Proctor and Gamble 2016 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 11

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Management's Discussion and Analysis

Forward-Looking Statements

Certain statements in this report, other than purely historical

information, including estimates, projections, statements

relating to our business plans, objectives and expected

operating results and the assumptions upon which those

statements are based, are “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-

looking statements may appear throughout this report,

including, without limitation, in the following sections:

“Management's Discussion and Analysis” and “Risk Factors.”

These forward-looking statements generally are identified by

the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result” and similar expressions.

Forward-looking statements are based on current expectations

and assumptions, which are subject to risks and uncertainties

that may cause results to differ materially from those expressed

or implied in the forward-looking statements. A detailed

discussion of risks and uncertainties that could cause results

and events to differ materially from such forward-looking

statements is included in the section titled "Economic

Conditions and Uncertainties" and the section titled “Risk

Factors” (Item 1A of this Form 10-K). Forward-looking

statements are made as of the date of this report, and we

undertake no obligation to update or revise publicly any

forward-looking statements, whether because of new

information, future events or otherwise.

The purpose of Management's Discussion and Analysis

(MD&A) is to provide an understanding of Procter & Gamble's

financial condition, results of operations and cash flows by

focusing on changes in certain key measures from year to year.

The MD&A is provided as a supplement to, and should be read

in conjunction with, our Consolidated Financial Statements

and accompanying notes. The MD&A is organized in the

following sections:

• Overview

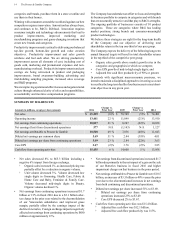

• Summary of 2016 Results

• Economic Conditions and Uncertainties

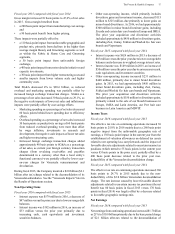

• Results of Operations

• Segment Results

• Cash Flow, Financial Condition and Liquidity

• Significant Accounting Policies and Estimates

• Other Information

Throughout the MD&A, we refer to measures used by

management to evaluate performance, including unit volume

growth, net sales and net earnings. We also refer to a number

of financial measures that are not defined under accounting

principles generally accepted in the United States of America

(U.S. GAAP), including organic sales growth, core earnings

per share (Core EPS), adjusted free cash flow and adjusted free

cash flow productivity. Organic sales growth is net sales

growth excluding the impacts of the Venezuela

deconsolidation, acquisitions, divestitures and foreign

exchange from year-over-year comparisons. Core EPS is

diluted net earnings per share from continuing operations

excluding certain items that are not judged to be part of the

Company's sustainable results or trends. Adjusted free cash

flow is operating cash flow less capital spending and certain

divestiture impacts. Adjusted free cash flow productivity is

the ratio of adjusted free cash flow to net earnings excluding

certain one-time items. We believe these measures provide our

investors with additional information about our underlying

results and trends, as well as insight to some of the metrics

used to evaluate management. The explanation at the end of

the MD&A provides more details on the use and the derivation

of these measures.

Management also uses certain market share and market

consumption estimates to evaluate performance relative to

competition despite some limitations on the availability and

comparability of share and consumption information.

References to market share and market consumption in the

MD&A are based on a combination of vendor-reported

consumption and market size data, as well as internal estimates.

All market share references represent the percentage of sales

in dollar terms on a constant currency basis of our products,

relative to all product sales in the category.

OVERVIEW

P&G is a global leader in fast-moving consumer goods,

focused on providing branded consumer packaged goods of

superior quality and value to our consumers around the world.

Our products are sold in more than 180 countries and territories

primarily through mass merchandisers, grocery stores,

membership club stores, drug stores, department stores,

distributors, baby stores, specialty beauty stores, e-commerce,

high-frequency stores and pharmacies. We have on-the-ground

operations in approximately 70 countries.

Our market environment is highly competitive with global,

regional and local competitors. In many of the markets and

industry segments in which we sell our products, we compete

against other branded products as well as retailers' private-label

brands. Additionally, many of the product segments in which

we compete are differentiated by price tiers (referred to as

super-premium, premium, mid-tier and value-tier products).

We are well positioned in the industry segments and markets

in which we operate, often holding a leadership or significant

market share position.