Proctor and Gamble 2016 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 47

Amounts in millions of dollars except per share amounts or as otherwise specified.

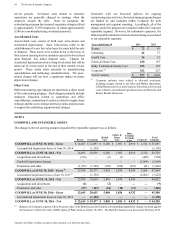

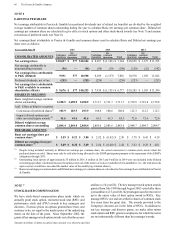

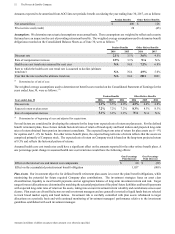

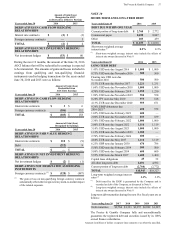

as appropriate. We have tax years open ranging from 2008 and

forward. We are generally not able to reliably estimate the

ultimate settlement amounts until the close of the audit. Based

on information currently available, we anticipate that over the

next 12 month period, audit activity could be completed related

to uncertain tax positions in multiple jurisdictions for which

we have accrued existing liabilities of approximately $250,

including interest and penalties.

Accounting pronouncements require that, without discretion,

we recognize the additional accrual of any possible related

interest and penalties relating to the underlying uncertain tax

position in income tax expense, unless the Company qualifies

for a specific exception. As of June 30, 2016, 2015 and 2014,

we had accrued interest of $323, $347 and $411 and accrued

penalties of $20, $19 and $32, respectively, which are not

included in the above table. During the fiscal years ended

June 30, 2016, 2015 and 2014, we recognized $2, $15 and $(6)

in interest benefit/(expense) and $(2), $13 and $2 in penalties

benefit/(expense), respectively. The net benefits recognized

resulted primarily from the favorable resolution of tax

positions for prior years.

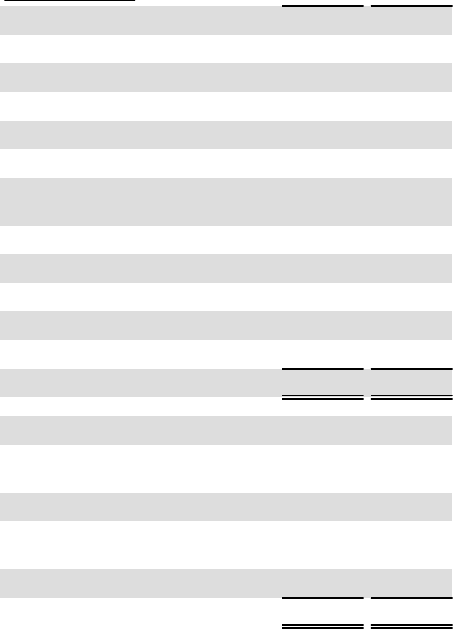

Deferred income tax assets and liabilities were comprised of

the following:

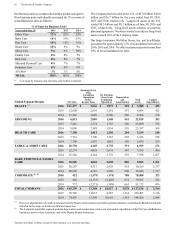

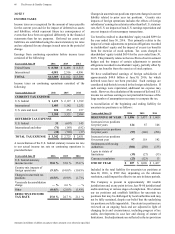

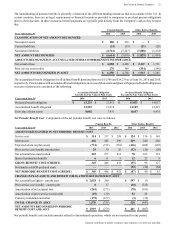

Years ended June 30 2016 2015

DEFERRED TAX ASSETS

Pension and postretirement benefits $ 2,226 $ 1,739

Loss and other carryforwards 1,077 1,014

Stock-based compensation 845 949

Advance payments 515 281

Accrued marketing and promotion 240 266

Unrealized loss on financial and

foreign exchange transactions 122 183

Fixed assets 216 139

Inventory 61 49

Accrued interest and taxes 55 48

Other 764 839

Valuation allowances (467) (324)

TOTAL $ 5,654 $ 5,183

DEFERRED TAX LIABILITIES

Goodwill and other intangible

assets $ 9,461 $ 9,530

Fixed assets 1,533 1,590

Unrealized gain on financial and

foreign exchange transactions 387 353

Other 105 149

TOTAL $ 11,486 $ 11,622

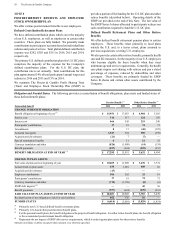

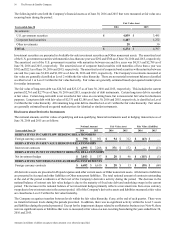

Net operating loss carryforwards were $3.2 billion and $3.1

billion at June 30, 2016 and 2015, respectively. If unused, $1.0

billion will expire between 2016 and 2035. The remainder,

totaling $2.2 billion at June 30, 2016, may be carried forward

indefinitely.