Proctor and Gamble 2016 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 The Procter & Gamble Company

accordance with the applicable accounting standards for

consolidation, effective June 30, 2015, we deconsolidated

our Venezuelan subsidiaries and began accounting for our

investment in those subsidiaries using the cost method of

accounting. The charge was incurred to write off our net

assets related to Venezuela.

•Charges for certain European legal matters: Several

countries in Europe issued separate complaints alleging

that the Company, along with several other companies,

engaged in violations of competition laws in prior periods.

The Company established Legal Reserves related to these

charges. Management does not view these charges as

indicative of underlying business results.

•Venezuela Balance Sheet Remeasurement & Devaluation

Impacts: Venezuela is a highly inflationary economy

under U.S. GAAP. Prior to deconsolidation, the

government enacted episodic changes to currency

exchange mechanisms and rates, which resulted in

currency remeasurement charges for non-dollar

denominated monetary assets and liabilities held by our

Venezuelan subsidiaries.

We do not view the above items to be part of our sustainable

results, and their exclusion from core earnings measures

provides a more comparable measure of year-on-year results.

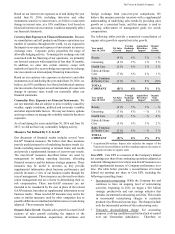

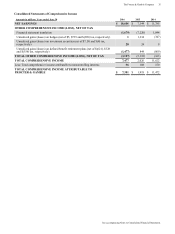

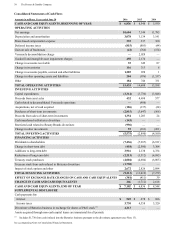

Years ended June 30 2016 2015 2014

Diluted net earnings per share -

continuing operations $3.49 $2.84 $3.63

Incremental restructuring charges 0.18 0.17 0.11

Venezuela balance sheet

devaluation impacts —0.04 0.09

Charges for European legal matters —0.01 0.02

Venezuelan deconsolidation —0.71 —

Rounding —(0.01) —

CORE EPS $3.67 $3.76 $3.85

Core EPS Growth (2)% (2)% 5%

* All reconciling items are presented net of tax. Tax effects are

calculated consistent with the nature of the underlying transaction.

Adjusted Free Cash Flow. Adjusted free cash flow is defined

as operating cash flow less capital spending excluding tax

payments related to the divestiture of the discontinued Pet

business. Adjusted free cash flow represents the cash that the

Company is able to generate after taking into account planned

maintenance and asset expansion. We view adjusted free cash

flow as an important measure because it is one factor used in

determining the amount of cash available for dividends, share

repurchases, acquisitions and other discretionary investment.

The following table provides a numerical reconciliation of

adjusted free cash flow ($ millions):

Operating

Cash

Flow

Capital

Spending

Free

Cash

Flow

Divestiture

impacts*

Adjusted

Free

Cash Flow

2016 $ 15,435 $ (3,314) $ 12,121 $ — $ 12,121

2015 14,608 (3,736) 10,872 729 11,601

2014 13,958 (3,848) 10,110 — 10,110

* Divestiture impacts relate to tax payments for the Pet Care

divestiture in fiscal 2015.

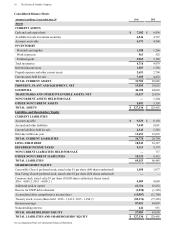

Adjusted Free Cash Flow Productivity. Adjusted free cash

flow productivity is defined as the ratio of adjusted free cash

flow to net earnings excluding Batteries impairments, the gain

on the sale of the Batteries business and Venezuela charges.

We view adjusted free cash flow productivity as a useful

measure to help investors understand P&G’s ability to generate

cash. Adjusted free cash flow productivity is used by

management in making operating decisions, in allocating

financial resources and for budget planning purposes. The

Company's long-term target is to generate annual adjusted free

cash flow productivity at or above 90 percent.

The following table provides a numerical reconciliation of

adjusted free cash flow productivity ($ millions):

Net

Earnings

Gain on

Batteries

Sale /

Impairment

&Decon-

solidation

Charges

Net Earnings

Excluding

Batteries Gain/

Impairment &

Deconsolid-

ation Charges

Adjusted

Free

Cash

Flow

Adjusted

Free

Cash Flow

Productivity

2016 $10,604 $ (72) $ 10,532 $ 12,121 115%

2015 7,144 4,187 11,331 11,601 102 %

2014 11,785 — 11,785 10,100 86 %

Item 7A. Quantitative and Qualitative Disclosures About

Market Risk.

The information required by this item is incorporated by

reference to the sect

ion entitled Other Information under

Management's Disclosure and Analysis, and Note 9 to the

Consolidated Financial Statements.