Proctor and Gamble 2016 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

Employee Stock Ownership Plan

We maintain the ESOPto provide funding for certain employee

benefits discussed in the preceding paragraphs.

The ESOPborrowed $1.0 billion in 1989 and the proceeds were

used to purchase Series A ESOP Convertible Class A Preferred

Stock to fund a portion of the U.S. DC plan. Principal and

interest requirements of the borrowing were paid by the Trust

from dividends on the preferred shares and from advances

provided by the Company. The original borrowing of $1.0

billion has been repaid in full, and advances from the Company

of $74 remain outstanding at June 30, 2016. Each share is

convertible at the option of the holder into one share of the

Company's common stock. The dividend for the current year

was equal to the common stock dividend of $2.66 per share.

The liquidation value is $6.82 per share.

In 1991, the ESOP borrowed an additional $1.0 billion. The

proceeds were used to purchase Series B ESOP Convertible

Class A Preferred Stock to fund a portion of retiree health care

benefits. These shares, net of the ESOP's debt, are considered

plan assets of the other retiree benefits plan discussed above.

Debt service requirements are funded by preferred stock

dividends, cash contributions and advances provided by the

Company, of which $718 is outstanding at June 30, 2016. Each

share is convertible at the option of the holder into one share

of the Company's common stock. The dividend for the current

year was equal to the common stock dividend of $2.66 per

share. The liquidation value is $12.96 per share.

Our ESOP accounting practices are consistent with current

ESOP accounting guidance, including the permissible

continuation of certain provisions from prior accounting

guidance. ESOP debt, which is guaranteed by the Company,

is recorded as debt (see Note 10) with an offset to the reserve

for ESOP debt retirement, which is presented within

Shareholders' equity. Advances to the ESOP by the Company

are recorded as an increase in the Reserve for ESOP debt

retirement. Interest incurred on the ESOP debt is recorded as

Interest expense. Dividends on all preferred shares, net of

related tax benefits, are charged to Retained earnings.

The series A and B preferred shares of the ESOP are allocated

to employees based on debt service requirements. The number

of preferred shares outstanding at June 30 was as follows:

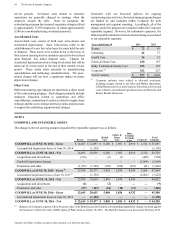

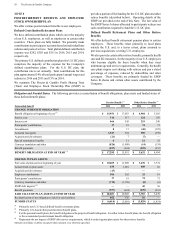

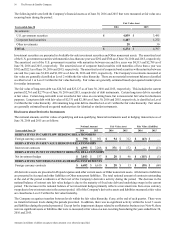

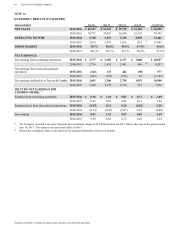

Shares in thousands 2016 2015 2014

Allocated 39,241 42,044 44,465

Unallocated 6,095 7,228 8,474

TOTAL SERIES A 45,336 49,272 52,939

Allocated 23,925 23,074 22,085

Unallocated 32,319 34,096 35,753

TOTAL SERIES B 56,244 57,170 57,838

For purposes of calculating diluted net earnings per common

share, the preferred shares held by the ESOP are considered

converted from inception.

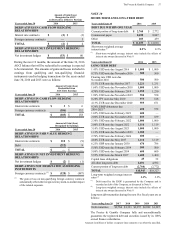

NOTE 9

RISK MANAGEMENT ACTIVITIES AND FAIR VALUE

MEASUREMENTS

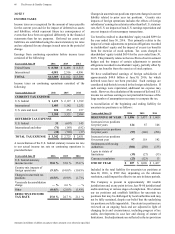

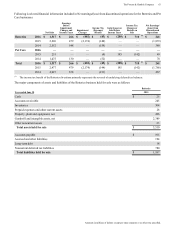

As a multinational company with diverse product offerings,

we are exposed to market risks, such as changes in interest

rates, currency exchange rates and commodity prices. We

evaluate exposures on a centralized basis to take advantage of

natural exposure correlation and netting. To the extent we

choose to manage volatility associated with the net exposures,

we enter into various financial transactions that we account for

using the applicable accounting guidance for derivative

instruments and hedging activities. These financial

transactions are governed by our policies covering acceptable

counterparty exposure, instrument types and other hedging

practices.

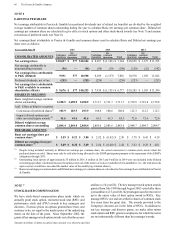

At inception, we formally designate and document qualifying

instruments as hedges of underlying exposures. We formally

assess, at inception and at least quarterly thereafter, whether

the financial instruments used in hedging transactions are

effective at offsetting changes in either the fair value or cash

flows of the related underlying exposures. Fluctuations in the

value of these instruments generally are offset by changes in

the fair value or cash flows of the underlying exposures being

hedged. This is driven by the high degree of effectiveness

between the exposure being hedged and the hedging

instrument. The ineffective portion of a change in the fair value

of a qualifying instrument is immediately recognized in

earnings. The amount of ineffectiveness recognized was

immaterial for all years presented.

Credit Risk Management

We have counterparty credit guidelines and normally enter into

transactions with investment grade financial institutions, to the

extent commercially viable. Counterparty exposures are

monitored daily and downgrades in counterparty credit ratings

are reviewed on a timely basis. We have not incurred, and do

not expect to incur, material credit losses on our risk

management or other financial instruments.

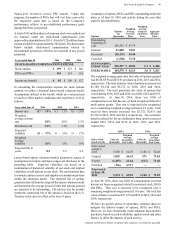

Substantially all of the Company's financial instruments used

in hedging transactions are governed by industry standard

netting and collateral agreements with counterparties. If the

Company's credit rating were to fall below the levels stipulated

in the agreements, the counterparties could demand either

collateralization or termination of the arrangements. The

aggregate fair value of the instruments covered by these

contractual features that are in a net liability position as of

June 30, 2016, was not material. The Company has not been

required to post collateral as a result of these contractual

features.

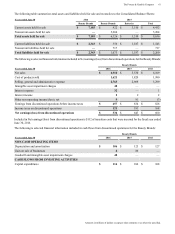

Interest Rate Risk Management

Our policy is to manage interest cost using a mixture of fixed-

rate and variable-rate debt. To manage this risk in a cost-

efficient manner, we enter into interest rate swaps whereby we

agree to exchange with the counterparty, at specified intervals,

the difference between fixed and variable interest amounts

calculated by reference to a notional amount.