Proctor and Gamble 2016 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 15

ECONOMIC CONDITIONS AND UNCERTAINTIES

We discuss expectations regarding future performance, events

and outcomes, such as our business outlook and objectives, in

annual and quarterly reports, press releases and other written

and oral communications. All such statements, except for

historical and present factual information, are "forward-

looking statements" and are based on financial data and our

business plans available only as of the time the statements are

made, which may become out-of-date or incomplete. We

assume no obligation to update any forward-looking

statements as a result of new information, future events or other

factors. Forward-looking statements are inherently uncertain

and investors must recognize that events could be significantly

different from our expectations. For more information on risks

that could impact our results, refer to Item 1A Risk Factors in

this Form 10-K.

Global Economic Conditions. Current macroeconomic

factors remain dynamic, and any causes of market size

contraction, such as reduced GDP in commodity-producing

economies as commodity prices decline, greater political

unrest in the Middle East and Eastern Europe, further economic

instability in the European Union, political instability in certain

Latin American markets and economic slowdowns in Japan

and China, could reduce our sales or erode our operating

margin, in either case reducing our earnings.

Changes in Costs. Our costs are subject to fluctuations,

particularly due to changes in commodity prices and our own

productivity efforts. We have significant exposures to certain

commodities, in particular certain oil-derived materials like

resins, and volatility in the market price of these commodity

input materials has a direct impact on our costs. If we are

unable to manage commodity fluctuations through pricing

actions, cost savings projects and sourcing decisions as well

as through consistent productivity improvements, it may

adversely impact our gross margin, operating margin and net

earnings. Sales could also be adversely impacted following

pricing actions if there is a negative impact on consumption of

our products. We strive to implement, achieve and sustain cost

improvement plans, including outsourcing projects, supply

chain optimization and general overhead and workforce

optimization. As discussed later in the MD&A, we initiated

certain non-manufacturing overhead reduction projects along

with manufacturing and other supply chain cost improvements

projects in 2012. If we are not successful in executing these

changes, there could be a negative impact on our operating

margin and net earnings.

Foreign Exchange. We have both translation and transaction

exposure to the fluctuation of exchange rates. Translation

exposures relate to exchange rate impacts of measuring income

statements of foreign subsidiaries that do not use the U.S. dollar

as their functional currency. Transaction exposures relate to

1) the impact from input costs that are denominated in a

currency other than the local reporting currency and 2) the

revaluation of transaction-related working capital balances

denominated in currencies other than the functional currency.

In 2016, 2015 and 2014, the U.S. dollar has strengthened versus

a number of foreign currencies leading to lower sales and

earnings from these foreign exchange impacts. Certain

countries experiencing significant exchange rate fluctuations,

likeArgentina, Brazil, Canada, Egypt, Mexico, Nigeria, Russia

and Turkey have had, and could have, a significant impact on

our sales, costs and earnings. Increased pricing in response to

these fluctuations in foreign currency exchange rates may

offset portions of the currency impacts, but could also have a

negative impact on consumption of our products, which would

affect our sales.

Government Policies. Our net earnings could be affected by

changes in U.S. or foreign government tax policies. For

example, the U.S. may consider corporate tax reform that could

significantly impact the corporate tax rate and change the U.S.

tax treatment of international earnings. Additionally, we

attempt to carefully manage our debt and currency exposure

in certain countries with currency exchange, import

authorization and pricing controls, such as Argentina, Egypt,

Nigeria and Ukraine. Changes in government policies in these

areas might cause an increase or decrease in our sales, operating

margin and net earnings.

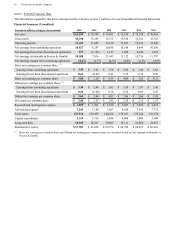

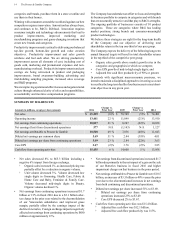

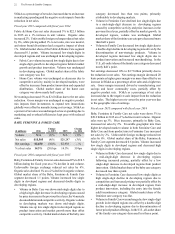

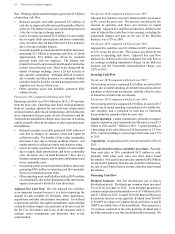

RESULTS OF OPERATIONS

The key metrics included in our discussion of our consolidated

results of operations include net sales, gross margin, selling,

general and administrative costs (SG&A), other non-operating

items and income taxes. The primary factors driving year-

over-year changes in net sales include overall market growth

in the categories in which we compete, product initiatives, the

level of initiatives and other activities by competitors,

geographic expansion and acquisition and divestiture activity,

all of which drive changes in our underlying unit volume, as

well as pricing actions (which can also indirectly impact

volume), changes in product and geographic mix and foreign

currency impacts on sales outside the U.S.

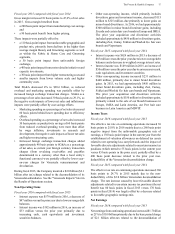

Most of our cost of products sold and SG&A are to some extent

variable in nature. Accordingly, our discussion of these

operating costs focuses primarily on relative margins rather

than the absolute year-over-year changes in total costs. The

primary drivers of changes in gross margin are input costs

(energy and other commodities), pricing impacts, geographic

mix (for example, gross margins in developed markets are

generally higher than in developing markets for similar

products), product mix (for example, the Beauty segment has

higher gross margins than the Company average), foreign

exchange rate fluctuations (in situations where certain input

costs may be tied to a different functional currency than the

underlying sales), the impacts of manufacturing savings

projects and to a lesser extent scale impacts (for costs that are

fixed or less variable in nature). The primary drivers of SG&A

are marketing-related costs and non-manufacturing overhead

costs. Marketing-related costs are primarily variable in nature,

although we may achieve some level of scale benefit over time

due to overall growth and other marketing efficiencies.

Overhead costs are also variable in nature, but on a relative

basis, less so than marketing costs due to our ability to leverage

our organization and systems infrastructures to support

business growth. Accordingly, we generally experience more

scale-related impacts for these costs.