Proctor and Gamble 2016 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 67

shares of The Procter & Gamble Company subject to an

exchange ratio of .975 shares of P&G stock per share of Gillette

stock. Only employees previously employed by The Gillette

Company prior to October 1, 2005 are eligible to receive grants

under this plan.

The plan was designed to attract, retain and motivate

employees of The Gillette Company and, until the effective

date of the merger between The Gillette Company and The

Procter & Gamble Company, non-employee members of the

Gillette Board of Directors. Under the plan, eligible

participants are: (i) granted or offered the right to purchase

stock options, (ii) granted stock appreciation rights and/or

(iii) granted shares of the Company's common stock or

restricted stock units (and dividend equivalents). Subject to

adjustment for changes in the Company's capitalization and

the addition of any shares authorized but not issued or

redeemed under The Gillette Company 1971 Stock Option

Plan, the number of shares to be granted under the plan is not

to exceed 19,000,000 shares.

Except in the case of death of the recipient, all stock options

and stock appreciation rights must expire no later than ten years

from the date of grant. The exercise price for all stock options

granted under the plan must be equal to or greater than the fair

market value of the Company's stock on the date of grant. Any

common stock awarded under the plan may be subject to

restrictions on sale or transfer while the recipient is employed,

as the committee administering the plan may determine.

If a recipient of a grant leaves the Company while holding an

unexercised option or right: (1) any unexercisable portions

immediately become void, except in the case of death,

retirement, special separation (as those terms are defined in the

plan) or any grants as to which the Compensation Committee

of the Board of Directors has waived the termination

provisions; and (2) any exercisable portions immediately

become void, except in the case of death, retirement, special

separation, voluntary resignation that is not for Good Reason

(as those terms are defined in the plan) or any grants as to which

the Compensation Committee of the Board of Directors has

waived the termination provisions.

Additional information required by this item is incorporated

by reference to the 2016 Proxy Statement filed pursuant to

Regulation 14A, beginning with the section entitled Security

Ownership of Management and Certain Beneficial Owners and

up to but not including the section entitled Section 16(a)

Beneficial Ownership Reporting Compliance.

Item 13. Certain Relationships and Related Transactions and

Director Independence.

The information required by this item is incorporated by

reference to the following sections of the 2016 Proxy Statement

filed pursuant to Regulation 14A: the subsections of the

Corporate Governance section entitled Director Independence

and Review and Approval of Transactions with Related

Persons.

Item 14. Principal Accountant Fees and Services.

The information required by this item is incorporated by

reference to the following section of the 2016 Proxy Statement

filed pursuant to Regulation 14A: Report of the Audit

Committee, which ends with the subsection entitled Services

Provided by Deloitte.

PART IV

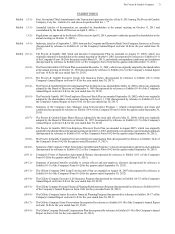

Item 15. Exhibits and Financial Statement Schedules.

1. Financial Statements:

The following Consolidated Financial Statements of The

Procter & Gamble Company and subsidiaries, management's

report and the reports of the independent registered public

accounting firm are incorporated by reference in Part II, Item 8

of this Form 10-K.

• Management's Report on Internal Control over Financial

Reporting

• Report of Independent Registered Public Accounting Firm

on Internal Control over Financial Reporting

• Report of Independent Registered Public Accounting Firm

on Consolidated Financial Statements

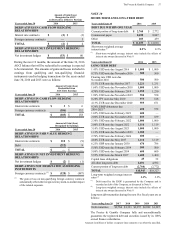

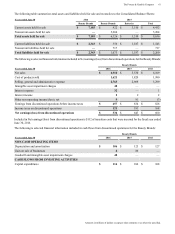

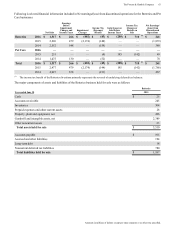

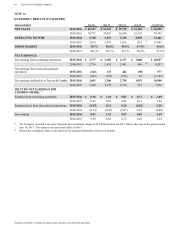

• Consolidated Statements of Earnings - for years ended

June 30, 2016, 2015 and 2014

• Consolidated Statements of Other Comprehensive

Income - for years ended June 30, 2016, 2015 and 2014

• Consolidated Balance Sheets - as of June 30, 2016 and

2015

• Consolidated Statements of Shareholders' Equity - for

years ended June 30, 2016, 2015 and 2014

• Consolidated Statements of Cash Flows - for years ended

June 30, 2016, 2015 and 2014

• Notes to Consolidated Financial Statements

2. Financial Statement Schedules:

These schedules are omitted because of the absence of the

conditions under which they are required or because the

information is set forth in the Consolidated Financial

Statements or Notes thereto.