Proctor and Gamble 2016 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 The Procter & Gamble Company

In part, our success can be attributed to the existence and

continued protection of these trademarks, patents and licenses.

Competitive Condition. The markets in which our products

are sold are highly competitive. Our products compete against

similar products of many large and small companies, including

well-known global competitors. In many of the markets and

industry segments in which we sell our products we compete

against other branded products as well as retailers' private-label

brands. We are well positioned in the industry segments and

markets in which we operate, often holding a leadership or

significant market share position. We support our products

with advertising, promotions and other marketing vehicles to

build awareness and trial of our brands and products in

conjunction with an extensive sales force. We believe this

combination provides the most efficient method of marketing

for these types of products. Product quality, performance, value

and packaging are also important differentiating factors.

Research and Development Expenditures. Research and

development expenditures enable us to develop technologies

and obtain patents across all categories in order to meet the

needs and improve the lives of our consumers. Research and

development expenses were $1.9 billion in 2016, $2.0 billion

in 2015 and $1.9 billion in 2014 (reported in Net earnings from

continuing operations).

Expenditures for Environmental Compliance. Expenditures

for compliance with federal, state and local environmental laws

and regulations are fairly consistent from year to year and are

not material to the Company. No material change is expected

in fiscal year 2017.

Employees. Total number of employees is an estimate of total

Company employees excluding interns, co-ops and employees

of joint ventures as of the years ended June 30. The number

of employees includes manufacturing and non-manufacturing

employees. A discussion of progress on non-manufacturing

enrollment objectives is included in Note 3 to our Consolidated

Financial Statements. The number of employees includes

employees of discontinued operations.

Total Number of Employees

2016 105,000

2015 110,000

2014 118,000

2013 121,000

2012 126,000

2011 129,000

Financial Information about Foreign and Domestic

Operations. Net sales in the U.S. account for 41% of total net

sales. No other individual country exceeds 10% of total net

sales. Operations outside the U.S. are generally characterized

by the same conditions discussed in the description of the

business above and may be affected by additional factors

including changing currency values, different rates of inflation,

economic growth and political and economic uncertainties and

disruptions.

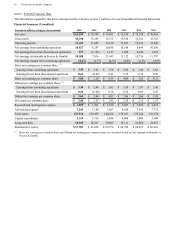

Our sales by geography for the fiscal years ended June 30 were

as follows:

2016 2015 2014

North America

(1)

44% 41% 39%

Europe 23% 24% 26%

Asia Pacific 9% 8% 8%

Greater China 8% 9% 9%

IMEA

(2)

8% 8% 8%

Latin America 8% 10% 10%

(1)

North America includes results for the United States, Canada and

Puerto Rico only.

(2)

IMEA includes India, Middle East and Africa.

Net sales and total assets in the United States and

internationally were as follows (in billions):

Net Sales (years ended June 30) United States International

2016 $27.0 $38.3

2015 $26.8 $43.9

2014 $26.7 $47.7

Total Assets (years ended June 30)

2016 $64.4 $62.7

2015 $65.0 $64.5

2014 $68.8 $75.5

Item 1A. Risk Factors.

We discuss our expectations regarding future performance,

events and outcomes, such as our business outlook and

objectives in this Form 10-K, quarterly reports, press releases

and other written and oral communications. All statements,

except for historical and present factual information, are

“forward-looking statements” and are based on financial data

and business plans available only as of the time the statements

are made, which may become outdated or incomplete. We

assume no obligation to update any forward-looking

statements as a result of new information, future events or other

factors. Forward-looking statements are inherently uncertain,

and investors must recognize that events could significantly

differ from our expectations.

The following discussion of “risk factors” identifies significant

factors that may adversely affect our business, operations,

financial position or future financial performance. This

information should be read in conjunction with the MD&Aand

the Consolidated Financial Statements and related Notes

incorporated in this report. The following discussion of risks

is not all inclusive, but is designed to highlight what we believe

are important factors to consider when evaluating our

expectations. These and other factors could cause our future

results to differ from those in the forward-looking statements

and from historical trends.