Samsung 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 71

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Redemption of shares

SEC is authorized, subject to the Board of Directors’ approval, to retire treasury stock in accordance with applicable laws up to the

maximum amount of certain undistributed earnings. As of December 31, 2010, 8,310,000 shares of common stock and 1,060,000 shares

of non-voting preferred stock had been retired over three tranches, with the Board of Directors’ approval. The par value of capital stock

differs from paid-in capital as the retirement of capital stock was recorded as a deduction from retained earnings.

Issuance of shares

SEC is authorized, subject to the Board of Directors’ approval, to issue shares of common or preferred stock to investors other than current

shareholders for issuance of depository receipts, general public subscription, urgent financing with financial institutions, and strategic

alliance.

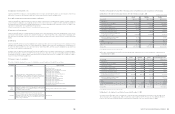

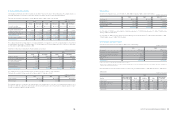

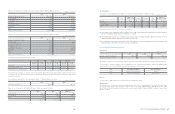

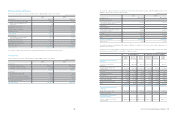

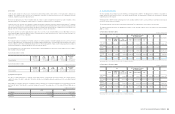

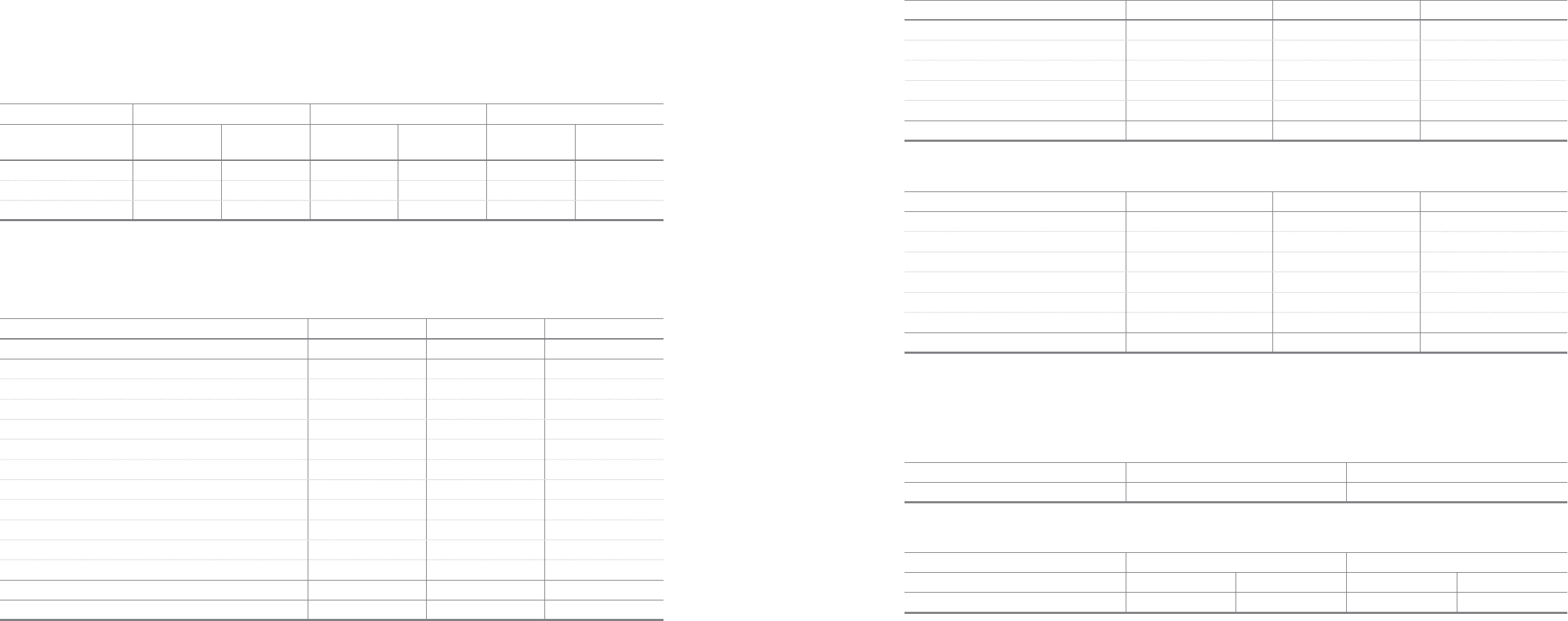

a. SEC has issued global depositary receipts (“GDR”) to overseas capital markets. The number of outstanding GDR as of December 31,

2010, 2009 and January 1, 2009, are as follows:

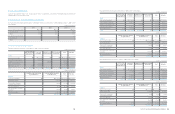

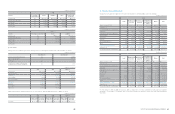

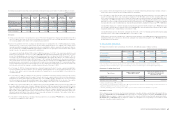

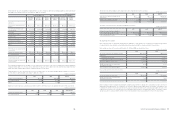

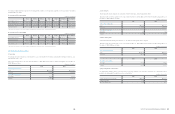

19. Retained Earnings

a. Retained earnings as of December 31, 2010, 2009 and January 1, 2009, consist of the following:

1 The Commercial Code of the Republic of Korea requires the Company to appropriate as a legal reserve, an amount equal to a minimum of 10% of annual

cash dividends declared, until the reserve equals 50% of its issued capital stock. The reserve is not available for the payment of cash dividends, but may

be transferred to capital stock through a resolution of the Board of Directors or used to reduce accumulated deficit, if any, with the ratification of the

shareholders.

2010 2009 2009. 1. 1

Non-voting

preferred stock

Common

stock

Non-voting

preferred stock

Common

stock

Non-voting

preferred stock

Common

stock

Outstanding GDR

- Share of stock 3,253,577 9,049,098 3,519,155 8,921,328 3,402,937 8,661,570

- Share of GDR 6,507,154 18,486,976 7,038,310 17,842,656 6,805,874 17,323,140

2010 2009 2009. 1. 1

Appropriated

Legal reserve:

Earned surplus reserve1

₩

450,789

₩

450,789

₩

450,789

Discretionary reserve:

Reserve for improvement of financial structure 204,815 204,815 204,815

Reserve for business rationalization 11,512,101 10,512,101 9,512,101

Reserve for overseas market development 510,750 510,750 510,750

Reserve for overseas investment losses 164,982 164,982 164,982

Reserve for research and human resource development 33,936,458 29,936,458 26,936,458

Reserve for export losses 167,749 167,749 167,749

Reserve for loss on disposal of treasury stock 3,100,000 3,100,000 3,100,000

Reserve for capital expenditure 13,096,986 9,632,937 8,816,905

Unappropriated 21,869,920 16,384,666 12,416,667

Total

₩

85,014,550

₩

71,065,247

₩

62,281,216

(In millions of Korean Won)

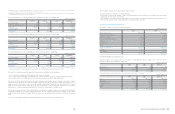

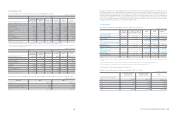

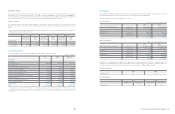

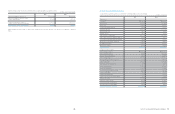

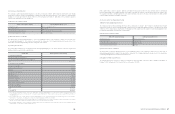

20. Dividends

SEC declared cash dividends to shareholders of common stock and preferred stock as interim dividends for the six-month periods ended

June 30, 2010 and 2009, and as year-end dividends for the years ended December 31, 2010 and 2009.

Details of interim dividends and year-end dividends are as follows:

(A) Interim dividends

(B) Year-end dividends

Dividend for the year 2010 will be paid in April, 2011 after approval from the general shareholders’ meeting scheduled in March, 2011. The

dividend for the year 2009 was paid on April 19, 2010. The statements of financial position as of December 31, 2010 and 2009 do not

reflect these dividend payables as they had not yet been declared as at December 31, 2010 and 2009, respectively.

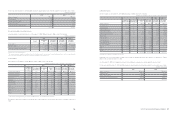

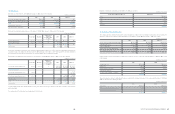

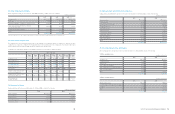

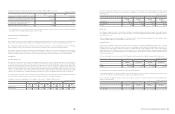

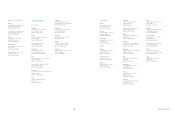

(C) Dividend payout ratio

(D) Dividend yield ratio

2010 2009

Number of shares eligible for dividends Common stock 129,558,812shares 127,160,064shares

Preferred stock 19,853,734shares 19,853,734shares

Dividend rate 100% 10%

Dividend amount Common stock

₩

647,794

₩

63,580

Preferred stock 99,269 9,927

₩

747,063

₩

73,507

2010 2009

Number of shares eligible for dividends Common stock 129,843,077shares 128,271,387shares

Preferred stock 19,853,734shares 19,853,734shares

Dividend rate Common stock 100% 150%

Preferred stock 101% 151%

Dividend amount Common stock

₩

649,216

₩

962,035

Preferred stock 100,261 149,896

₩

749,477

₩

1,111,931

(In millions of Korean Won and number of shares)

(In millions of Korean Won and number of shares)

2010 2009

Dividend payout ratio 9.5% 12.4%

2010 2009

Common stock Preferred stock Common stock Preferred stock

Dividend yield ratio 1.1% 1.6% 1.0% 1.6%