Proctor and Gamble 2016 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 41

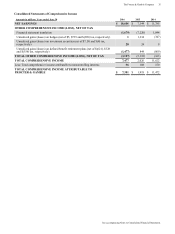

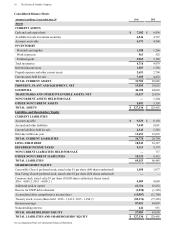

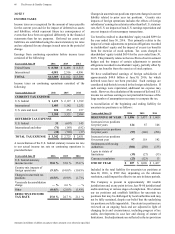

Amounts in millions of dollars except per share amounts or as otherwise specified.

Fair Values of Financial Instruments

Certain financial instruments are required to be recorded at fair

value. Changes in assumptions or estimation methods could

affect the fair value estimates; however, we do not believe any

such changes would have a material impact on our financial

condition, results of operations or cash flows. Other financial

instruments, including cash equivalents, certain investments

and short-term debt, are recorded at cost, which approximates

fair value. The fair values of long-term debt and financial

instruments are disclosed in Note 9.

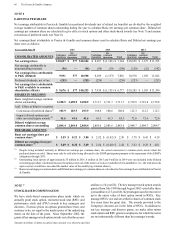

New Accounting Pronouncements and Policies

In May 2014, the FASB issued ASU 2014-09, “Revenue from

Contracts with Customers (Topic 606)”. This guidance

outlines a single, comprehensive model for accounting for

revenue from contracts with customers. We will adopt the

standard no later than July 1, 2018. While we are currently

assessing the impact of the new standard, we do not expect this

new guidance to have a material impact on our Consolidated

Financial Statements.

On July 1, 2015, the Company adopted ASU 2014-08,

"Presentation of Financial Statements (Topic 205) and

Property, Plant, and Equipment (Topic 360): Reporting

Discontinued Operations and Disclosures of Disposals of

Components of an Entity". The guidance included new

reporting and disclosure requirements for discontinued

operations. For additional details on discontinued operations,

see Note 13.

In February 2016, the FASB issued ASU 2016-02, “Leases

(Topic 842)”. The standard requires lessees to recognize lease

assets and lease liabilities on the balance sheet and requires

expanded disclosures about leasing arrangements. We will

adopt the standard no later than July 1, 2019. We are currently

assessing the impact that the new standard will have on our

Consolidated Financial Statements. For additional details on

our operating leases, see Note 12.

In March 2016, the FASB issued ASU 2016-09, “Stock

Compensation (Topic 718): Improvements to Employee Share-

Based Payment Accounting”. The standard amends several

aspects of the accounting for employee share-based payment

transactions including the accounting for income taxes,

forfeitures and statutory tax withholding requirements, as well

as classification in the statement of cash flows. We will adopt

the standard no later than July 1, 2017. While we are currently

assessing the impact of the new standard, we do not expect the

new guidance to have a material impact on our Consolidated

Financial Statements.

No other new accounting pronouncement issued or effective

during the fiscal year had or is expected to have a material

impact on our Consolidated Financial Statements.

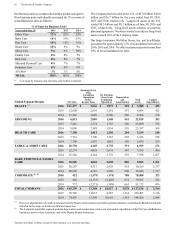

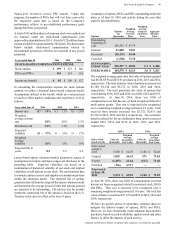

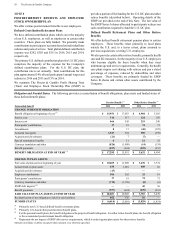

NOTE 2

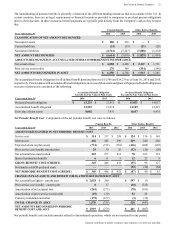

SEGMENT INFORMATION

On July 9, 2015, the Company announced the signing of a

definitive agreement to divest four product categories, initially

comprised of 43 of its beauty brands (“Beauty Brands”), which

will be merged with Coty Inc. ("Coty"). The transaction

includes the global salon professional hair care and color, retail

haircolor,cosmeticsandfinefragrancebusinesses,alongwith

select hair styling brands and is expected to close in October

2016. In February 2016, the Company completed the

divestiture of its Batteries business to Berkshire Hathaway.

The Company completed the divestiture of its Pet Care

business in the previous fiscal year. Each of these businesses

are reported as discontinued operations for all periods

presented (see Note 13).

Under U.S. GAAP, our remaining Global Business Units

(GBUs) are aggregated into five reportable segments: 1)

Beauty, 2) Grooming, 3) Health Care, 4) Fabric & Home Care

and 5) Baby, Feminine & Family Care. Our five reportable

segments are comprised of:

•Beauty: Hair Care (Conditioner, Shampoo, Styling Aids,

Treatments); Skin and Personal Care (Antiperspirant and

Deodorant, Personal Cleansing, Skin Care);

• Grooming: Shave Care (Female Blades & Razors, Male

Blades & Razors, Pre- and Post-Shave Products, Other

Shave Care); Appliances;

• Health Care: Oral Care (Toothbrushes, Toothpaste, Other

Oral Care); Personal Health Care (Gastrointestinal,

Rapid Diagnostics, Respiratory, Vitamins/Minerals/

Supplements, Other Personal Health Care);

• Fabric & Home Care: Fabric Care (Fabric Enhancers,

Laundry Additives, Laundry Detergents); Home Care (Air

Care, Dish Care, P&G Professional, Surface Care ); and

• Baby, Feminine & Family Care: Baby Care (Baby Wipes,

Diapers and Pants); Feminine Care (Adult Incontinence,

Feminine Care); Family Care (Paper Towels, Tissues,

Toilet Paper).

The accounting policies of the segments are generally the same

as those described in Note 1. Differences between these

policies and U.S. GAAP primarily reflect income taxes, which

are reflected in the segments using applicable blended statutory

rates. Adjustments to arrive at our effective tax rate are

included in Corporate.

Corporate includes certain operating and non-operating

activities that are not reflected in the operating results used

internally to measure and evaluate the businesses, as well as

items to adjust management reporting principles to U.S. GAAP.

Operating activities in Corporate include the results of

incidental businesses managed at the corporate level.

Operating elements also include certain employee benefit

costs, the costs of certain restructuring-type activities to

maintain a competitive cost structure, including manufacturing

and workforce optimization and other general Corporate items.

The non-operating elements in Corporate primarily include

interest expense, certain acquisition and divestiture gains and

interest and investing income.

Total assets for the reportable segments include those assets

managed by the reportable segment, primarily inventory, fixed

assets and intangible assets. Other assets, primarily cash,

accounts receivable, investment securities and goodwill, are

included in Corporate.