Proctor and Gamble 2016 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 19

SEGMENT RESULTS

Segment results reflect information on the same basis we use for internal management reporting and performance evaluation. The

results of these reportable segments do not include certain non-business unit specific costs such as interest expense, investing

activities and certain restructuring and asset impairment costs. These costs are reported in our Corporate segment and are included

as part of our Corporate segment discussion. Additionally, as described in Note 2 to the Consolidated Financial Statements, we

apply blended statutory tax rates in the segments. Eliminations to adjust segment results to arrive at our effective tax rate are

included in Corporate. All references to net earnings throughout the discussion of segment results refer to net earnings from

continuing operations.

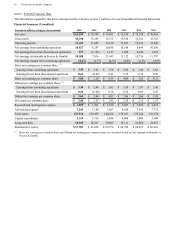

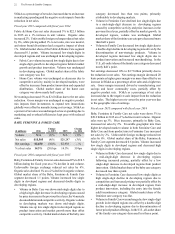

Net Sales Change Drivers 2016 vs. 2015*

Volume with

Acquisitions &

Divestitures

Volume

Excluding

Acquisitions &

Divestitures

Foreign

Exchange Price Mix Other**

Net Sales

Growth

Beauty (5 )% (2 )% (6 )% 2 % — % — % (9 )%

Grooming (2 )% (2 )% (9 )% 5 % (2)% — % (8 )%

Health Care (2 )% (2 )% (6 )% 2% 1 % —% (5 )%

Fabric & Home Care (1 )% 1 % (6 )% —% — % —% (7 )%

Baby, Feminine & Family Care (3 )% (2 )% (6 )% —% — % —% (9 )%

TOTAL COMPANY (3)% (1)% (6)% 1% — % —% (8)%

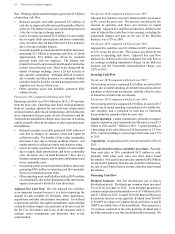

Net Sales Change Drivers 2015 vs. 2014*

Volume with

Acquisitions &

Divestitures

Volume

Excluding

Acquisitions &

Divestitures

Foreign

Exchange Price Mix Other**

Net Sales

Growth

Beauty (3 )% (2 )% (5 )% 2 % — % — % (6 )%

Grooming (3 )% (3 )% (8 )% 4 % — % — % (7 )%

Health Care (1 )% (1 )% (5 )% 2 % 3 % — % (1 )%

Fabric & Home Care 1 % 1 % (6 )% 1 % — % (1 )% (5 )%

Baby, Feminine & Family Care (1 )% (1 )% (6 )% 2 % 2 % — % (3 )%

TOTAL COMPANY (1)% (1)% (6)% 2% 1% (1)% (5)%

* Net sales percentage changes are approximations based on quantitative formulas that are consistently applied.

** Other includes the sales mix impact from acquisitions and divestitures and rounding impacts necessary to reconcile volume to net sales.

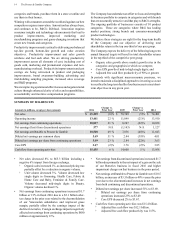

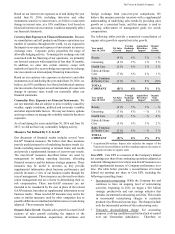

BEAUTY

($ millions) 2016

Change

vs. 2015 2015

Change

vs. 2014

Volume N/A (5)% N/A (3)%

Net sales $11,477 (9)% $12,608 (6)%

Net earnings $1,975 (9)% $2,181 (5)%

% of net sales 17.2% (10) bps 17.3% 10 bps

Fiscal year 2016 compared with fiscal year 2015

Beauty net sales decreased 9% to $11.5 billion during the fiscal

year on a 5% decrease in unit volume. Unfavorable foreign

exchange reduced net sales by 6%. Price increases had a 2%

positive impact on net sales. Organic sales were unchanged

on organic volume that decreased 2%. Global market share of

the Beauty segment decreased 1.0 points. Volume decreased

low single digits in developed markets and decreased high

single digits in developing markets.

• Volume in Hair Care was down mid-single digits.

Developed markets declined mid-single digits due to

competitive activity while developing markets declined

mid-single digits driven by increased pricing, the

Venezuela deconsolidation and minor brand divestitures.

Global market share of the hair care category decreased

more than a point.

• Volume in Skin and Personal Care decreased high single

digits, while organic volume decreased low single digits,

with the difference attributable to the Camay and Zest

brand divestitures and the Venezuela deconsolidation.

Organic volume was unchanged in developed regions as

commercial innovation was offset by ongoing competitive

activity. Organic volume declined mid-single digits in

developing regions primarily due to increased pricing and

competitive activity. Global market share of the skin and

personal care category decreased nearly a point.