Samsung 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 67

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

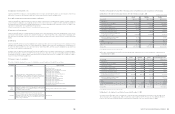

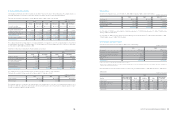

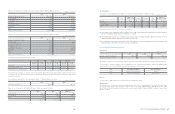

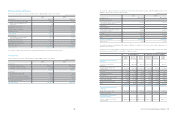

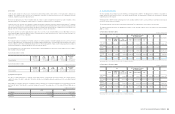

Changes in the defined benefit obligation for the years ended December 31, 2010 and 2009, are as follows:

Changes in the fair value of plan assets for the years ended December 31, 2010 and 2009, are as follows:

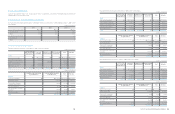

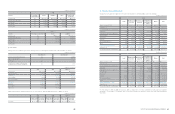

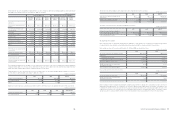

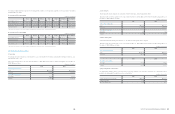

The principal actuarial assumptions used were as follows:

The expected return on plan assets is based on the expected return multiplied with the respective percentage weight of the market-related

value of plan assets. The expected return is defined on a uniform basis, reflecting long-term historical returns, current market conditions and

strategic asset allocation.

The actual returns on plan assets for the years ended December 31, 2010 and 2009, were as follows:

Plan assets as of December 31, 2010, 2009 and January 1, 2009, are comprised as follows:

2010 2009

Balance at the beginning of the year

₩

2,372,950

₩

2,257,593

Foreign exchange 15,416 16,325

Current service cost 421,343 411,603

Interest cost 148,506 147,860

Actuarial gains and losses 251,936 (21,273)

Benefits paid (555,084) (473,422)

Others (6,435) 34,264

Balance at the end of the year

₩

2,648,632

₩

2,372,950

2010 2009

Balance at the beginning of the year

₩

1,635,056

₩

1,427,257

Foreign exchange (4,707) (1,031)

Expected return on plan assets 79,219 75,635

Actuarial gains and losses (12,376) (7,900)

Contributions by the employer 422,567 295,845

Benefits paid (287,535) (155,679)

Others (34,518) 929

Balance at the end of the year

₩

1,797,706

₩

1,635,056

2010 2009

The actual return on plan assets

₩

66,843

₩

67,735

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)

(In %)

2010 2009 2009. 1. 1

Domestic Foreign Domestic Foreign Domestic Foreign

Discount rate 6.3~7.3 6.0~7.5 6.5~7.5 5.9~8.5 6.5~7.5 5.4~7.5

Expected return on plan assets 5.0~5.3 5.0~5.3 5.0~5.5 5.0~5.3 5.0~5.5 5.0~5.5

Future salary increases (Including inflation) 5.3~9.4 5.1~6.0 5.2~7.8 5.5~6.0 5.5~7.5 5.9~6.0

2010 2009 2009. 1. 1

Equity instruments

₩

2,935

₩

1,740

₩

-

Debt instruments 1,761,884 1,596,267 1,418,312

Other 32,887 37,049 8,945

₩

1,797,706

₩

1,635,056

₩

1,427,257

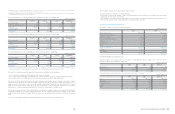

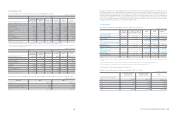

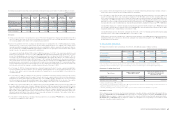

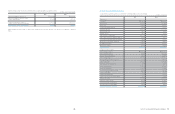

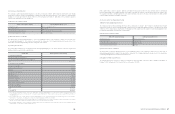

16. Provisions

The changes in the main liability provisions during the 12 month period ended December 31, 2010, are as follows:

(A) The Company accrues warranty reserves for estimated costs of future service, repairs and recalls, based on historical experience

and terms of warranty programs (which have terms from 1 to 4 years).

(B) The Company makes provisions for estimated royalty expenses related to technical assistance agreements that have not been

settled. The timing of payment depends on the settlement of agreement.

(C) The Company has a long-term incentive plans for its executives based on a three-year management performance criteria and has

made a provision for the estimated incentive cost for the accrued period.

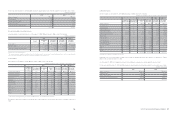

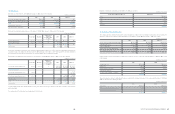

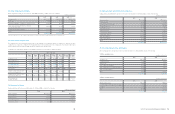

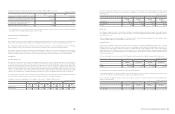

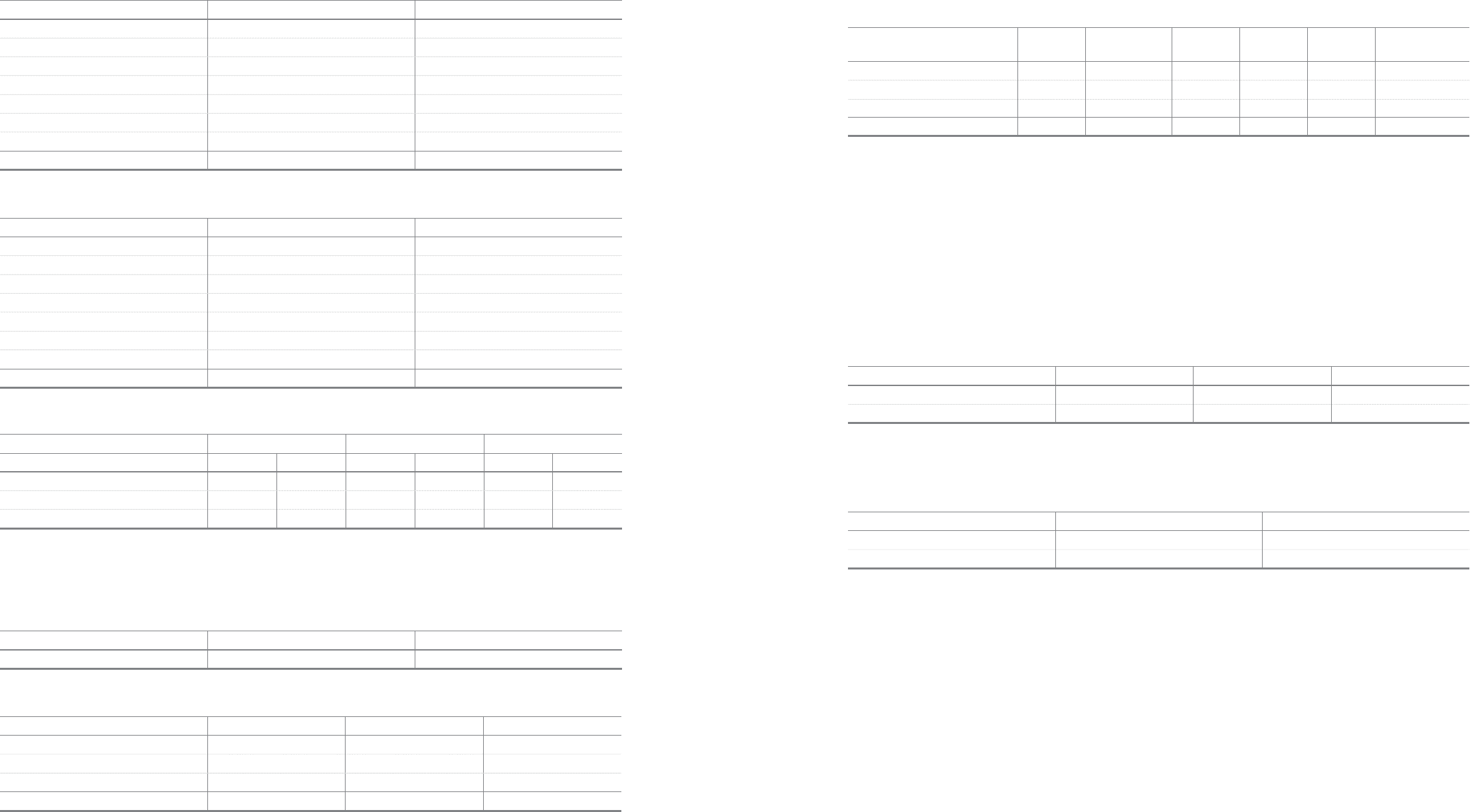

17. Commitments and Contingencies

(A) Guarantees

The guarantees of debt for housing rental relate to guarantees provided by the Company to landlords for housing for expatriate employees.

As of December 31, 2010, the Company’s overseas subsidiaries enter into “Cash Pooling Arrangement” contracts and “Banking Facility”

agreements with overseas financial institutions to provide mutual guarantees of indebtedness.

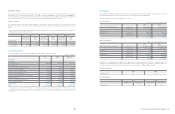

(B) Lease

As of December 31, 2010, details of lease contracts held by the Company are as follows:

Finance lease

The Company leases certain property, plant and equipment under various finance lease arrangements. Assets recorded under finance

lease agreements are included in property, plant and equipment with a net book value of

₩

109,838 million (2009:

₩

102,971 million, 2008:

₩

52,857 million). Depreciation expense for the finance lease assets amounted to

₩

6,817 million (2009:

₩

5,135 million) for the year ended

December 31, 2010.

Ref. Balance at

January 1, 2010 Increase Decrease Other1Balance at

December 31, 2010

Warranty (A)

₩

1,442,088

₩

1,765,182

₩

(1,560,227)

₩

(13,537)

₩

1,633,506

Royalty expenses (B) 1,560,955 1,261,464 (1,821,301) (12,061) 989,057

Long-term incentives (C) 244,443 389,079 (42,810) - 590,712

Total

₩

3,247,486

₩

3,415,725

₩

(3,424,338)

₩

(25,598)

₩

3,213,275

(In millions of Korean Won)

(In millions of Korean Won)

1 Others include amounts from changes in foreign currency exchange rates.

2010 2009 2009. 1. 1

Guarantees of debt for housing rental1

₩

171,674

₩

138,848

₩

250,132

Other domestic guarantees of debt - 9,791 10,312

Area Participating subsidiaries Financial institutions

Europe SEUK and 25 other subsidiaries Citibank

Asia SAPL and 9 other subsidiaries Bank of America