Samsung 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 51

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

3) Capitalization of development costs

Under Korean GAAP the Company recorded expenditures related to research and development activities as current expense. Under Korean

IFRS if such costs related to development activities meet certain criteria they are recorded as intangible assets.

4) Goodwill or bargain purchase arising from business combinations

Under Korean GAAP, the Company amortizes goodwill or recognizes a gain in relation to bargain purchase (negative goodwill1) acquired as

a result of business combinations on a straight-line method over five years from the year of acquisition. Under Korean IFRS, goodwill is not

amortized but reviewed for impairment annually. Bargain purchase is recognized immediately in the statement of income. The impact of this

adjustment is included within “other” adjustment in the tables below.

5) Derecognition of financial assets

Under Korean GAAP, when the Company transferred a financial asset to financial institutions and it was determined that control over the

asset has been transferred the Company derecognized the financial asset. Under Korean IFRS, if the Company retains substantially all the

risks and rewards of ownership of the asset, the asset is not derecognized but instead the related cash proceeds are recognized as financial

liabilities.

6) Deferred tax

Under Korean GAAP, deferred tax assets and liabilities were classified as either current or non-current based on the classification of their

underlying assets and liabilities. If there are no corresponding assets or liabilities, deferred tax assets and liabilities were classified based on

the periods the temporary differences were expected to reverse. Under Korean IFRS, deferred tax assets and liabilities are all classified as

non-current on the statement of financial position.

In addition, there is a difference between Korean IFRS and Korean GAAP in terms of recognition of deferred tax assets or liabilities relating to

investments in subsidiaries. Under Korean GAAP there is specific criteria as to when deferred tax assets and liabilities relating to investments

in subsidiaries should be recognized, whereas under Korean IFRS, the related deferred tax assets or liabilities are recognized according to

sources of reversal of the temporary differences.

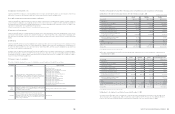

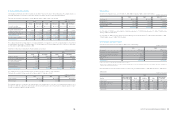

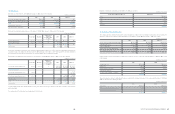

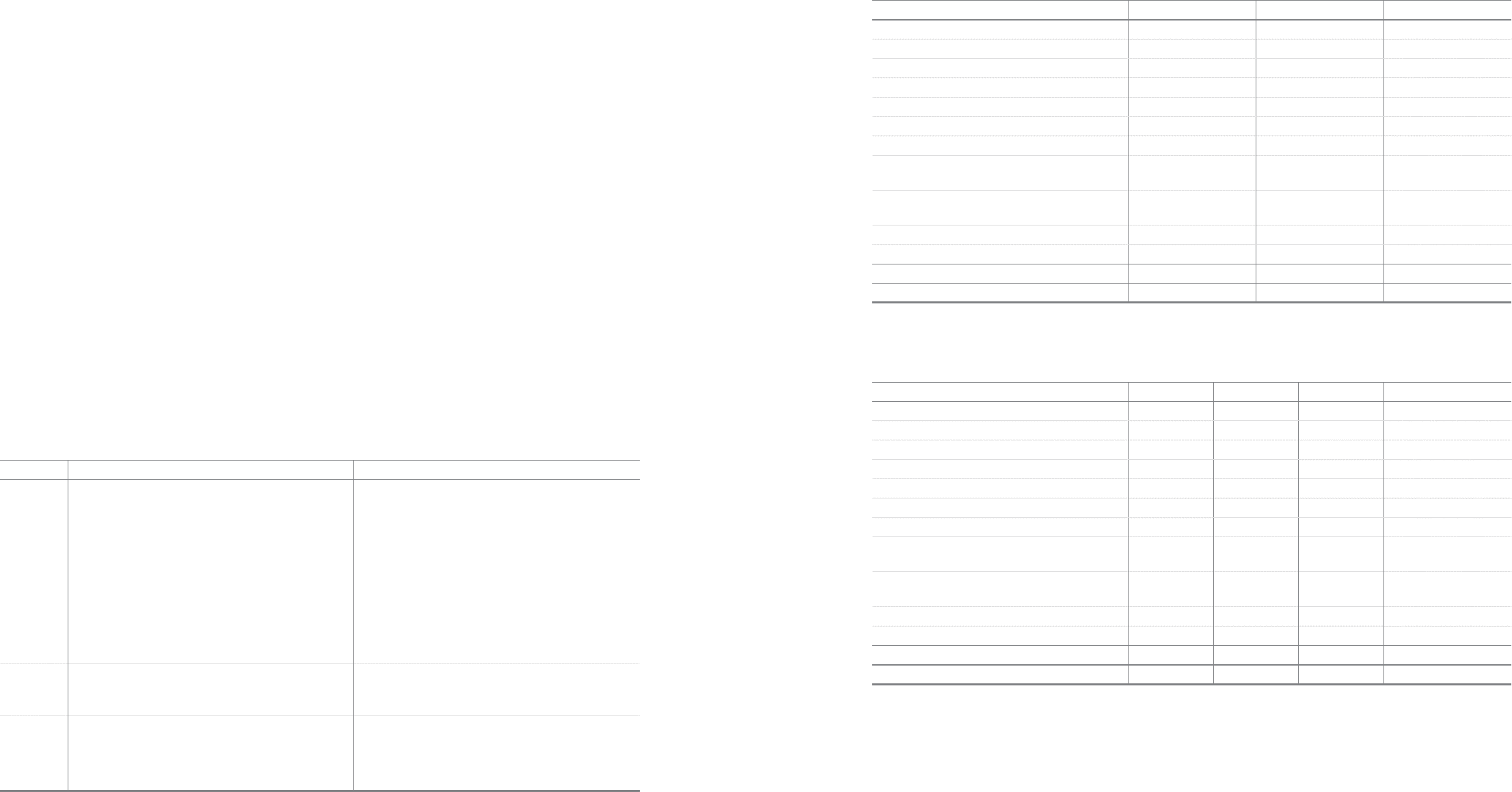

7) Changes in scope of consolidation

At the date of transition, changes in the scope of consolidation as a result of adoption of Korean IFRS are as follows:

Changes Description Name of entity

Newly

added

Under the former ‘Act on External Audit of Stock companies’

in the Republic of Korea, companies those whose total assets are

less than 10 billion Korean Won were not subject to consideration,

but they are subject to consolidation under Korean IFRS.

World Cyber Games,

Samsung Electronics Football Club,

SEMES America, Samsung Electronics Ukraine,

Samsung Electronics Romania,

Samsung Electronics Kazakhstan,

Samsung Electronics Czech and Slovak s.r.o.

Samsung Electronics Levant,

Samsung Electronics European Holding,

Batino Realty Corporation,

Samsung Telecommunications Malaysia,

Samsung Electronics Shenzhen,

Samsung Electronics China R&D Center,

Samsung Electronics Limited,

Samsung Electronics Poland Manufacturing,

Samsung Telecoms (UK)

Newly

added

Under Korean GAAP, a union is not regarded as a legal entity and

excluded from scope of consolidation. However, it is subject to

consolidation under Korean IFRS.

Samsung Venture Capital Union #6, #7 and #14

Excluded

Under Korean GAAP, entities where the Company owns more

than 30% of shares and is the largest shareholder with the largest

voting rights were included in scope of consolidation. Under Korean

IFRS, such entities are not subject to consolidation unless control

over the entity is established.

Samsung Card

1 Negative goodwill under Korean GAAP is referred to as bargain purchase under Korean IFRS

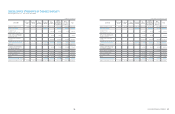

The effects of the adoption of Korean IFRS on financial position, Comprehensive income and cash flows of the Company

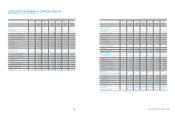

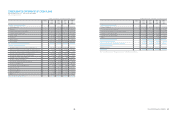

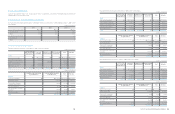

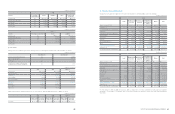

(a) Adjustments to the statement of financial position as of the date of transition, January 1, 2009.

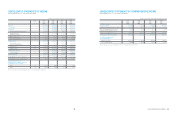

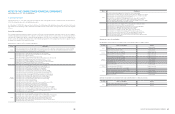

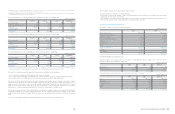

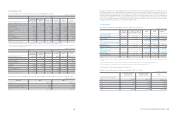

(b) The effect of the adoption of Korean IFRS on financial position and comprehensive income of the Company as of and for the year

ended December 31, 2009.

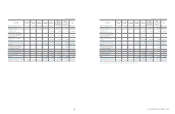

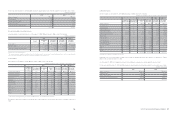

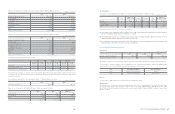

(c) Adjustments to the statement of cash flows for the year ended December 31, 2009

According to Korean IFRS 1007, Cash Flow Statements, cash flows from interest, dividends received and taxes on income shall each be

disclosed separately. The comparison year, 2009, is restated in accordance with Korean IFRS. There are no other significant differences

between cash flows under Korean IFRS and those under previous Korean GAAP for the year ended December 31, 2009.

Assets Liabilities Equity Comprehensive income

Korean GAAP

₩

118,281,488

₩

45,227,196

₩

73,054,292

₩

9,700,671

Adjustments:

Change in scope of consolidation (10,120,256) (7,372,830) (2,747,426) (489,504)

Fair valuation of land (*) 3,804,404 924,525 2,879,879 (9,273)

Derecognition of financial assets 754,969 754,969 - -

Capitalization of development costs 214,451 - 214,451 13,973

Pension and compensated absence - 153,357 (153,357) 33,621

Deferred tax on investments in equity and

reclassification to non-current (874,056) (564,016) (310,040) (200,099)

Effect of the adoption of IFRS for jointly

controlled entities and associates 266,742 - 266,742 111,579

Other (143,058) - (143,058) (47,994)

Tax-effect on adjustments (4,895) 11,386 (16,281) (14,130)

Total (6,101,699) (6,092,609) (9,090) (601,827)

Korean IFRS

₩

112,179,789

₩

39,134,587

₩

73,045,202

₩

9,098,844

Assets Liabilities Equity

Korean GAAP

₩

105,300,650

₩

42,376,696

₩

62,923,954

Adjustments:

Change in scope of consolidation (12,972,168) (10,649,400) (2,322,768)

Fair valuation of land (*) 3,816,293 927,141 2,889,152

Derecognition of financial assets 1,807,675 1,807,675 -

Capitalization of development costs 200,478 - 200,478

Pension and compensated absence - 186,978 (186,978)

Deferred tax on investments in equity and

reclassification to non-current (1,434,287) (1,332,886) (101,401)

Effect of the adoption of IFRS for jointly

controlled entities and associates 155,163 - 155,163

Other (95,064) - (95,064)

Tax-effect on adjustments (141) 2,010 (2,151)

Total (8,522,051) (9,058,482) 536,431

Korean IFRS

₩

96,778,599

₩

33,318,214

₩

63,460,385

(In millions of Korean Won)

(In millions of Korean Won)

(*) The adjustment includes the effect of deferred tax

(*) The adjustment includes the effect of deferred tax