Proctor and Gamble 2016 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2016 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 53

Amounts in millions of dollars except per share amounts or as otherwise specified.

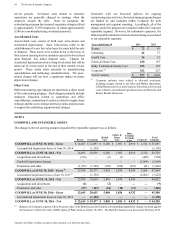

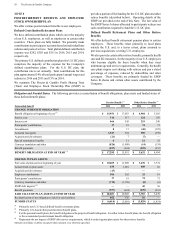

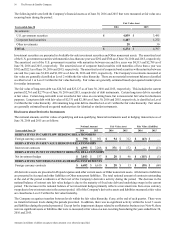

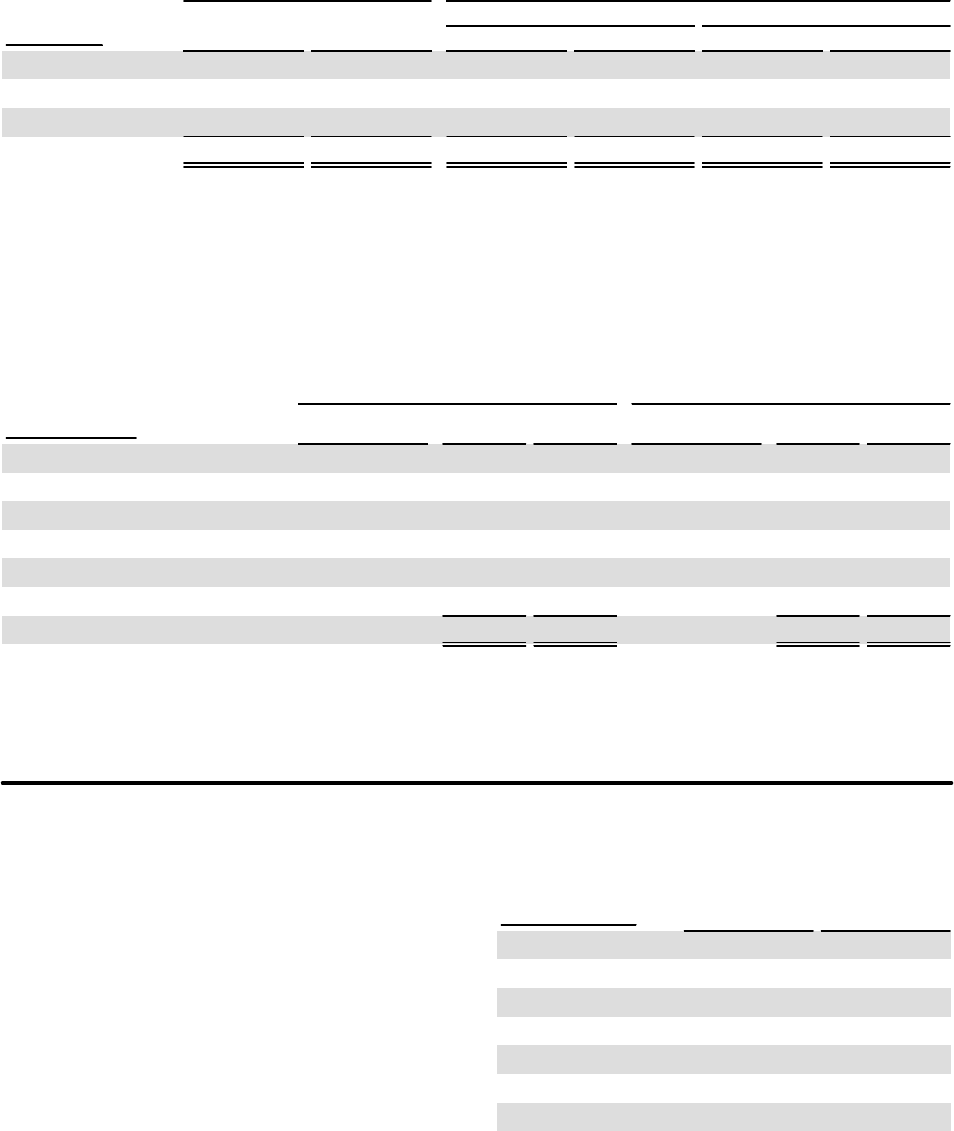

Our target asset allocation for the year ended June 30, 2016, and actual asset allocation by asset category as of June 30, 2016 and

2015, were as follows:

Target Asset Allocation Actual Asset Allocation at June 30

Pension Benefits

Other Retiree

Benefits

Pension Benefits Other Retiree Benefits

Asset Category 2016 2015 2016 2015

Cash 2% 2% 2% 2% 2% 1%

Debt securities 55% 3% 55% 50% 4% 5%

Equity securities 43% 95% 43% 48% 94% 94%

TOTAL 100% 100% 100% 100% 100% 100%

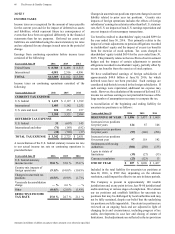

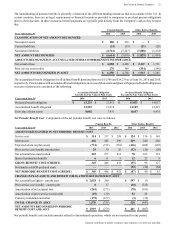

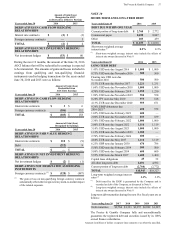

The following tables set forth the fair value of the Company's plan assets as of June 30, 2016 and 2015 segregated by level within

the fair value hierarchy (refer to Note 9 for further discussion on the fair value hierarchy and fair value principles). Collective

funds are valued using the net asset value reported by the managers of the funds and as supported by the unit prices of actual

purchase and sale transactions. Company stock listed as Level 2 in the hierarchy represents preferred shares which are valued

based on the value of Company common stock. The majority of our Level 3 pension assets are insurance contracts. Their fair

values are based on their cash equivalent or models that project future cash flows and discount the future amounts to a present

value using market-based observable inputs, including credit risk and interest rate curves. There was no significant activity within

the Level 3 pension and other retiree benefits plan assets during the years presented.

Pension Benefits Other Retiree Benefits

Years ended June 30

Fair Value

Hierarchy Level 2016 2015

Fair Value

Hierarchy Level 2016 2015

ASSETS AT FAIR VALUE

Cash and cash equivalents 1 & 2 $ 262 $ 266 1 $70

$36

Company stock

(1)

——2 3,545 3,239

Collective fund - equity 2 4,381 5,054 2 14 17

Collective fund - fixed income 2 5,498 5,162 2 158 178

Other

(2)

1&3 128 123 ——

TOTAL ASSETS AT FAIR VALUE $ 10,269 $ 10,605 $ 3,787 $ 3,470

(1)

Company stock is net of ESOP debt discussed below.

(2)

The Company's other pension and other retiree benefit plan assets measured at fair value are generally classified as Level 3 within the fair

value hierarchy. There are no material other pension and other retiree benefit plan asset balances classified as Level 1 within the fair value

hierarchy.

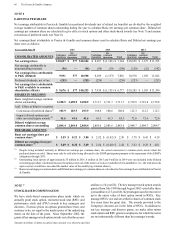

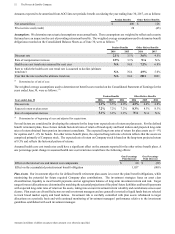

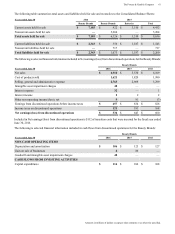

Cash Flows.Management's best estimate of cash requirements

and discretionary contributions for the defined benefit

retirement plans and other retiree benefit plans for the year

ending June 30, 2017, is $217 and $37, respectively. For the

defined benefit retirement plans, this is comprised of $93 in

expected benefit payments from the Company directly to

participants of unfunded plans and $124 of expected

contributions to funded plans. For other retiree benefit plans,

this is comprised of $22 in expected benefit payments from the

Company directly to participants of unfunded plans and $15

of expected contributions to funded plans. Expected

contributions are dependent on many variables, including the

variability of the market value of the plan assets as compared

to the benefit obligation and other market or regulatory

conditions. In addition, we take into consideration our business

investment opportunities and resulting cash requirements.

Accordingly, actual funding may differ significantly from

current estimates.

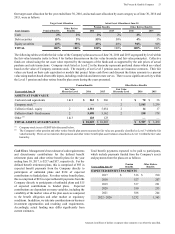

Total benefit payments expected to be paid to participants,

which include payments funded from the Company's assets

and payments from the plans are as follows:

Years ending June 30

Pension

Benefits

Other Retiree

Benefits

EXPECTED BENEFIT PAYMENTS

2017 $ 516 $ 190

2018 527 207

2019 537 221

2020 550 233

2021 588 244

2022 - 2026 3,232 1,365