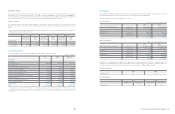

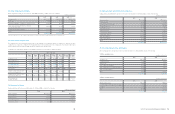

Samsung 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 65

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

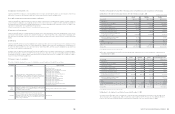

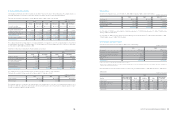

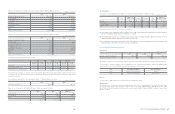

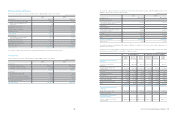

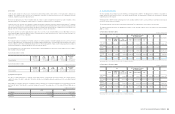

14. Debentures

Debentures as of December 31, 2010, 2009 and January 1, 2009, consist of the following:

(A) Korean Won denominated debentures as of December 31, 2010, 2009, January 1, 2009, consist of the following:

Korean Won denominated debentures were issued by Samsung Mobile Display, one of SEC’s domestic subsidiaries and included in

consolidation scope since 2009. The debenture issued in 2006 will mature on December 1, 2011 with repayment to be made annually for

two years after a three-year grace period, while the one issued in 2010 is due for repayment at maturity.

(B) Debentures denominated in foreign currencies as of December 31, 2010, 2009 and January 1, 2009, consist of the following:

US dollar straight bonds will be repaid annually for twenty years after a ten-year grace period from the date of issuance. Interests will be

paid semi-annually.

The carrying value of the debenture issued approximates their fair value.

Issue date Due date

Annual interest

rates (%)

as of December

31, 2010

2010 2009 2009. 1. 1

Samsung Mobile Display 2006.12.01 2011.12.01 5.1

₩

100,000

₩

200,000

₩

-

Samsung Mobile Display 2010.6.17 2013.6.17 4.7 500,000 - -

Total

₩

600,000

₩

200,000

₩

-

Current portion 100,000 100,000 -

Issue date Due date

Annual interest

rates (%)

as of December

31, 2010

2010 2009 2009. 1. 1

US dollar denominated straight bonds 1997.10.2 2027.10.1 7.7

₩

96,807

(USD 85M)

₩

105,084

(USD 90M)

₩

119,463

(USD 95M)

Overseas subsidiaries

US dollar denominated fixed rate notes 1997.4.1 - - - - 31,438

(USD 25M)

US dollar denominated fixed rate notes 2000.4.1 - - - 29,190

(USD 25M)

31,438

(USD 25M)

Less: Discounts (4,010) (4,253) (5,006)

Total

₩

92,797

₩

130,021

₩

177,333

Current portion 5,459 5,838 6,288

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)

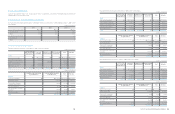

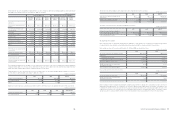

2010 2009 2009.1.1

Korea Won denominated debenture (A)

₩

600,000

₩

200,000

₩

-

Foreign currency denominated debenture (B) 92,797 130,021 177,333

Total

₩

692,797

₩

330,021

₩

177,333

Current portion of debentures 105,459 105,838 6,288

Non-current portion of debentures 587,338 224,183 171,045

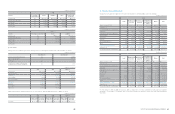

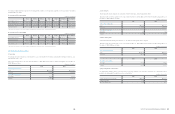

Maturities of debentures outstanding as of December 31, 2010, are as follows:

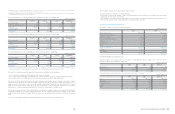

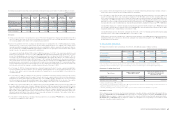

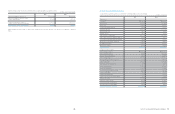

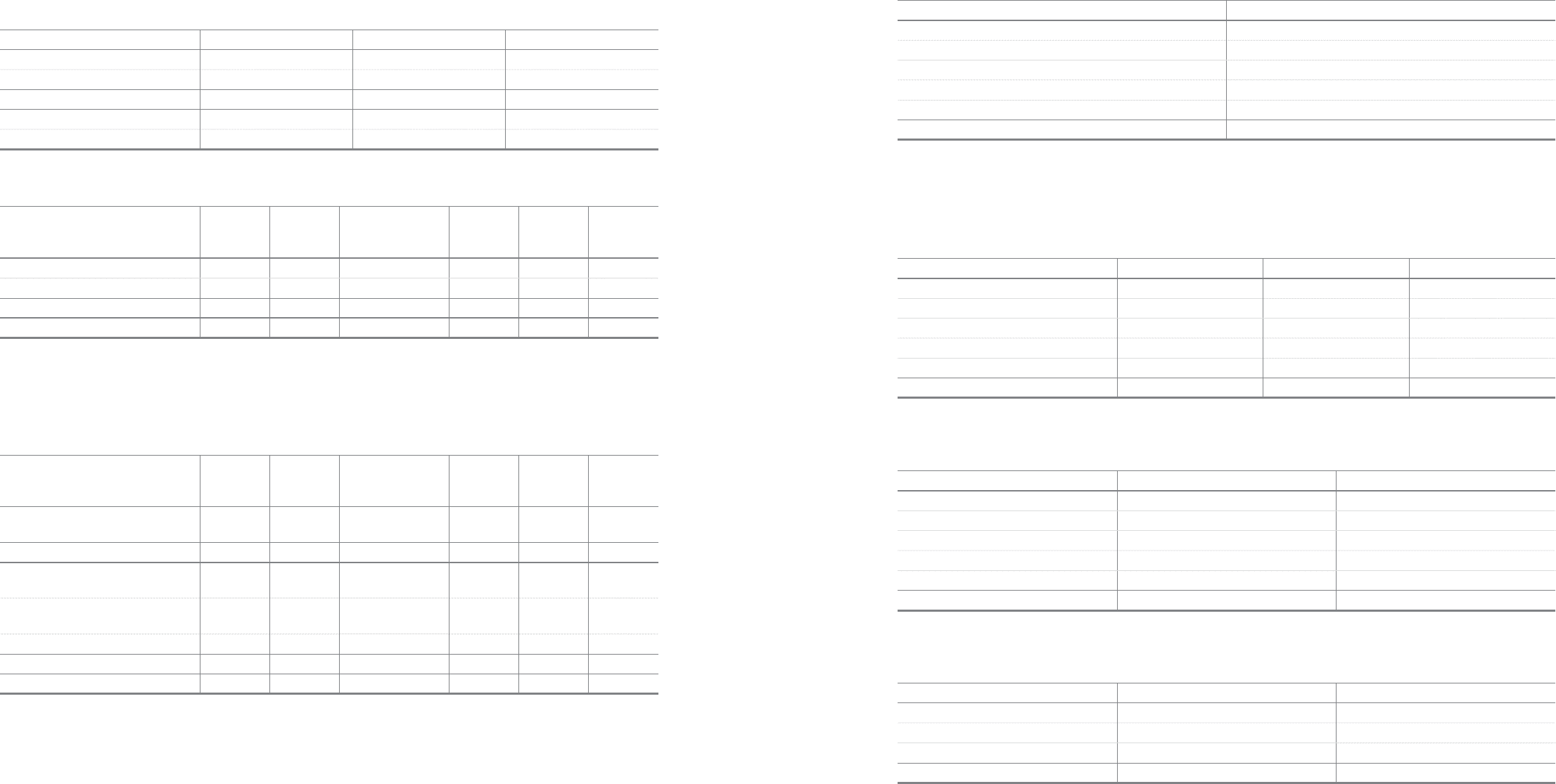

15. Retirement Benefit Obligation

The Company operates defined pension plans in various subsidiaries according to their local regulations and practices in each country. The

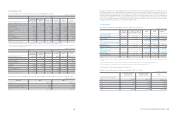

amounts recognized in the statement of financial position as of December 31, 2010, 2009 and January 1, 2009, are as follows:

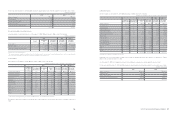

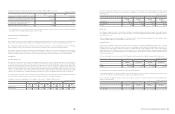

Expense details for defined benefit plans recognized in the statement of income for the years ended December 31, 2010 and 2009, consist

of the following:

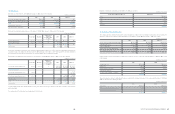

The pension expenses related to defined-benefit plans recognized in the statement of income for the years ended December 31, 2010 and

2009, are allocated to the following accounts:

For the years ending December 31 Debentures

2011

₩

105,695

2012 5,695

2013 505,695

2014 5,695

Thereafter 74,027

₩

696,807

2010 2009 2009. 1. 1

Present value of funded defined benefit obligation

₩

2,293,468

₩

2,088,933

₩

1,861,559

Fair value of plan assets (1,797,706) (1,635,056) (1,427,257)

Deficit of funded plans 495,762 453,877 434,302

Present value of unfunded defined benefit 355,164 284,017 396,034

Unrecognized actuarial gains or losses (253,097) 13,373 -

₩

597,829

₩

751,267

₩

830,336

2010 2009

Current service cost

₩

421,343

₩

411,603

Interest cost 148,506 147,860

Expected return on plan assets (76,983) (73,399)

Actuarial gains and losses (2,158) -

The effect of any settlement or curtailment 13,754 -

₩

504,462

₩

486,064

2010 2009

Cost of sales

₩

191,690

₩

256,155

Selling, general and administrative expenses 139,584 103,823

Research and development expenses 173,188 126,086

₩

504,462

₩

486,064

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)