Proctor and Gamble 2016 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 The Procter & Gamble Company

ORGANIZATIONAL STRUCTURE

Our organizational structure is comprised of Global Business Units (GBUs), Selling and Market Operations (SMOs), Global

Business Services (GBS) and Corporate Functions (CF).

Global Business Units

Our GBUs are organized into ten product categories. Under U.S. GAAP, the GBUs underlying the ten product categories are

aggregated into five reportable segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine &

Family Care. The GBUs are responsible for developing overall brand strategy, new product upgrades and innovations and

marketing plans. The following provides additional detail on our reportable segments and the ten product categories and brand

composition within each segment.

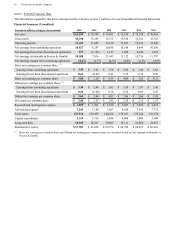

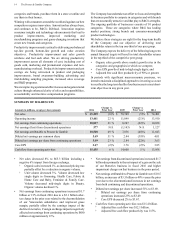

Reportable Segments

% of

Net Sales

1

% of Net

Earnings

1

Product Categories (Sub-Categories) Major Brands

Beauty 18% 20%

Hair Care (Conditioner, Shampoo, Styling Aids,

Treatments)

Head & Shoulders,

Pantene, Rejoice

Skin and Personal Care (Antiperspirant and

Deodorant, Personal Cleansing, Skin Care)

Olay, Old Spice,

Safeguard, SK-II

Grooming 11% 15%

Grooming

2

(Shave Care - Female Blades & Razors,

Male Blades & Razors, Pre- and Post-Shave

Products, Other Shave Care; Appliances)

Braun, Fusion, Gillette,

Mach3, Prestobarba,

Venus

Health Care 11% 12%

Oral Care (Toothbrushes, Toothpaste, Other Oral

Care)Crest, Oral-B

Personal Health Care (Gastrointestinal, Rapid

Diagnostics, Respiratory, Vitamins/Minerals/

Supplements, Other Personal Health Care)

Prilosec, Vicks

Fabric & Home Care 32% 27%

Fabric Care (Fabric Enhancers, Laundry Additives,

Laundry Detergents)Ariel, Downy, Gain, Tide

Home Care (Air Care, Dish Care, P&G

Professional, Surface Care)

Cascade, Dawn, Febreze,

Mr. Clean, Swiffer

Baby, Feminine &

Family Care 28% 26%

Baby Care (Baby Wipes, Diapers and Pants) Luvs, Pampers

Feminine Care (Adult Incontinence, Feminine Care)Always,Tampax

Family Care (Paper Towels, Tissues, Toilet Paper) Bounty, Charmin

(1)

Percent of Net sales and Net earnings from continuing operations for the year ended June 30, 2016 (excluding results held in Corporate).

(2)

The Grooming product category is comprised of the Shave Care and Appliances GBUs.

Recent Developments: As of June 30, 2015, the Company

deconsolidated our Venezuelan subsidiaries and began

accounting for our investment in those subsidiaries using the

cost method of accounting. This change resulted in a fiscal

2015 one-time after-tax charge of $2.1 billion ($0.71 per share).

Beginning in fiscal 2016, our financial results only include

sales of finished goods to our Venezuelan subsidiaries to the

extent we receive cash payments from Venezuela (expected to

be largely through the DIPRO and DICOM exchange market).

Accordingly, we no longer include the results of our

Venezuelan subsidiaries' operations in reporting periods

following fiscal 2015 (see Note 1 to the Consolidated Financial

Statements and additional discussion in the MD&A under

"Venezuela Impacts" in Results of Operations).

InAugust 2014, the Company announced a plan to significantly

streamline our product portfolio by divesting, discontinuing or

consolidating about 100 non-strategic brands. The resulting

portfolio of about 65 key brands are in 10 category-based

businesses where P&G has leading market positions, strong

brands and consumer-meaningful product technologies.

During fiscal 2016, the company completed the divestiture of

its Batteries business. The Batteries business had historically

been part of the Company’s Fabric & Home Care reportable

segment. The results of the Batteries business are presented

as discontinued operations and, as such, are excluded from both

continuing operations and segment results for all periods

presented. Additionally, the Batteries balance sheet positions

as of June 30, 2015 are presented as held for sale in the

Consolidated Balance Sheets.

On July 9, 2015, the Company announced the signing of a

definitive agreement to divest four product categories, to Coty

Inc. ("Coty"). Coty's offer was $12.5 billion. The divestiture

was initially comprised of 43 of the Company's beauty brands

("Beauty Brands"), including the global salon professional hair

care and color, retail hair color, cosmetics and fine fragrance

businesses, along with select hair styling brands. Subsequent

to signing, two of the fine fragrance brands, Dolce Gabbana

and Christina Aguilera, were excluded from the divestiture.

While the ultimate form of the transaction has not yet been

decided, the Company’s current preference is for a Reverse