Samsung 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

83

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

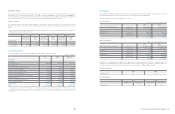

(2) Credit risk

Credit risk arises during the normal course of transactions and investing activities, where clients or other party fails to discharge an

obligation. The Company monitors and sets the counterparty’s credit limit on a periodic basis based on the counterparty’s financial

conditions, default history and other important factors.

There were no significant loans or other receivables which are overdue or subject to impairment, included in accounts receivables or other

financial instruments. The Company has evaluated there is no indication of default by any of its counterparties.

Credit risk arises from cash and cash equivalents, savings and derivative instruments transactions with financial institutions. To minimize

such risk, the Company transacts only with banks which have strong international credit rating (S&P A above), and all new transactions with

financial institutions with no prior transaction history are approved, managed and monitored by the Company’s finance team and the local

financial center. The Company requires separate approval procedure for contracts with restrictions.

The top five customers account for approximately occupies 14.3% and 14.2% and 2,734,014 million and 2,527,089 million for the year

ended 2010 and 2009, respectively, while the top three credit exposures by country amounted to 15.6%, 12.0% and 11.0% (December 31,

2009: 13.4%, 13.4% and 11.1%), respectively.

(3) Liquidity risk

The Company manages its liquidity risk to maintain adequate net working capital by constantly managing projected cash flows. Beyond

effective working capital and cash management, the Company mitigates liquidity risk by contracting with financial institutions with respect

to bank overdrafts, Cash Pooling or Banking Facility agreement for efficient management of funds. Cash Pooling program allows sharing of

funds among subsidiaries to minimize liquidity risk and reduce financial expense.

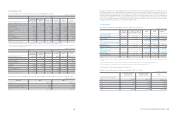

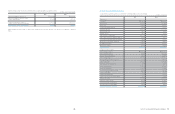

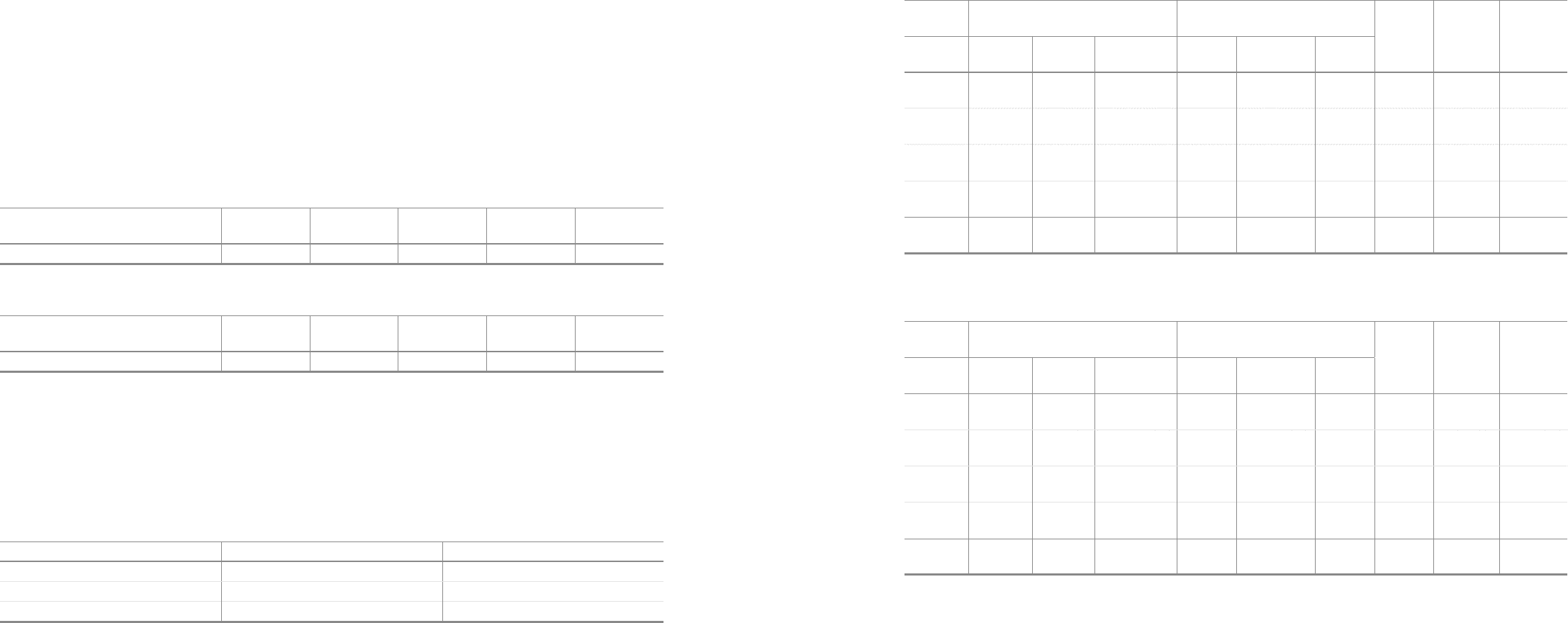

The following table below is an undiscounted cash flow analysis for financial liabilities that are presented on the balance sheet according to

their remaining contractual maturity.

Year ended December 31, 2010

Year ended December 31, 2009

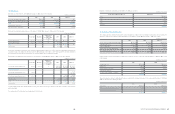

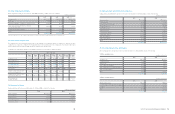

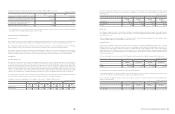

(4) Capital risk management

The object of capital management is to maintain sound capital structure. Consistent with others in the industry, the Company monitors

capital on the basis of the debt to equity ratio. This ratio is calculated as total liabilities divided by equity based on the consolidated financial

statements.

During 2010, the Company’s strategy was to maintain a reliable credit rating. The Company has maintained an A credit rating for long term

debt from S&P and A1 from Moody’s, respectively throughout the period. The gearing ratios at 31 December 2010 and 2009 were as

follows:

(In millions of Korean Won)

Less than

3 months

4-6

months

7-12

months

1-2

years

More than

2 years

Financial liabilities

₩

30,303,459

₩

245,863

₩

2,409,404

₩

623,227

₩

2,403,727

Less than

3 months

4-6

months

7-12

months

1-2

years

More than

2 years

Financial liabilities

₩

23,714,278

₩

231,348

₩

3,226,914

₩

1,279,017

₩

2,553,339

2010 2009

Total liabilities

₩

44,939,653

₩

39,134,587

Total equity 89,349,091 73,045,202

Gearing ratio 50.3% 53.6%

(In millions of Korean Won)

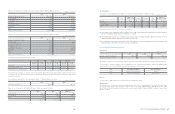

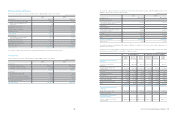

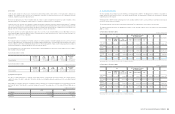

31. Segment Information

The chief operating decision maker has been identified as the Management Committee. The Management Committee is responsible for

making strategic decisions based on review of the group’s internal reporting. The management committee has determined the operating

segments based on these reports.

The Management Committee reviews operating profit of each operating segment in order to assess performance and make decisions about

resources to be allocated to the segment.

The operating segments are product based and include Digital media, Telecommunication, Semiconductor, LCD and others.

The segment information provided to the Management committee for the reportable segments for the year ended 31 December 2010 and

2009 is as follows:

1) Year ended 31 December 2010

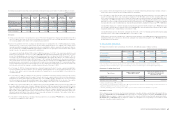

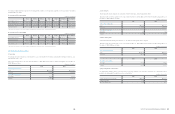

2) Year ended 31 December 2009

Set 2010 Summary of business

by segment device

Others Elimination Consolidated

Total Digital

Media

Tele-

Communication Total Semiconductor LCD

Total segment

revenue

₩

214,945,026

₩

132,443,114

₩

81,502,962

₩

134,384,718

₩

72,806,264

₩

62,162,133

₩

12,768,940

₩

(207,468,356)

₩

154,630,328

Inter-segment

revenue (115,898,073) (75,185,552) (40,303,412) (67,546,082) (35,167,480) (32,242,249) (24,024,201) 207,468,356 -

Revenue

from external

customers

99,046,953 57,257,562 41,199,550 66,838,636 37,638,784 29,919,884 (11,255,261) - 154,630,328

Operating

profit14,822,401 486,182 4,302,554 12,089,126 10,110,698 1,991,990 385,009 - 17,296,536

Total assets

₩

89,076,990

₩

43,515,660

₩

34,365,368

₩

88,118,185

₩

55,583,214

₩

31,547,027

₩

12,360,932

₩

(55,267,363)

₩

134,288,744

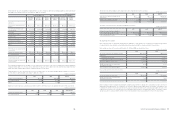

Set 2009 Summary of business

by segment device

Others Elimination Consolidated

Total Digital

Media

Tele-

Communication Total Semiconductor LCD

Total segment

revenue

₩

207,745,409

₩

114,328,769

₩

72,748,628

₩

110,092,134

₩

54,813,121

₩

55,279,013

₩

2,672,165

₩

(184,186,038)

₩

136,323,670

Inter-segment

revenue (116,486,918) (63,066,694) (35,157,318) (57,447,689) (28,005,498) (29,442,191) (10,251,431) 184,186,038 -

Revenue

from external

customers

91,258,491 51,262,075 37,591,310 52,644,445 26,807,623 25,836,822 (7,579,266) - 136,323,670

Operating

profit17,162,479 3,059,935 4,091,052 3,602,445 2,058,733 1,707,433 160,335 - 10,925,259

Total assets

₩

78,804,810

₩

42,605,421

₩

31,882,983

₩

76,543,625

₩

45,458,634

₩

30,959,630

₩

7,845,175

₩

(51,013,821)

₩

112,179,789

(In millions of Korean Won)

(In millions of Korean Won)

1 Operating profit for each segment is inclusive of all consolidation eliminations.

1 Operating profit for each segment is inclusive of all consolidation eliminations.

(In millions of Korean Won)