Samsung 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 69

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

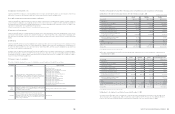

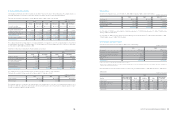

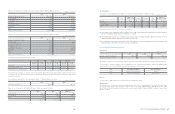

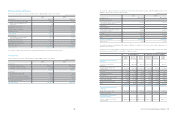

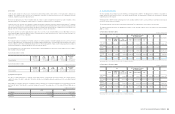

The minimum lease payments under finance lease agreements and their present value as of December 31, 2010 and 2009, are as follows:

(C) Litigation

A. Civil class actions with respect to fixed pricing on the sales of TFT-LCD were filed against the Company and its subsidiaries in the United

States. As of balance sheet date, the outcome of the investigation and civil actions can not be reasonably determined, the Company has

not recorded any liability for these matters in the consolidated financial statements.

B. Based on the agreement entered into on August 24,1999 with respect to Samsung Motor Inc.’s (“SMI”) bankruptcy proceedings,

Samsung Motor Inc.’s creditors (“the Creditors”) filed a civil action lawsuit against Mr. Kun Hee Lee, chairman of the Company, and 28

Samsung Group affiliates including the Company under joint and several liability for failing to comply with such agreement. Under the

suit, the Creditors have sought

₩

2,450,000 million (approximately $1.95 billion) for loss of principal on loans extended to SMI, a separate

amount for breach of the agreement, and an amount for default interest.

SLI completed its Initial Public Offering (“IPO”) on May 7, 2010. After disposing of 2,277,787 of the shares donated by Mr. Lee and

payment of the principal balance owed to the Creditors,

₩

878,000 million (approximately $0.80 billion) was deposited in to an escrow

account. That remaining balance was to be used to pay the Creditors interest due to the delay in the SLI IPO. On January 11, 2011, the

Seoul High Court ordered Samsung Group affiliates to pay

₩

600,000 million (approximately $0.53 billion) to the Creditors and pay 5%

annual interest for the period between May 8, 2010 and January 11, 2011, and pay 20% annual interest for the period after January 11,

2011 until the amounts owed to the Creditors are paid. In accordance with the Seoul High Court order,

₩

620,400 million (which includes

penalties and interest owed) was paid to the Creditors from the funds held in escrow during January 2011. Samsung Group affiliates

and the Creditors all have appealed to the Korean Supreme Court. The Company has concluded that no provision for loss related to this

matter should be reflected in the Company’s consolidated financial statements at December 31, 2010.

C. As of December 31, 2010, the Company was named as a defendant in legal actions filed by 22 overseas companies including Philips,

and as the plaintiff in legal actions against 4 overseas companies including Spansion Inc. for alleged patent infringements. As the

outcome of these matters can not be reasonably determined, the Company has not recorded any liability for these matters in the

consolidated financial.

D. As of December 31, 2010, the Company was also named as a defendant in legal actions filed by 34 domestic and overseas

companies, and as the plaintiff in legal actions against 7 domestic and overseas companies relating to matters other than alleged patent

infringements. The amount claimed against the Company in these cases totals

₩

44,279 million, although in nine of the cases no amount

has yet been claimed and the amount being claimed against other companies totals

₩

2,603 million. As the outcome of these matters

can not be reasonably determined, the Company has not recorded any liability for these matters in the consolidated financial.

E. In addition to the cases mentioned above, the Company’s domestic and foreign subsidiaries have been involved in various claims and

proceedings during the normal course of business. Samsung India Electronics (SIEL) and Samsung Electronics Iberia (SESA) located in

Spain are undergoing tax investigations brought by the local tax authorities with claims amounting up to

₩

110,892 million and

₩

27,216

million, respectively. As of December 31, 2010, the amount of claims for which the Company’s subsidiaries are the defendant is totals

₩

62,574 million, including

₩

5,710 million relating to Samsung Electronics America (SEA). The Company's management believes that,

although the amount and timing of these matters can not be reasonably determined, the conclusion of these matters will not have a

material adverse effect on the financial position of the Company.

F. As of December 31, 2010, Living Plaza, a subsidiary of SEC has provided two notes amounting to

₩

30,000 million, to financial institutions

as collaterals for the fulfillment of certain contracts.

2010 2009 2009. 1. 1

Minimum

lease payments

Present

values

Minimum

lease payments

Present

values

Minimum

lease payments

Present

values

Within one year

₩

19,679

₩

9,591

₩

19,421

₩

5,639

₩

10,659

₩

1,345

From one year to five years 73,862 40,356 73,155 22,685 32,866 9,214

More than five years 118,567 57,154 167,140 85,472 70,403 47,434

Total

₩

212,108

₩

107,101

₩

259,716

₩

113,796

₩

113,928

₩

57,993

Present value adjustment (105,007) (145,920) (55,935)

Finance lease payables 107,101 113,796 57,993

G. In accordance with its risk management policy, the Company uses derivative instruments, primarily forward exchange contracts, to

hedge foreign currency exchange rate risks regarding foreign assets and liabilities.

H. As of December 31, 2010, SEA and other overseas subsidiary have agreements with financial institutions to sell certain eligible trade

accounts receivable under which, on an ongoing basis, a maximum of US$1.065 billion can be sold. SEC and Living Plaza, one of

SEC’s domestic subsidiaries, have trade notes receivable discounting facilities with financial institutions, including Shinhan Bank with a

combined limit of up to

₩

884,945 million. SEC has trade financing agreement with 26 banks including Woori Bank for up to US$11.398

billion and an accounts receivable factoring agreement with Korea Exchange Bank for up to

₩

150,000 million. In addition, the Company

has loan facilities with accounts receivable pledged as collaterals with financial institutions, including Woori Bank, for up to

₩

1,163,000 million.

Samsung Mobile Display, one of domestic subsidiary has trade financing agreement with Woori Bank for up to

₩

340 million, trade

note receivable loan facility with Korea Exchange Bank for up to

₩

10,000 million, and export bill negotiation agreement with four banks

including Woori Bank for up to US$0.47 billion as of December 31, 2010.

Samsung Mobil Display and four other domestic subsidiaries has entered into a letter of credit facility agreement with 4 banks including

Woori Bank for up to US$16.3 million and

₩

45,000 million as of December 31, 2010.

SEMES and two other domestic subsidiaries have credit purchase facility agreements of up to

₩

148,900 million with financial institutions,

including Hana Bank, and S-LCD and one other domestic subsidiaries have general term loan facilities of up to

₩

200,000 million with

Kookmin Bank and one other bank.

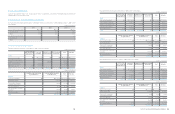

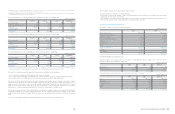

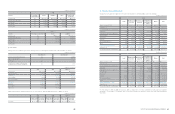

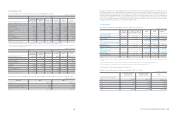

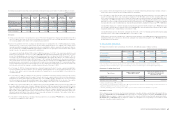

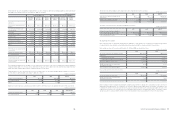

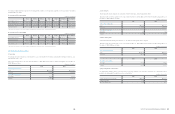

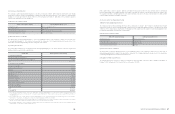

18. Share Capital and Premium

The changes in the number of shares outstanding as of December 31, 2010, 2009 and January 1, 2009, are as follows:

Common stock and preferred stock

Convertible securities

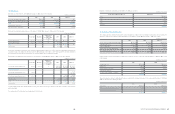

SEC is authorized to issue to investors, other than current shareholders, convertible debentures and debentures with warrants with face

values up to

₩

4,000,000 million and

₩

2,000,000 million, respectively. The convertible debentures amounting to

₩

3,000,000 million and

₩

1,000,000 million are assigned to common stock and preferred stock, respectively. While the debentures with warrants amounting to

₩

1,500,000 million and

₩

500,000 million are assigned to common stock and preferred stock, respectively. As of December 31, 2010,

there are no convertible securities currently in issue.

Number of shares (*) Share capital Share premium Total

At 1 January 2009 146,889,642

₩

897,514

₩

4,403,893

₩

5,301,407

Shares issued (**)1,235,479 - - -

At 31 December 2009 148,125,121 897,514 4,403,893 5,301,407

Shares issued (**) 1,571,690

At 31 December 2010 149,696,811

₩

897,514

₩

4,403,893

₩

5,301,407

(In millions of Korean Won and number of shares)

(*) As of December 31, 2010 and 2009, and January 1, 2009, 19,853,734 shares of preferred stock were included in the number of shares.

(**) Treasury stocks were issued with respect to options exercised during 2009 and 2010 and the merger of Samsung Digital Imaging during 2010.

1 Common stock with par value of

₩

5,000 per share.

2 Non-cumulative, non-voting preferred stock with par value of

₩

5,000 per share that were all issued on or before February 28, 1997 and are entitled to an

additional cash dividend of 1% of par value over common stock.

3 Cumulative, participating preferred stock with par value of

₩

5,000 per share entitled to a minimum cash dividend at 9% of par value.

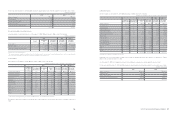

Type of shares Number of shares issued as

at December 31, 2010

Further shares authorized to issue

under articles of incorporation as

at December 31, 2010

Common stock1129,843,077 250,303,189

Preferred stock non-voting, non-cumulative219,853,734 -

Preferred stock non-voting, cumulative3- 100,000,000

(In millions of Korean Won)