Proctor and Gamble 2016 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

NOTE 5

INCOME TAXES

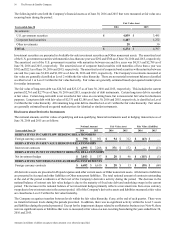

Income taxes are recognized for the amount of taxes payable

for the current year and for the impact of deferred tax assets

and liabilities, which represent future tax consequences of

events that have been recognized differently in the financial

statements than for tax purposes. Deferred tax assets and

liabilities are established using the enacted statutory tax rates

and are adjusted for any changes in such rates in the period of

change.

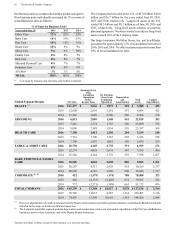

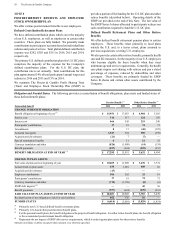

Earnings from continuing operations before income taxes

consisted of the following:

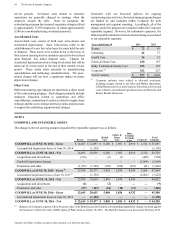

Years ended June 30 2016 2015 2014

United States $8,788 $ 8,496 $ 8,513

International 4,581 2,516 4,996

TOTAL $ 13,369 $11,012 $13,509

Income taxes on continuing operations consisted of the

following:

Years ended June 30 2016 2015 2014

CURRENT TAX EXPENSE

U.S. federal $1,673 $ 2,127 $ 1,399

International 1,483 1,142 1,252

U.S. state and local 224 252 237

3,380 3,521 2,888

DEFERRED TAX EXPENSE

U.S. federal 33 (607) 145

International and other (71) (189) (182)

(38) (796) (37)

TOTAL TAX EXPENSE $ 3,342 $ 2,725 $ 2,851

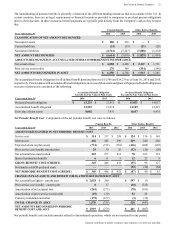

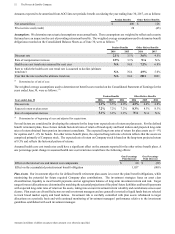

A reconciliation of the U.S. federal statutory income tax rate

to our actual income tax rate on continuing operations is

provided below:

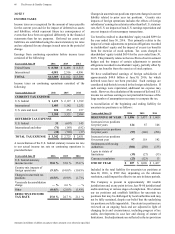

Years ended June 30 2016 2015 2014

U.S. federal statutory

income tax rate 35.0 % 35.0 % 35.0 %

Country mix impacts of

foreign operations (9.1)% (14.0)% (10.8)%

Changes in uncertain tax

positions (0.5)% (0.9)% (1.7)%

Venezuela deconsolidation

charge —% 6.6 % — %

Other (0.4)% (2.0)% (1.4)%

EFFECTIVE INCOME

TAX RATE 25.0 % 24.7 % 21.1 %

Changes in uncertain tax positions represent changes in our net

liability related to prior year tax positions. Country mix

impacts of foreign operations includes the effects of foreign

subsidiaries' earnings taxed at rates other than the U.S. statutory

rate, the U.S. tax impacts of non-U.S. earnings repatriation and

any net impacts of intercompany transactions.

Tax benefits credited to shareholders' equity totaled $899 for

the year ended June 30, 2016. This primarily relates to the

impact of certain adjustments to pension obligations recorded

in stockholders' equity and the impact of excess tax benefits

from the exercise of stock options. Tax costs charged to

shareholders' equity totaled $634 for the year ended June 30,

2015. This primarily relates to the tax effects of net investment

hedges and the impact of certain adjustments to pension

obligations recorded in stockholders' equity, partially offset by

excess tax benefits from the exercise of stock options.

We have undistributed earnings of foreign subsidiaries of

approximately $49.0 billion at June 30, 2016, for which

deferred taxes have not been provided. Such earnings are

considered indefinitely invested in the foreign subsidiaries. If

such earnings were repatriated, additional tax expense may

result. However, the calculation of the amount of deferred U.S.

income tax on these earnings is not practicable because of the

large number of assumptions necessary to compute the tax.

A reconciliation of the beginning and ending liability for

uncertain tax positions is as follows:

Years ended June 30 2016 2015 2014

BEGINNING OF YEAR $ 1,096 $ 1,437 $ 1,600

Increases in tax positions

for prior years 124 87 146

Decreases in tax positions

for prior years (97) (146) (296)

Increases in tax positions

for current year 97 118 142

Settlements with taxing

authorities (301) (250) (135)

Lapse in statute of

limitations (39) (27) (33)

Currency translation (23) (123) 13

END OF YEAR $ 857 $ 1,096 $ 1,437

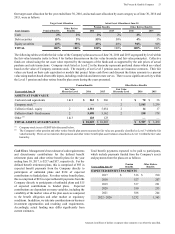

Included in the total liability for uncertain tax positions at

June 30, 2016, is $589 that, depending on the ultimate

resolution, could impact the effective tax rate in future periods.

The Company is present in approximately 140 taxable

jurisdictions and, at any point in time, has 50-60 jurisdictional

audits underway at various stages of completion. We evaluate

our tax positions and establish liabilities for uncertain tax

positions that may be challenged by local authorities and may

not be fully sustained, despite our belief that the underlying

tax positions are fully supportable. Uncertain tax positions are

reviewed on an ongoing basis and are adjusted in light of

changing facts and circumstances, including progress of tax

audits, developments in case law and closing of statute of

limitations. Such adjustments are reflected in the tax provision