Proctor and Gamble 2016 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

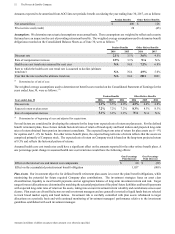

The Procter & Gamble Company 49

Amounts in millions of dollars except per share amounts or as otherwise specified.

Senior-level executives receive PSU awards. Under this

program, the number of PSUs that will vest three years after

the respective grant date is based on the Company's

performance relative to pre-established performance goals

during that three year period.

Atotal of 185 million shares of common stock were authorized

for issuance under the stock-based compensation plan

approved by shareholders in 2014. Atotal of 125 million shares

remain available for grant under the 2014 plan. The disclosures

below include stock-based compensation related to

discontinued operations, which is not material in any period

presented.

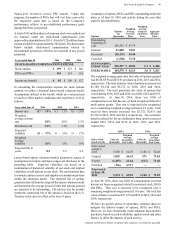

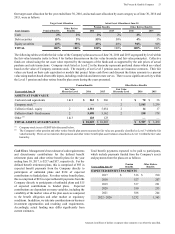

Years ended June 30 2016 2015 2014

STOCK-BASED COMPENSATION EXPENSE

Stock options $ 199 $ 223 $ 246

RSUs and PSUs 143 114 114

Income tax benefit $85

$ 109 $ 127

In calculating the compensation expense for stock options

granted, we utilize a binomial lattice-based valuation model.

Assumptions utilized in the model, which are evaluated and

revised to reflect market conditions and experience, were as

follows:

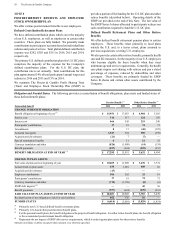

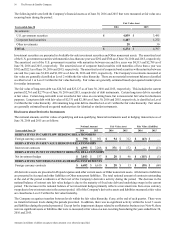

Years ended June 30

2016 2015 2014

Interest rate

0.7

-

1.9% 0.1

-

2.1% 0.1

-

2.8%

Weighted

average interest

rate 1.8% 2.0% 2.5%

Dividend yield 3.2% 3.1% 3.1%

Expected

volatility 15 -17% 11 -15% 15 -17%

Weighted

average

volatility 16% 15% 16%

Expected life in

years 8.3 8.3 8.2

Lattice-based option valuation models incorporate ranges of

assumptions for inputs and those ranges are disclosed in the

preceding table. Expected volatilities are based on a

combination of historical volatility of our stock and implied

volatilities of call options on our stock. We use historical data

to estimate option exercise and employee termination patterns

within the valuation model. The expected life of options

granted is derived from the output of the option valuation model

and represents the average period of time that options granted

are expected to be outstanding. The interest rate for periods

within the contractual life of the options is based on the U.S.

Treasury yield curve in effect at the time of grant.

A summary of options, RSUs and PSUs outstanding under the

plans as of June 30, 2016 and activity during the year then

ended is presented below:

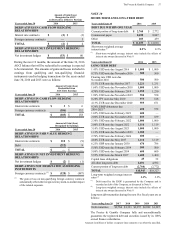

Options

Options

(in

thousands)

Weighted

Average

Exercise

Price

Weighted

Average

Contract-

ual Life in

Years

Aggregate

Intrinsic

Value

Outstanding,

beginning of

year 260,292 $ 63.74

Granted 21,848 79.01

Exercised (50,175) 49.40

Canceled (1,568) 73.70

OUTSTANDING,

END OF YEAR

230,397 $ 68.02 5.1 $ 3,440

EXERCISABLE

164,578 $ 62.63 3.6 $ 3,263

The weighted average grant-date fair value of options granted

was $8.48, $9.38 and $10.01 per share in 2016, 2015 and 2014,

respectively. The total intrinsic value of options exercised was

$1,388, $1,814 and $1,152 in 2016, 2015 and 2014,

respectively. The total grant-date fair value of options that

vested during 2016, 2015 and 2014 was $200, $241 and $319,

respectively. At June 30, 2016, there was $186 of

compensation cost that has not yet been recognized related to

stock option grants. That cost is expected to be recognized

over a remaining weighted average period of 1.9 years. Cash

received from options exercised was $2,332, $2,631 and

$1,938 in 2016, 2015 and 2014, respectively. The actual tax

benefit realized for the tax deductions from option exercises

totaled $433, $519 and $338 in 2016, 2015 and 2014,

respectively.

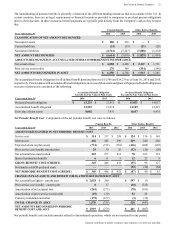

RSUs PSUs

Other stock-

based awards

Units (in

thousands)

Weighted

Average

Grant Date

Fair Value

Units (in

thousands)

Weighted

Average

Grant Date

Fair Value

Non-vested

at July 1,

2015 5,008 $ 64.78 1,188 $ 74.48

Granted 1,855 66.32 571 73.02

Vested (1,453) 61.64 (613) 71.68

Forfeited (136) 67.17 — —

Non-vested

at June 30,

2016 5,274 $ 65.53 1,146 $ 75.25

At June 30, 2016, there was $202 of compensation cost that

has not yet been recognized related to restricted stock, RSUs

and PSUs. That cost is expected to be recognized over a

remaining weighted average period of 3.0 years. The total fair

value of shares vested was $97, $79 and $95 in 2016, 2015 and

2014, respectively.

We have no specific policy to repurchase common shares to

mitigate the dilutive impact of options, RSUs and PSUs.

However, we have historically made adequate discretionary

purchases, based on cash availability, market trends and other

factors, to offset the impacts of such activity.