Samsung 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 63

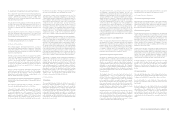

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

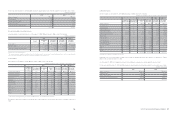

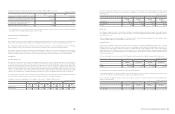

12. Intangible Assets

Changes in intangible assets for the years ended December 31, 2010 and 2009, are as follows:

The amortization expense of intangible assets for the years ended December 31, 2010 and 2009, is allocated to the following accounts:

2009

Intellectual

property rights

Development

expense Membership Goodwill Others Total

Balance at January 1, 2009

₩

405,817

₩

200,478

₩

170,546

₩

9,885

₩

301,346

₩

1,088,072

Internally generated (Development costs) - 176,530 - - - 176,530

External acquisition 174,445 - 14,309 - 184,769 373,523

Business combinations - - - 80,300 (275) 80,025

Amortization (80,891) (157,149) (128,362) (366,402)

Disposal (38,011) (5,408) (1,232) - (12,144) (56,795)

Net exchange differences 5,669 - - (1,982) (190) 3,497

Others (13,481) - - (4,741) (24,220) (42,442)

Balance at December 31, 2009

₩

453,548

₩

214,451

₩

183,623

₩

83,462

₩

320,924

₩

1,256,008

(In millions of Korean Won)

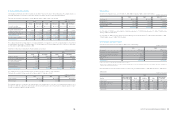

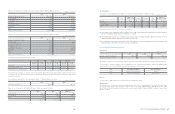

2010

Intellectual

property rights

Development

expense Membership Goodwill Others Total

Balance at January 1, 2010

₩

453,548

₩

214,451

₩

183,623

₩

83,462

₩

320,924

₩

1,256,008

Internally generated (Development costs) - 311,510 - - - 311,510

External acquisition 144,037 - 8,715 - 795,633 948,385

Business combinations (*) 119,805 - - 624,284 242,688 986,777

Amortization (76,182) (191,344) - - (278,996) (546,522)

Disposal (15,768) - (852) - - (16,620)

Impairment (**) (5,382) - - (154,117) (674) (160,173)

Net exchange differences (153) - 7 (281) (1,658) (2,085)

Others (18,023) - (62) 18,064 2,180 2,159

Balance at December 31, 2010

₩

601,882

₩

334,617

₩

191,431

₩

571,412

₩

1,080,097

₩

2,779,439

(*) The amount includes intangible assets and goodwill arising from the business combination with Samsung Digital Imaging.

(**) The impairment charge relates to Samsung Digital Imaging, and is a result of a decline in market profitability share and increased market competitiveness

that occurred in the fourth quarter of 2010.

Account 2010 2009

Production costs

₩

236,223

₩

285,063

Selling general and administrative expenses 227,195 78,083

Research and development expenses 83,104 3,256

Total

₩

546,522

₩

366,402

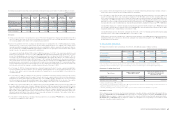

Goodwill was allocated to each cash-generating unit. The recoverable amounts of cash generating units have been determined based on

value-in-use calculations. The Company has performed impairment test for goodwill annually. The revenue growth rate and discount rate

associated with future cash flows were the major assumptions. The majority of good will as of December 31, 2010 relates to the business

combination with Samsung Digital Imaging. For this goodwill, the discount rate used to present value cash flows of the cash-generating unit

as of December 31, 2010 was 15.23%. The revenue growth rate was based on the Company’s forecast for the next five years, and its range

was 2.5%. The Company determines its revenue growth rate based on historical performance and its expectation for market conditions.

The applied weighted average growth rate is consistent with industry reports.

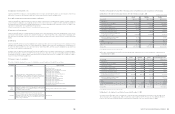

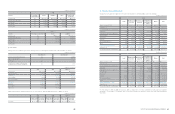

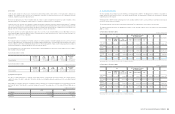

13. Borrowings

Borrowings as of December 31, 2010, 2009 and January 1, 2009, consist of the following:

The carrying value of the borrowings approximates their fair value.

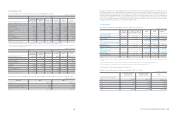

Maturities of long-term borrowings, outstanding as of December 31, 2010, are as follows:

Financial

institutions

Annual interest rates (%)

as of December 31, 2010 2010 2009 2009. 1. 1

Short-term borrowings

Collateralized borrowings Woori Bank etc 1.5 ~ 4.6

₩

5,090,433

₩

5,355,185

₩

5,533,419

Bank borrowings Woori Bank etc 0.2 ~ 16.4 3,339,288 2,424,822 3,521,124

Total

₩

8,429,721

₩

7,780,007

₩

9,054,543

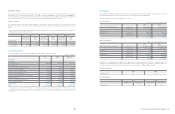

Current portion of long-term borrowings

Bank borrowings Woori Bank etc 1.0 ~ 9.6

₩

1,008,884

₩

123,100

₩

13,094

Financial lease liabilities APCI etc 6.0 ~ 15.7 9,591 5,639 1,345

Total

₩

1,018,475

₩

128,739

₩

14,439

Long-term borrowings

Bank borrowings Woori Bank etc 1.0 ~ 9.6

₩

536,871

₩

1,047,937

₩

913,191

Financial lease liabilities APCI etc 2.3 ~ 15.7 97,510 108,157 56,648

Total

₩

634,381

₩

1,156,094

₩

969,839

(In millions of Korean Won)

(In millions of Korean Won)

(*1) As of December 31, 2010, 2009 and January 1, 2009, overdraft facilities of the Company amount to

202,700 million,

239,300 million and

239,300

million.

(*2) Collateralized borrowings are secured by trade receivables (Note 8). Bank borrowings are secured by lands and buildings (Note 11).

(*3) The Company leases certain property, plant and equipment under various finance lease arrangements (Note 17).

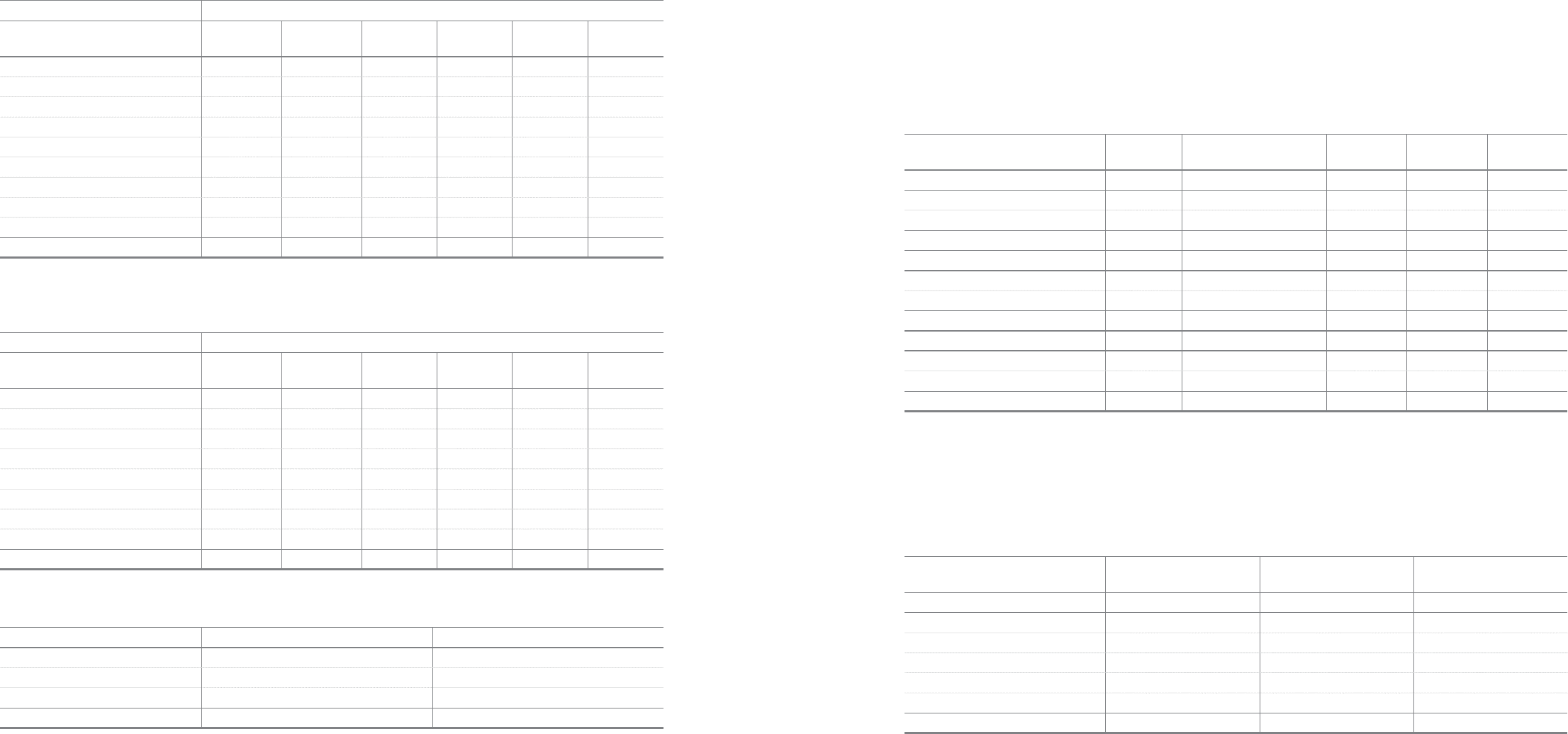

Long-term borrowings

in local currency

Long-term borrowings

in foreign currency Total

For the years ending December 31

2011

₩

254,850

₩

763,625

₩

1,018,475

2012 2,430 42,828 45,258

2013 50,000 465,696 515,696

2014 - 13,143 13,143

Thereafter - 60,284 60,284

Total

₩

307,280

₩

1,345,576

₩

1,652,856

(In millions of Korean Won)

(In millions of Korean Won)