Proctor and Gamble 2016 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 17

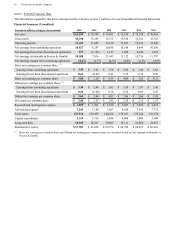

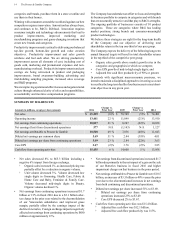

Fiscal year 2015 compared with fiscal year 2014

Gross margin increased 10 basis points to 47.6% of net sales

in 2015. Gross margin benefited from:

• a 200 basis point impact from manufacturing cost savings

and

• a 90 basis point benefit from higher pricing.

These impacts were partially offset by:

• a 110 basis point impact from unfavorable geographic and

product mix, primarily from declines in the higher than

average margin Beauty and Grooming segments as well

as within the Fabric & Home Care and Grooming

segments,

• a 50 basis point impact from unfavorable foreign

exchange,

• a 40 basis point impact from costs related to initiatives and

capacity investments,

• a 30 basis point impact from higher restructuring costs and

• smaller impacts from lower volume scale and higher

commodity costs.

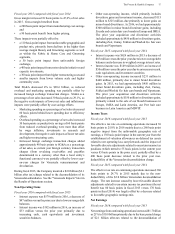

Total SG&A decreased 4% to $20.6 billion, as reduced

overhead and marketing spending was partially offset by

increased foreign exchange transaction charges. SG&A as a

percentage of net sales increased 30 basis points to 29.1%, as

the negative scale impacts of lower net sales and inflationary

impacts were partially offset by cost savings efforts.

• Marketing spending as a percentage of net sales decreased

60 basis points behind lower spending due to efficiency

efforts.

• Overhead spending as a percentage of net sales increased

50 basis points as productivity savings of 60 basis points

from reduced overhead spending were more than offset

by wage inflation, investments in research and

development, the negative scale impacts of lower net sales

and higher restructuring costs.

• Increased foreign exchange transaction charges added

approximately 40 basis points to SG&A as a percentage

of net sales, as current year foreign currency transaction

charges (from revaluing receivables and payables

denominated in a currency other than a local entity’s

functional currency) were partially offset by lower year-

on-year charges for Venezuela remeasurement and

devaluation.

During fiscal 2015, the Company incurred a $2.0 billion ($2.1

billion after tax) charge related to the deconsolidation of its

Venezuelan subsidiaries. See the “Venezuela Impacts” later in

the Results of Operations section.

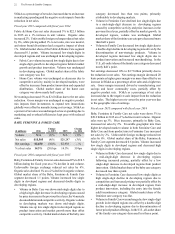

Non-Operating Items

Fiscal year 2016 compared with fiscal year 2015

• Interest expense was $579 million in 2016, a decrease of

$47 million versus the prior year due to lower average debt

balances.

• Interest income was $182 million in 2016, an increase of

$33 million versus the prior year primarily due to

increasing cash, cash equivalents and investment

securities balances.

• Other non-operating income, which primarily includes

divestiture gains and investment income, decreased $115

million to $325 million, due primarily to lower gains on

minor brand divestitures. In 2016, we had approximately

$300 million in minor brand divestiture gains, including

Escudo and certain hair care brands in Europe and IMEA.

The prior year acquisition and divestiture activities

included approximately $450 million in divestiture gains,

including Zest, Camay, Fekkai and Wash & Go hair care

brands and Vaposteam.

Fiscal year 2015 compared with fiscal year 2014

• Interest expense was $626 million in 2015 a decrease of

$83 million versus the prior year due to lower average debt

balances and a decrease in weighted average interest rates.

• Interest income was $149 million in 2015, an increase of

$50 million versus the prior year due to an increase in cash,

cash equivalents and investment securities.

• Other non-operating income increased $231 million to

$440 million, primarily due to minor brand divestiture

gains. In 2015, we had approximately $450 million in

minor brand divestiture gains, including Zest, Camay,

Fekkai and Wash & Go hair care brands and Vaposteam.

The prior year acquisition and divestiture activities

included approximately $150 million in divestiture gains,

primarily related to the sale of our bleach businesses in

Europe, IMEA and Latin America, our Pert hair care

business in Latin America and MDVIP.

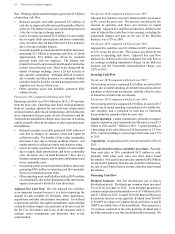

Income Taxes

Fiscal year 2016 compared with fiscal year 2015

The effective tax rate on continuing operations increased 30

basis points to 25.0% in 2016 mainly due to a 260 basis point

negative impact from the unfavorable geographic mix of

earnings, a 130 basis point impact in the current year from the

establishment of valuation allowances on deferred tax assets

related to net operating loss carryforwards and the impact of

favorable discrete adjustments related to uncertain income tax

positions (which netted to 55 basis points in the current year

versus 85 basis points in the prior year), partially offset by a

400 basis point decrease related to the prior year non-

deductibility of the Venezuelan deconsolidation charge.

Fiscal year 2015 compared with fiscal year 2014

The effective tax rate on continuing operations increased 360

basis points to 24.7% in 2015 mainly due to the non-

deductibility of the $2.0 billion Venezuelan deconsolidation

charge. The rate increase caused by lower favorable discrete

adjustments related to uncertain income tax positions (the net

benefit was 80 basis points in fiscal 2015 versus 170 basis

points in fiscal 2014) was largely offset by a decrease related

to favorable geographic earnings mix.

Net Earnings

Fiscal year 2016 compared with fiscal year 2015

Net earnings from continuing operations increased $1.7 billion

or 21% to $10.0 billion primarily due to the base period charge

of $2.1 billion after-tax related to the deconsolidation of