336

₩

13,915,906

₩

1,524,129

Receivables related toassociated

companies and joint ventures 61,587 8,638 43,788 10,293 42,560 31,484

Less: Allowances for impairment (185,758) (19,585) (129,078) (26,510) (89,987) (30,816)

Trade receivables, net

₩

19,153,129

₩

2,160,168

₩

17,841,429

₩

2,033,119

₩

13,868,479

₩

1,524,797

Less: Non-current receivables (15) (4,448) (22,689) (55,080) (17,158) (9,574)

Current receivables

₩

19,153,114

₩

2,155,720

₩

17,818,740

₩

1,978,039

₩

13,851,321

₩

1,515,223

(In millions of Korean Won)

2010 2009

Trade Non-trade Trade Non-trade

Balance on January 1

₩

(129,078)

₩

(26,510)

₩

(89,987)

₩

(30,816)

Provision for receivables impairment (100,912) (10,561) (97,203) (5,565)

Receivables written off during

the year as uncollectible 10,909 10,668 31,108 5,700

Unused amounts reversed 32,062 7,776 24,246 3,520

Translation difference 1,261 (958) 2,758 651

Balance on December 31

₩

(185,758)

₩

(19,585)

₩

(129,078)

₩

(26,510)

2010 2009 2009. 1. 1

Trade receivables

₩

1,065,603

₩

1,078,189

₩

1,261,800

Other receivables 93,326 58,251 73,714

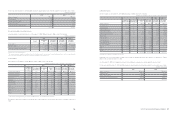

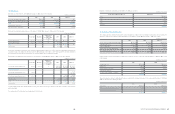

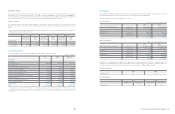

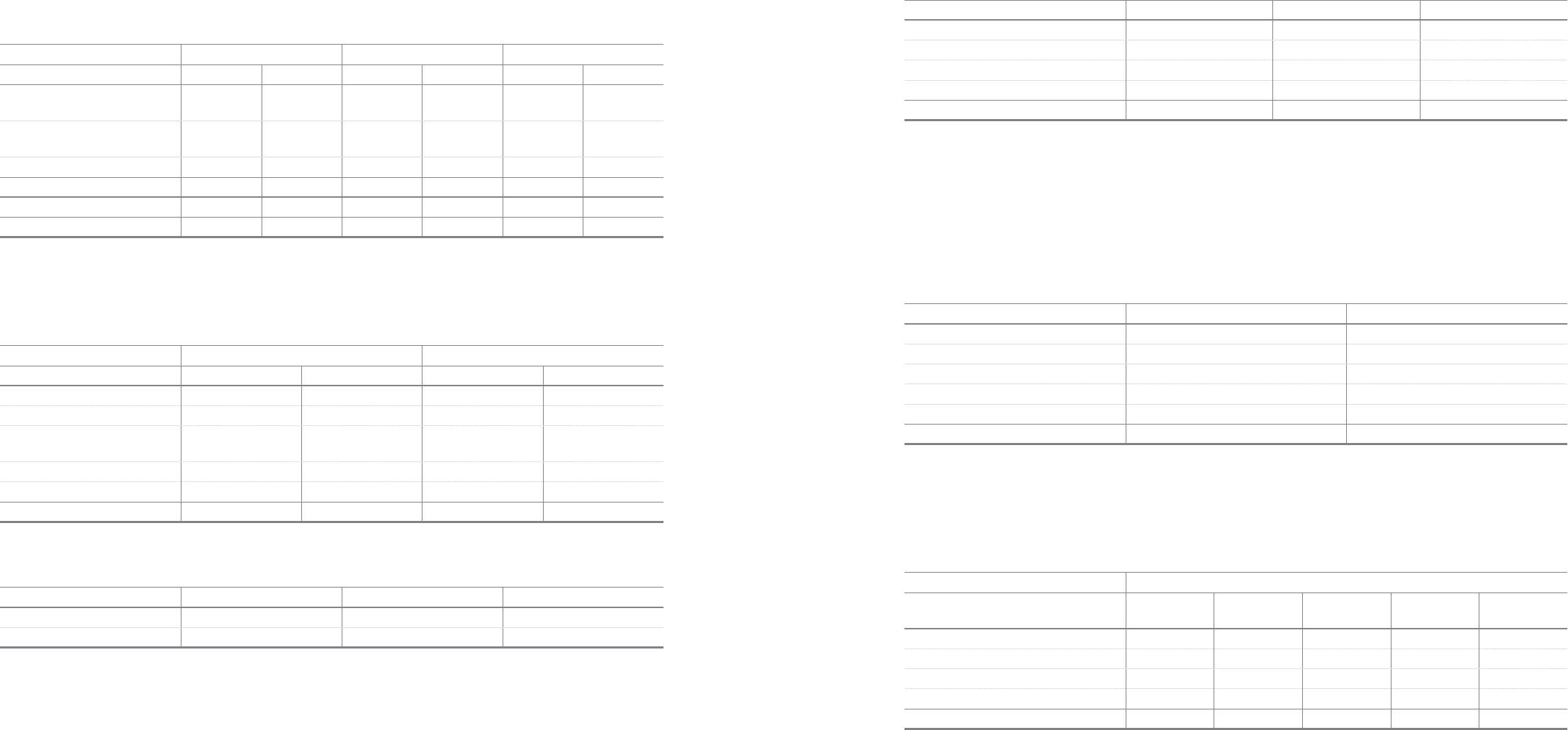

9. Inventories

Inventories, net of valuation losses, as of December 31, 2010, 2009 and January, 1 2009, consist of the following:

As of December 31, 2010, losses from valuation of inventories amounted to

524,850 million (December 31, 2009:

369,033 million,

January 1, 2009:

651,085 million).

As of December 31, 2010, losses from obsolescence and scrappage of inventories amounted to

1,284,956 million (December 31, 2009:

458,826 million, January 1, 2009:

506,319 million).

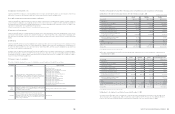

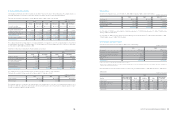

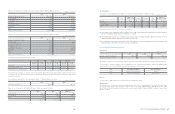

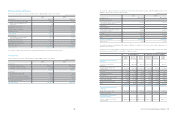

10. Associates and Joint Ventures

Associates and joint ventures as of December 31, 2010, consist of the following:

Financial information of associates and joint ventures as of and for the year ended December 31, 2010, 2009 and January 1, 2009, follows:

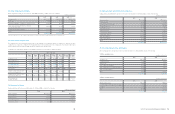

1) Associates

2010 2009 2009. 1. 1

Finished goods

₩

4,511,391

₩

3,010,502

₩

3,064,671

Work in process 2,619,713 1,901,363 1,948,698

Raw materials and supplies 4,159,842 3,188,373 3,136,361

Materials-in-transit 2,073,578 1,739,091 1,248,345

Total

₩

13,364,524

₩

9,839,329

₩

9,398,075

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)

2010 2009

At January 1

₩

7,334,705

₩

5,912,930

Acquisition of associates and joint ventures 243 180,916

Disposal of associates and joint ventures (216,733) (44,832)

Share of profit12,267,091 1,713,299

Others² (1,050,016) (427,608)

At December 31

₩

8,335,290

₩

7,334,705

2010

Investee Percentage of

ownership (%) Assets Liabilities Sales Proportionate

net income

Samsung Card 35.3

₩

14,246,893

₩

8,057,223

₩

3,171,971

₩

1,199,091

Samsung Electro-Mechanics 22.8 6,972,461 3,169,622 7,180,831 666,716

Samsung SDI 19.7 7,933,567 1,702,446 5,124,275 385,112

Samsung SDS 21.3 3,653,483 1,013,265 4,329,994 327,635

Samsung LED 50.0 1,339,988 788,624 1,317,753 204,399

1 Share of profit / (loss) is after tax and minority interest in associates.

2

Others consist of dividends and effect of change in foreign exchange rates. For the year ended December 31, it also includes effect from combination of

Samsung SDS and Samsung Networks.

(In millions of Korean Won)

(In millions of Korean Won)