Proctor and Gamble 2016 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 29

Based on our interest rate exposure as of and during the year

ended June 30, 2016, including derivative and other

instruments sensitive to interest rates, we believe a near-term

change in interest rates, at a 95% confidence level based on

historical interest rate movements, would not materially affect

our financial statements.

Currency Rate Exposure on Financial Instruments. Because

we manufacture and sell products and finance operations in a

number of countries throughout the world, we are exposed to

the impact on revenue and expenses of movements in currency

exchange rates. Corporate policy prescribes the range of

allowable hedging activity. To manage the exchange rate risk

associated with the financing of our operations, we primarily

use forward contracts with maturities of less than 18 months.

In addition, we enter into certain currency swaps with

maturities of up to five years to hedge our exposure to exchange

rate movements on intercompany financing transactions.

Based on our currency rate exposure on derivative and other

instruments as of and during the year ended June 30, 2016, we

believe, at a 95% confidence level based on historical currency

rate movements, the impact on such instruments of a near-term

change in currency rates would not materially affect our

financial statements.

Commodity Price Exposure on Financial Instruments. We

use raw materials that are subject to price volatility caused by

weather, supply conditions, political and economic variables

and other unpredictable factors. We may use futures, options

and swap contracts to manage the volatility related to the above

exposures.

As of and during the years ended June 30, 2016 and June 30,

2015, we did not have any commodity hedging activity.

Measures Not Defined By U.S. GAAP

Our discussion of financial results includes several "non-

GAAP" financial measures. We believe that these measures

provide useful perspective of underlying business trends (i.e.

trends excluding non-recurring or unusual items) and results

and provide a supplemental measure of year-on-year results.

The non-GAAP measures described below are used by

management in making operating decisions, allocating

financial resources and for business strategy purposes. These

measures may be useful to investors as they provide

supplemental information about business performance and

provide investors a view of our business results through the

eyes of management. These measures are also used to evaluate

senior management and are a factor in determining their at-

risk compensation. These non-GAAP measures are not

intended to be considered by the user in place of the related

GAAP measure, but rather as supplemental information to our

business results. These non-GAAP measures may not be the

same as similar measures used by other companies due to

possible differences in method and in the items or events being

adjusted. These measures include:

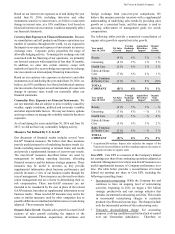

Organic Sales Growth. Organic sales growth is a non-GAAP

measure of sales growth excluding the impacts of the

Venezuela deconsolidation, acquisitions, divestitures and

foreign exchange from year-over-year comparisons. We

believe this measure provides investors with a supplemental

understanding of underlying sales trends by providing sales

growth on a consistent basis, and this measure is used in

assessing achievement of management goals for at-risk

compensation.

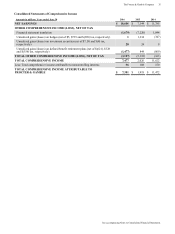

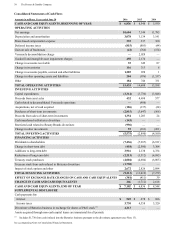

The following tables provide a numerical reconciliation of

organic sales growth to reported net sales growth:

Year ended

June 30, 2016

Net Sales

Growth

Foreign

Exchange

Impact

Acquisition/

Divestiture

Impact*

Organic

Sales

Growth

Beauty (9 )% 6 % 3 % — %

Grooming (8 )% 9 % 1 % 2 %

Health Care (5 )% 6 % 1 % 2 %

Fabric & Home

Care (7 )% 6 % 2 % 1 %

Baby, Feminine

& Family Care (9 )% 6 % 2 % (1)%

TOTAL

COMPANY (8)% 6% 3% 1 %

Year ended

June 30, 2015

Net Sales

Growth

Foreign

Exchange

Impact

Acquisition/

Divestiture

Impact*

Organic

Sales

Growth

Beauty (6 )% 5 % 1 % — %

Grooming (7 )% 8 % — % 1 %

Health Care (1 )% 5 % — % 4 %

Fabric & Home

Care (5 )% 6 % 1 % 2 %

Baby, Feminine

& Family Care (3 )% 6 % — % 3 %

TOTAL

COMPANY (5)% 6% 1% 2 %

* Acquisition/Divestiture Impact also includes the impact of the

Venezuela deconsolidation and the rounding impacts necessary to

reconcile net sales to organic sales.

Core EPS. Core EPS is a measure of the Company's diluted

net earnings per share from continuing operations adjusted as

indicated. Management views these non-GAAP measures as a

useful supplemental measure of Company performance over

time. The table below provides a reconciliation of revised

diluted net earnings per share to Core EPS, including the

following reconciling items:

•Incremental restructuring: While the Company has and

continues to have an ongoing level of restructuring

activities, beginning in 2012 we began a $10 billion

strategic productivity and cost savings initiative that

includes incremental restructuring activities. This results

in incremental restructuring charges to accelerate

productivity efforts and cost savings. The charges include

only the incremental portion of the restructuring costs.

•Venezuela deconsolidation charge: For accounting

purposes, evolving conditions resulted in a lack of control

over our Venezuelan subsidiaries. Therefore, in