Proctor and Gamble 2016 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

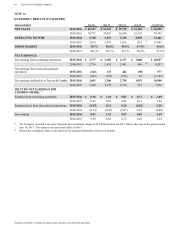

The Procter & Gamble Company 59

Amounts in millions of dollars except per share amounts or as otherwise specified.

NOTE 12

COMMITMENTS AND CONTINGENCIES

Guarantees

In conjunction with certain transactions, primarily divestitures,

we may provide routine indemnifications (e.g.,

indemnification for representations and warranties and

retention of previously existing environmental, tax and

employee liabilities) for which terms range in duration and, in

some circumstances, are not explicitly defined. The maximum

obligation under some indemnifications is also not explicitly

stated and, as a result, the overall amount of these obligations

cannot be reasonably estimated. Other than obligations

recorded as liabilities at the time of divestiture, we have not

made significant payments for these indemnifications. We

believe that if we were to incur a loss on any of these matters,

the loss would not have a material effect on our financial

position, results of operations or cash flows.

In certain situations, we guarantee loans for suppliers and

customers. The total amount of guarantees issued under such

arrangements is not material.

Off-Balance Sheet Arrangements

We do not have off-balance sheet financing arrangements,

including variable interest entities, that have a material impact

on our financial statements.

Purchase Commitments and Operating Leases

We have purchase commitments for materials, supplies,

services and property, plant and equipment as part of the normal

course of business. Commitments made under take-or-pay

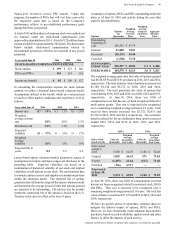

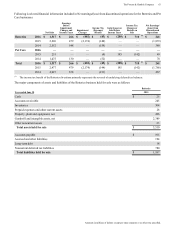

obligations are as follows:

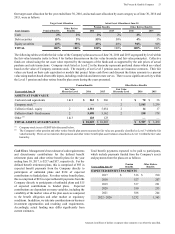

Years ending

June 30 2017 2018 2019 2020 2021

There

after

Purchase

obligations $ 881 $ 221 $ 170 $ 129 $ 105 $ 288

Such amounts represent future purchases in line with expected

usage to obtain favorable pricing. This includes purchase

commitments related to service contracts for information

technology, human resources management and facilities

management activities that have been outsourced to third-party

suppliers. Due to the proprietary nature of many of our

materials and processes, certain supply contracts contain

penalty provisions for early termination. We do not expect to

incur penalty payments under these provisions that would

materially affect our financial position, results of operations

or cash flows.

We also lease certain property and equipment for varying

periods. Future minimum rental commitments under non-

cancelable operating leases, net of guaranteed sublease

income, are as follows:

Years ending

June 30 2017 2018 2019 2020 2021

There

after

Operating

leases $ 237 $ 240 $ 224 $ 206 $ 154 $ 502

Litigation

We are subject to various legal proceedings and claims arising

out of our business which cover a wide range of matters such

as antitrust, trade and other governmental regulations, product

liability, patent and trademark, advertising, contracts,

environmental, labor and employment and tax.

While considerable uncertainty exists, in the opinion of

management and our counsel, the ultimate resolution of the

various lawsuits and claims will not materially affect our

financial position, results of operations or cash flows.

We are also subject to contingencies pursuant to environmental

laws and regulations that in the future may require us to take

action to correct the effects on the environment of prior

manufacturing and waste disposal practices. Based on

currently available information, we do not believe the ultimate

resolution of environmental remediation will materially affect

our financial position, results of operations or cash flows.

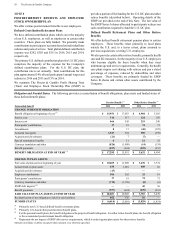

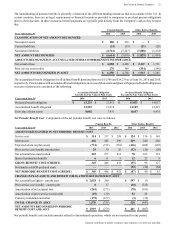

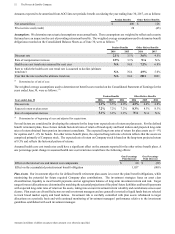

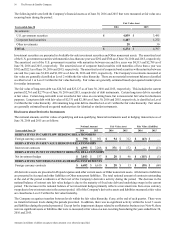

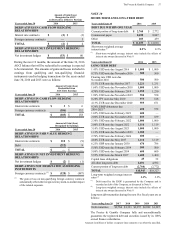

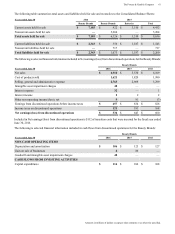

NOTE 13

DISCONTINUED OPERATIONS

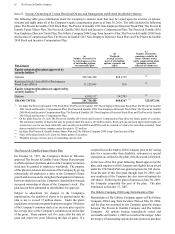

On July 9, 2015, the Company announced the signing of a

definitive agreement to divest four product categories which

will be merged with Coty. The divestiture was initially

comprised of 43 of the Company's beauty brands (“Beauty

Brands”), including the global salon professional hair care and

color, retail hair color, cosmetics and fine fragrance businesses,

along with select hair styling brands. Subsequent to signing,

the fine fragrance brands of Dolce & Gabbana and Christina

Aguilera were excluded from the divestiture. In connection

with the decision to exclude these brands, the Company

recorded a non-cash, before-tax impairment charge in

discontinued operations of approximately $48 ($42 after tax)

in fiscal 2016 in order to record the Dolce & Gabbana license

intangible asset at its revised estimated net realizable value.

On May 11, 2016, the Company entered into a separate

transaction to sell the Christina Aguilera brand prior to or

concurrent with the expected close date of the Coty transaction.

On June 30, 2016, Dolce & Gabbana and the Shiseido Group

announced the signing of the worldwide license agreement for

the Dolce & Gabbana beauty business. The Company will

transition out of the Dolce & Gabbana license upon the

effectiveness of the new license, which is expected to occur

prior to or concurrent with the expected close of the Coty

transaction. In connection with this transition, the Company

agreed to pay a termination payment of $83 ($76 after tax).

This termination payment charge is included in discontinued

operations for the year ended June 30, 2016.

While the ultimate form of the Beauty Brands transaction has

not yet been decided, the Company’s current preference is for

a Reverse Morris Trust split-off transaction in which P&G

shareholders could elect to participate in an exchange offer to

exchange their P&G shares for shares of a new corporation that

would hold the Beauty Brands (excluding Dolce & Gabbana

and Christina Aguilera) and then immediately exchange those

shares for Coty shares. The Company expects to close the

transaction in October 2016.