Samsung 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 81

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

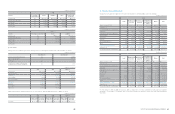

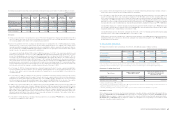

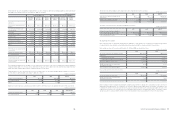

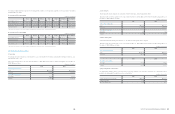

b. Significant transactions not affecting cash flows for the years ended, 2010 and 2009, are as follows:

c. The company reported on a net basis cash receipts and payments arising from transactions occurring frequently and financial

instruments, loans, borrowings which maturity in less than 3 months.

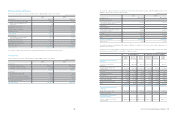

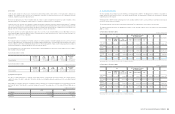

30. Financial Risk Management

Financial risk factors

The Company is exposed to credit risk, liquidity risk and market risk. Market risk arises from currency risk, interest rate risk and fair value

risk associated with investments. The Company has a risk management program in place to monitor and actively manage such risks.

Also, financial risk management officers are dispatched to the regional head quarters of each area including United States of America,

England, Singapore, China, Japan, and Brazil to run and operate a local financial center for global financial risk management.

The Company’s financial assets that are under financial risk management are composed of cash and cash equivalents, short-term financial

instruments, available-for-sale financial assets, trade and other receivables and other financial assets. The Company’s financial liabilities

under financial risk management are composed of trade and other payables, borrowings and debentures and other financial liabilities.

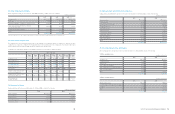

(1) Market risk

(a) Foreign exchange risk

The Company is exposed to foreign exchange risk arising from various currency exposures, primarily with respect to the United States

of America, European Union, Japan, other Asian countries and South America. Revenues and expenses arise from foreign currency

transactions and exchange positions, and the most widely used currencies are the US Dollar, EU’s EURO, Japanese Yen and Chinese Yuan.

Foreign exchange risk management of the Company is carried out by both SEC and its subsidiaries. To minimize foreign exchange risk

arising from operating activities, the Company’s foreign exchange management policy requires all normal business transactions to be in local

currency, or cash-in currency be matched up with cash-out currency. The Company’s foreign risk management policy also defines foreign

exchange risk, measuring period, controlling responsibilities, management procedures, hedging period and hedge ratio very specifically.

The Company limits all speculative foreign exchange transactions and operates a system to manage receivables and payables denominated

in foreign currency. It evaluates, manages and reports foreign currency exposures to receivables and payables.

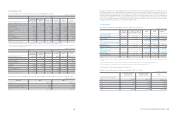

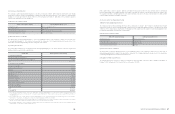

A summary of foreign assets and liabilities of the Company as of December 31, 2009 and 2010 is as follows:

2010 2009

USD EUR JPY Other USD EUR JPY Other

Financial assets 2,489,727 210,014 5,286 210,501 2,824,738 243,906 14,712 228,157

Financial liabilities 2,323,562 205,674 120,991 72,043 2,587,024 196,341 36,759 49,287

The effect of foreign currency risk to net income is a sum of net foreign currency fluctuations of Korean Won against other foreign currency

fluctuations. Foreign currency exposure to financial assets and liabilities of a 5% currency rate change against the Korean Won are

presented below.

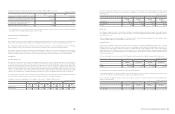

(b) Price risk

The Company’s investment portfolio consists of direct and indirect investments in listed and non-listed securities. The market values for

the Company’s equity investments for the year-ended December 31, 2010 and 2009 are

₩

2,990,441 million and

₩

1,458,642 million

respectively. Refer to Note 7.

If there is change in price of equity investment by 1%, the amount of other comprehensive income changes for the year-ended December

31, 2010 and 2009 are

₩

26,641 million and

₩

12,297 million, respectively.

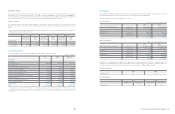

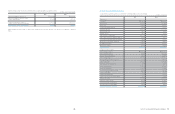

(c) Interest rate risk

Interest rate risk is defined as the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes

in market interest rates. The Company is exposed to interest rate risk mainly arising through interest bearing liabilities and assets. The

Company’s position with regard to interest rate risk exposure is mainly driven by its debt obligations such as bonds, interest-bearing

deposits and issuance of receivables. In order to avoid interest rate risk, the Company maintains minimum external borrowing by facilitating

cash pooling systems on a regional and global basis. The Company manages exposed interest rate risk via periodic monitoring and handles

risk factors on a timely basis.

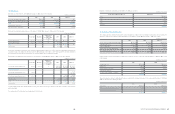

As at the reporting date, the interest rate profile of the Company’s interest bearing assets and liabilities is presented in the table below:

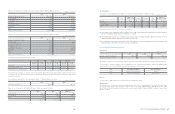

The sensitivity risk of the Company is determined based the following assumptions:

- When financial instruments are evaluated changes to profit and net equity as a result of changes in market interest rates which impact

interest income (expense) to financial instruments are evaluated using floating interest rates.

Based on the above assumption, changes to profit and net equity as a result of 1% increases in interest rate on borrowings in foreign

currency are presented below.

2010 2009

Increase Decrease Increase Decrease

Financial assets

₩

-

₩

-

₩

-

₩

-

Financial liabilities (49,693) 49,693 (41,429) 41,429

2010 2009

Increase in gain on valuation of available-for-sale securities

₩

1.193,297

₩

143,637

Reclassification of construction-in-progress and machinery-

in-transit to other property, plant and equipment accounts 14,351,744 8,850,888

Increase in share of associates and joint ventures

accumulated other comprehensive income 387,457 49,879

Net assets acquired in business combination 1,043,554 -

(In millions of Korean Won)

(In millions of Korean Won)

(In millions of Korean Won)

2010 2009

Increase Decrease Increase Decrease

Financial assets

₩

145,776

₩

(145,776)

₩

165,576

₩

(165,576)

Financial liabilities (136,113) 136,113 (143,471) 143,471

Net effect 9,663 (9,663) 22,105 (22,105)

2010 2009

Fixed rate Floating rate Fixed rate Floating rate

Assets

₩

48,532,894

₩

-

₩

43,590,557

₩

-

Liabilities 30,742,720 4,969,320 26,587,896 4,142,908

(In millions of Korean Won)

(In millions of Korean Won)